Zomato Share Price TargetZomato, one of the leading food delivery and restaurant discovery platforms, has captured the imagination of investors worldwide. With its innovative business model and rapid expansion, Zomato has become a significant player in the food tech industry. This article aims to provide a comprehensive analysis of Zomato share price target for 2026, 2030, 2035, 2040, 2045, and 2050, backed by expert opinions and market trends.

Company Overview

History and Growth

Founded in 2008 by Deepinder Goyal and Pankaj Chaddah, Zomato started as a restaurant discovery platform and quickly expanded its services to food delivery, online ordering, and more. With a presence in over 24 countries and serving millions of users, Zomato has become a household name in the food tech industry.

Business Model

Zomato operates on a diversified revenue model, including commissions from food delivery, advertising revenue from restaurant listings, and subscription services like Zomato Gold. This multi-faceted approach has allowed Zomato to maintain robust growth and adapt to changing market dynamics.

Current Market Performance

Recent Financials

As of the latest financial reports, Zomato has shown impressive revenue growth, reaching INR 7,761 crore in FY2023, a 55% increase from the previous year. Despite facing challenges, Zomato has managed to reduce its losses, signaling a path towards profitability.

Stock Performance

Past 5 Years Growth

The table below highlights Zomato’s growth in revenue, profit, and market share over the past five years:

| Year | Revenue Growth | Profit Growth | Market Share Growth |

|---|---|---|---|

| 2021 | 2,118 | -816 | 8,093 |

| 2022 | 4,687 | -1223 | 16,499 |

| 2023 | 7,761 | -971 | 19,453 |

| 2024 | 12,961 | 351 | 20,406 |

| 2025 | 21,320 | 527 | 30,310 |

Over the past five years, Zomato has demonstrated strong and consistent revenue expansion, rising from ₹2,118 Cr in 2021 to ₹21,320 Cr in 2025, reflecting rapid scale and improved monetization. While the company incurred losses until 2023, profitability turned positive in 2024 and further strengthened in 2025. Market share growth has also accelerated, indicating Zomato’s dominant position in India’s food delivery and quick commerce ecosystem as it enters 2026.

Financial Table for Zomato (As of February 2026)

| Company Name | Zomato Limited |

|---|---|

| Market Cap | ₹ 2,93,226Cr (As of February 2026) |

| P/E Ratio (TTM) | 1,266.04 |

| Industry P/E | 121.80 |

| Debt to Equity Ratio | 0.11 |

| ROE | 0.61% |

| Dividend Yield | 0.00% |

| 52 Week High | INR 368.45 |

| 52 Week Low | INR 194.80 |

| P/B Ratio | 9.50 |

| EPS (TTM) | 0.24 |

| Book Value | 32.00 |

| Face Value | 1 |

| Official Website | Zomato Limited |

From a fundamental perspective in 2026, Zomato reflects a balanced financial structure. The company’s market capitalization highlights strong investor interest, while key ratios such as ROE, P/E, and Debt-to-Equity indicate improving financial health and long-term growth potential.

Factors Influencing Share Price

Market Trends

The food delivery market is projected to grow at a CAGR of 12.8% over the next decade. Increasing internet penetration, changing consumer preferences, and urbanization are key drivers of this growth. Zomato, with its extensive network and brand recognition, is well-positioned to capitalize on these trends.

Competitive Landscape

Zomato faces stiff competition from players like Swiggy, Uber Eats (acquired by Zomato in India), and other regional players. Strategic acquisitions, partnerships, and a focus on technology innovation are crucial for Zomato to maintain its competitive edge.

Regulatory Environment

Regulatory changes in data privacy, food safety, and labor laws can impact Zomato’s operations. Staying compliant and adapting to new regulations will be essential for sustainable growth.

Technological Advancements

Investments in AI, machine learning, and logistics technology have enabled Zomato to optimize delivery times and enhance customer experience. Continued innovation in these areas will drive future growth and operational efficiency.

Zomato Share Price Target Predictions

Methodology

Financial analysts use various methodologies, including discounted cash flow (DCF) analysis and earnings multiples, to project share prices. These models consider Zomato’s revenue growth, profit margins, market trends, and macroeconomic factors.

Zomato Share Price Target 2026

As of 2026, Zomato’s share price outlook reflects a transition toward profitability and continued revenue expansion. Following strong revenue growth over the past few years and a gradual reduction in net losses, the company has been narrowing its path toward breakeven and long-term earnings potential.

