3M India Share Price Target offers a strategic insight into the company’s future growth potential. Investors who are considering 3M India as part of their portfolio should closely examine the projected share price targets for the coming decades. This article provides an in-depth analysis of the expected share price targets from 2026 to 2050, based on the company’s current financial performance and market standing.

Company Overview

3M India, a subsidiary of the globally renowned 3M Corporation, operates across multiple sectors, offering innovative products in the fields of healthcare, safety, and industrial solutions. The company has established a strong market presence in India, supported by its diverse product portfolio and commitment to innovation. Understanding the 3M India Share Price Target is crucial for investors looking to benefit from the company’s ongoing growth and market leadership.

Financial Overview

Current Share Price

Revenue and Profit Growth

3M India has demonstrated a consistent increase in both revenue and net profit over recent years, as highlighted below:

| Year | Revenue (₹ Cr) | Net Profit (₹ Cr) |

|---|---|---|

| 2020 | 3,032 | 322 |

| 2021 | 2,630 | 162 |

| 2022 | 3,373 | 272 |

| 2023 | 4,027 | 451 |

| 2024 | 4,268 | 583 |

| 2025 | 4516 | 476 |

From a 2026 perspective, 3M India has demonstrated a structurally strong and consistent financial trajectory. Despite a temporary dip in profits during 2025, the long-term trend reflects expanding revenue, strong operating margins, and high-quality earnings.

The company’s ability to scale revenue beyond ₹4,500 Cr while maintaining profitability highlights its strong pricing power and demand resilience across healthcare, industrial, and safety verticals. This consistency plays a critical role in sustaining premium valuations and directly supports the long-term 3M India Share Price Target.

Fundamental Metrics (As of February 2026)

The following fundamental metrics provide a clear picture of 3M India’s financial health, essential for forecasting the 3M India Share Price Target:

| Metric | Value |

|---|---|

| Market Cap | ₹39,548 Cr |

| P/E Ratio (TTM) | 71.37 |

| P/B Ratio | 24.56 |

| ROE | 34.41% |

| Debt to Equity | 0.06 |

| EPS (TTM) | ₹491.71 |

| Book Value | ₹1428.96 |

| Dividend Yield | 1.52% |

| 52-Week High | ₹37,305.00 |

| 52-Week Low | ₹25,718.15 |

| Website | 3M India ltd |

As of 2026, 3M India trades at very high valuation multiples, with a P/E above 70 and a P/B above 24. This indicates that the market is assigning a significant quality premium to the stock due to its superior return ratios, stable cash flows, and low-risk business model.

The most important metric is ROE of 34.41%, which places 3M India among the top-quality companies in India. The low debt-to-equity ratio further strengthens the company’s financial stability and supports long-term compounding potential.

Factors Influencing 3M India Share Price Target

Market Leadership and Innovation

3M India’s strong market leadership and its commitment to innovation across various sectors are critical factors driving its growth. The company’s ability to consistently introduce new products and technologies gives it a competitive edge, which is likely to support a positive 3M India Share Price Target in the coming years.

Promoter Confidence

As of June 2024, promoters hold a significant 75.00% stake in 3M India. This high level of promoter confidence reflects a strong belief in the company’s future prospects. A substantial promoter holding is often seen as a positive signal for investors, indicating that those closest to the company are confident in its long-term success, which bodes well for the 3M India Share Price Target.

Financial Stability and Growth Prospects

3M India’s financial stability, marked by consistent revenue and profit growth, low debt levels, and strong return on equity, positions the company well for future share price appreciation. These factors, coupled with a robust dividend yield, make 3M India an attractive investment for those seeking long-term growth, supporting an optimistic 3M India Share Price Target.

3M India Share Price Target 2026

Based on the 2026 fundamentals:

-

EPS (TTM): ₹491.71

-

Reasonable quality P/E range: 65x – 75x

-

Book Value: ₹1,428.96

-

ROE: 34%+

A fair valuation range for a high-quality compounder like 3M India in 2026 becomes:

₹32,000 to ₹38,000

This range is derived from:

-

EPS × justified quality multiple

-

Historical high of ₹37,305

-

Sustained ROE above 30%

-

Premium brand and low business risk

This positions 3M India as a valuation-expensive but fundamentally strong stock in 2026, suitable for long-term compounding rather than short-term trading.

