Trident share price target for 2026, 2030, 2035, 2040, 2045, and 2050 is an important topic for investors looking at long-term opportunities in the textile and paper sector. Trident Limited has created a significant presence in domestic and worldwide markets by sustained revenue growth, careful debt management, and a clear focus on sustainability.

This article evaluates Trident’s latest financial data, historical performance, and growth factors to determine realistic share price targets for the following decades.

Company Overview

Trident Limited is headquartered in Ludhiana, Punjab, India. Founded in 1990, the company operates across textiles (bed linen, towels, yarn) and paper products (writing and copier paper). Over the years, Trident has evolved into a globally recognized exporter with a strong emphasis on eco-friendly manufacturing and operational efficiency. The company is listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

Current Share Price

Past 5-Year Financial Analysis (Revenue & Profit)

The table below provides a combined view of Trident Limited’s revenue and profit performance over the last five years, helping investors better understand the company’s financial trend and stability.

| Year | Revenue (₹ Cr) | Profit (₹ Cr) |

|---|---|---|

| 2021 | 4,547 | 304 |

| 2022 | 7,020 | 834 |

| 2023 | 6,357 | 442 |

| 2024 | 6,867 | 350 |

| 2025 | 7,047 | 371 |

Analysis

Trident Limited had a strong gain in revenue and profitability in 2022, driven by favorable industry conditions. Although earnings fell in later years, the company continued to sustain stable revenue above ₹6,800 Cr and remained profitable throughout the time.

This financial stability illustrates Trident’s operational robustness, effective cost control, and strong market presence, which are crucial aspects supporting the long-term trident share price target forecast.

Financial Table

| Metric | Value |

|---|---|

| Market Capitalization | ₹13,565 Cr |

| P/E Ratio (TTM) | 30.60 |

| Industry P/E | 33.05 |

| P/B Ratio | 2.94 |

| EPS (TTM) | 0.87 |

| ROE | 9.61% |

| Debt to Equity | 0.35 |

| Dividend Yield | 1.35% |

| 52 Week High | INR 52.90 |

| 52 Week Low | INR 31.60 |

| Official Website | Trident |

A low debt-to-equity ratio and a reasonable P/E compared to industry average indicate a financially disciplined business.

Performance Analysis

Trident Limited has achieved consistent financial success despite cyclical headwinds in the textile and paper industries. Revenue growth remains constant, profits have stabilized following a high year, and debt levels are well under control. The company’s ROE of over 10% and continuous dividend payout demonstrate operational strength.

Overall, Trident’s fundamentals suggest stable long-term growth rather than speculative short-term rallies.

Factors Influencing Trident Share Price Target

- Demand in the Market for Paper and Textiles:

- Consumer trends: An increase in the market for high-end paper and textile goods.

- Sustainability: A growing inclination towards environmentally friendly and sustainable goods.

- Technological Progress:

- Innovation in manufacturing: Advances in the technologies used to produce paper and textiles.

- R&D Investments: Ongoing expenditures made on research to improve the effectiveness and quality of products.

- Cash Management:

- Growth in Revenue and Profit: Steady growth encourages investor trust.

- Cost management: Higher profit margins result from efficient cost control.

- Market Growth:

- Geographic diversification refers to the process of entering new local and foreign markets.

- Product Line Expansion: Broadening the range of paper and textile products available.

- Strategic Alliances and Cooperations:

- Industry alliances are partnerships aimed at expanding a company’s product line and market reach.

- Government Contracts: Getting major projects approved increases revenue sources.

Trident Share Price Target 2026

The trident share price target for 2026 is expected to range between INR 35 and INR 40. This prediction is based on revenue stability, progressive margin recovery, and better market sentiment. As input costs settle and demand remains consistent, Trident is projected to witness moderate gains supported by its solid balance sheet.

Trident Share Price Target 2030

The trident share price target for 2030 is estimated to be between INR 105 and INR 120. By this time, steady profits growth, export expansion, and better operational efficiency are likely to contribute positively to valuation. Trident’s sustainability-focused strategy may also draw long-term institutional interest.

Trident Share Price Target 2035

The trident share price target for 2035 is projected to range from INR 240 to INR 260. Long-term gains from capacity growth, technical upgrades, and consistent cash flows are likely to support continuous appreciation. Continued innovation will be important to sustaining competitiveness.

Trident Share Price Target 2040

The trident share price target for 2040 is anticipated to lie between INR 420 and INR 460. Growth during this phase is likely to be driven by worldwide market penetration, leadership in sustainable manufacturing, and high brand equity across textile and paper markets.

Trident Share Price Target 2045

The trident share price target for 2045 is expected to be in the range of INR 620 to INR 680. Decades of continuous corporate operations, increased return ratios, and long-term investor trust could support greater valuations over this period.

Trident Share Price Target 2050

The trident share price target for 2050 is projected to be between INR 800 and INR 850. With consistent profits growth, financial discipline, and adaptation to industry shifts, Trident Limited has the potential to emerge as a long-term wealth builder for patient investors.

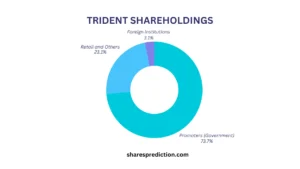

Trident Shareholding Pattern

| Investor Type | Shareholding (%) |

|---|---|

| Promoters | 73.68% |

| Retail & Others | 23.12% |

| Foreign Institutions | 3.06% |

| Mutual Funds | 0.12% |

| Other Domestic Institutions | 0.03% |

This table shows a mix of institutional and retail investors, with promoters holding a major interest. This varied ownership structure ensures stability and long-term support for the company’s expansion plans.

Conclusion

With strong financial growth, ongoing innovation, and strategic development, Trident share price target for 2026, 2030, 2035, 2040, 2045, and 2050 point to a bright future. Supported by strong fundamentals, low debt, consistent profitability, and a clear sustainability roadmap, Trident Limited remains a solid long-term investment option in the textile and paper sector. Trident Limited is an appealing investment choice in the growing textile and paper industries, with significant value appreciation expected.

FAQs About Trident Limited

1. Who is the Chairman of Trident Limited?

The Chairman of Trident Limited is Mr. Rajinder Gupta.

2. Who is the CEO of Trident Limited?

The CEO of Trident Limited is Mr. Deepak Nanda.

3. When was Trident Limited established?

Trident Limited was established in 1990.

4. Where is Trident Limited headquartered?

Trident Limited is headquartered in Ludhiana, Punjab, India.

5. What are the main products offered by Trident Limited?

Trident Limited offers textiles (including towels, bed linen, and yarn) and paper products (like copier paper and writing paper).

6. What certifications does Trident Limited hold?

Trident Limited holds several certifications including ISO 9001 for quality management and ISO 14001 for environmental management.

7. What awards and recognitions has Trident Limited received?

Trident Limited has received numerous awards for excellence in export performance, sustainability practices, and quality standards, including accolades from prestigious industry bodies and associations.

8. What sustainability initiatives is Trident Limited involved in?

Trident Limited is involved in various sustainability initiatives such as water conservation, energy efficiency, and using eco-friendly raw materials in its production processes.

9. What is Trident Limited’s approach to corporate social responsibility (CSR)?

Trident Limited actively engages in CSR activities focusing on education, healthcare, community development, and environmental sustainability to contribute positively to society.

10. What is the vision and mission of Trident Limited?

Trident Limited’s vision is to be a globally recognized organization known for quality and innovation. Its mission is to deliver excellence through sustainable practices and customer-centric approaches.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.