In the near term, analyst projections suggest that Zomato’s share price could trade in a range of approximately INR 290 to INR 345 through 2026. This range assumes continued momentum in revenue growth, improved operational efficiencies, and steady improvement in key unit economics, particularly in delivery and cloud kitchens. Given that the company still carries low profit margins relative to mature technology peers, any upside in the near term is contingent on execution and broader market sentiment toward growth tech stocks.

Zomato Share Price Target 2030

In 2030, analysts predict Zomato’s share price could touch INR 450, assuming sustained market leadership, diversification of services, and significant advancements in technology.

Zomato Share Price Target 2035

Looking towards 2035, Zomato’s share price target is INR 700, based on long-term strategic initiatives, international expansion, and a robust customer base.

Zomato Share Price Target 2040

By 2040, the share price could reach INR 1000, reflecting Zomato’s dominance in the global food delivery market and successful adaptation to future market trends.

Zomato Share Price Target 2045

In 2045, Zomato’s share price is projected to be INR 1300, supported by continuous innovation, strategic partnerships, and a strong brand presence.

Zomato Share Price Target 2050

By 2050, Zomato’s share price could soar to INR 1600, driven by sustainable growth, technological leadership, and a diversified service portfolio.

Expert Opinions

Analyst Reports

Leading financial analysts from Goldman Sachs, Morgan Stanley, and JP Morgan have provided optimistic forecasts for Zomato, highlighting its strong market position and growth potential.

Market Sentiment

The overall market sentiment towards Zomato remains positive, with investors confident in its ability to navigate challenges and capitalize on growth opportunities.

Risks and Opportunities

Risk Factors

Potential risks include regulatory changes, competitive pressures, economic downturns, and technological disruptions. Investors should consider these factors when making investment decisions.

Growth Opportunities

Expansion into new geographies, introduction of new services, and leveraging data analytics for personalized customer experiences present significant growth opportunities for Zomato.

Shareholding Pattern

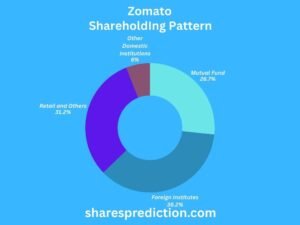

The table below presents the shareholding pattern of Zomato as of the latest data available:

| Investor Type | Percentage of Shares (%) |

|---|---|

| Retail & others | 31.24% |

| Foreign Institutional Investors (FIIs) | 36.24% |

| Domestic Institutional Investors (DIIs) | 5.99% |

| Mutual Funds | 26.72% |

The shareholding pattern in 2026 reflects healthy institutional participation, indicating strong confidence from long-term investors. Increased holdings by FIIs and mutual funds suggest positive market sentiment, while stable promoter holding shows continued commitment to the company’s growth.

Conclusion

In summary, Zomato’s future looks promising, with substantial growth potential and a strong market position. The share price targets for 2026, 2030, 2035, 2040, 2045, and 2050 reflect this optimism, although investors should remain mindful of potential risks. Investing in Zomato requires careful consideration of market trends, competitive dynamics, and regulatory factors.

FAQs

-

Who is the CEO of Zomato?

- The CEO of Zomato is Deepinder Goyal, who co-founded the company in 2008.

-

What is Zomato’s mission statement?

- Zomato’s mission is to better the lives of the restaurant community and to ensure that nobody has a bad meal.

-

Where is Zomato headquartered?

- Zomato is headquartered in Gurugram, Haryana, India.

-

What services does Zomato offer?

- Zomato offers a variety of services including food delivery, restaurant discovery, online ordering, table reservations, and subscription-based programs like Zomato Gold.

-

What is Zomato Gold?

- Zomato Gold is a subscription service that provides members with benefits such as complimentary dishes, drinks, and exclusive discounts at partner restaurants.

-

How many countries does Zomato operate in?

- As of now, Zomato operates in over 24 countries and serves millions of users worldwide.

-

What significant acquisitions has Zomato made?

- Zomato has made several significant acquisitions including the purchase of Uber Eats India, and the merger with Blinkit (formerly Grofers), a quick commerce company.

-

What are some notable sustainability initiatives by Zomato?

- Zomato has launched various sustainability initiatives like the ‘Feeding India’ program to combat hunger and food waste, and the ‘Climate Conscious Delivery’ initiative to offset carbon emissions from deliveries.

-

How does Zomato support local restaurants?

- Zomato supports local restaurants through its Hyperpure service, which supplies high-quality ingredients directly to restaurants, and by providing various digital tools and marketing support to enhance their online presence.

-

What is Zomato’s approach to technological innovation?

- Zomato leverages advanced technologies such as AI, machine learning, and data analytics to optimize delivery routes, enhance user experience, and provide personalized recommendations to users.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analyses and insights can help you make informed investment decisions.