3M India Share Price Target 2030

Looking ahead to 2030, the 3M India Share Price Target is projected to reach between ₹65,000 and ₹70,000. The company’s sustained focus on innovation, coupled with its expanding presence in key markets, will be crucial in achieving this target. As 3M India continues to grow and capitalize on emerging opportunities, its share price is expected to follow an upward trajectory.

3M India Share Price Target 2035

By 2035, 3M India is anticipated to reach a 3M India Share Price Target of ₹90,000 to ₹95,000. The company’s ongoing investments in technology, coupled with its strong market presence, are expected to drive significant value creation for shareholders. This period is likely to see 3M India further solidify its position as a leader in the Indian market, boosting its share price.

3M India Share Price Target 2040

In 2040, the 3M India Share Price Target is expected to rise to approximately ₹120,000 to ₹130,000. 3M India’s ability to stay ahead of market trends and maintain financial discipline will be instrumental in reaching this target. Strategic initiatives, including global expansion and product innovation, are likely to contribute to substantial share price growth.

3M India Share Price Target 2045

By 2045, the 3M India Share Price Target is forecasted to be between ₹160,000 and ₹170,000. This projection is based on 3M India’s sustained efforts to enhance its market presence, improve profitability, and expand its global footprint. Investors can expect significant returns as the company continues to execute its long-term vision.

3M India Share Price Target 2050

Looking towards 2050, the 3M India Share Price Target is anticipated to be in the range of ₹200,000 to ₹220,000. 3M India’s long-term strategies, including innovation, market expansion, and operational efficiency, are expected to drive substantial shareholder value. The company’s commitment to maintaining its competitive edge and adapting to industry changes will likely make it a standout investment over the next few decades.

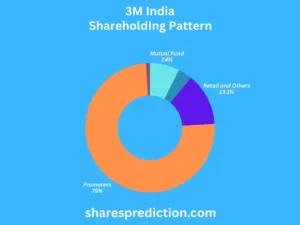

Shareholding Pattern

As of February 2026, 3M India’s shareholding pattern is as follows:

| Category | Percentage (%) |

|---|---|

| Promoters | 75.00% |

| Retail and Others | 13.11% |

| Mutual Funds | 7.40% |

| Foreign Institutions | 3.50% |

| Other Domestic Institutions | 0.99% |

The extremely high promoter holding of 75% reflects long-term strategic commitment from the parent company. Institutional participation from mutual funds and FIIs further reinforces confidence in 3M India’s governance standards and earnings stability.

From a 2026 perspective, this ownership structure supports low volatility and long-term price stability, making the stock attractive for conservative investors.

Conclusion

The 3M India Share Price Target for 2026, 2030, 2035, 2040, 2045, and 2050 suggests a promising future for the company, characterized by steady financial growth and strategic expansion. Investors can expect significant value appreciation over the long term, making 3M India an attractive investment opportunity. The company’s strong fundamentals, coupled with its strategic initiatives, are expected to deliver substantial returns for shareholders, positioning 3M India as a leading player in the market.

FAQs About 3M India

Q1. What products does 3M India manufacture?

3M India manufactures a wide range of products across various sectors, including healthcare, safety, and industrial solutions.

Q2. Where is 3M India headquartered?

3M India is headquartered in Bengaluru, Karnataka, India.

Q3. How does 3M India maintain its competitive edge?

3M India maintains its competitive edge through continuous innovation and a diverse product portfolio that caters to various industries.

Q4. What sectors does 3M India serve?

3M India serves multiple sectors, including healthcare, safety, transportation, and industrial manufacturing.

Q5. What are 3M India’s sustainability initiatives?

3M India focuses on sustainable practices, including reducing its environmental impact and promoting energy efficiency across its operations.

Q6. What is 3M India’s primary market?

3M India primarily serves the Indian market but also exports products to various international markets.

Q7. Who are the main competitors of 3M India?

Key competitors of 3M India include Honeywell, DuPont, and Siemens.

Q8. How does 3M India innovate its products?

3M India invests heavily in R&D to continuously innovate and improve its product offerings, keeping pace with industry advancements.

Q9. What is 3M India’s approach to customer satisfaction?

3M India focuses on delivering high-quality, innovative solutions that meet customer needs and enhance satisfaction.

Q10. Does 3M India have international operations?

Yes, 3M India operates globally, with a presence in various international markets through its parent company, 3M Corporation.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.