NBCC Share Price Target for 2026, 2030, 2035, 2040, 2045, and 2050 should be analyzed based on various factors such as market trends, company performance, and economic conditions as they evaluate the company’s future prospects. One of India’s top public sector companies, NBCC (India) Ltd., has made a substantial contribution to the building and infrastructure advancement of the country. Based on recent data, this article examines NBCC’s stock performance and offers predictions for its potential future development.

Company Overview

About NBCC (India) Ltd.

NBCC (India) Ltd., a Navratna firm under the Ministry of Housing and Urban Affairs, was founded in 1960. The business is well-known for its proficiency in real estate development, project management consulting (PMC), and EPC (Engineering, Procurement, and Construction) contracting. Major stock markets, such as the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), list NBCC.

Current Share Price and Performance

Factors Influencing NBCC Share Price Target

Market Demand for Infrastructure Development

- Government Initiatives: NBCC gains from advantageous laws and regulations that support the development of infrastructure.

- Urbanization: As the population becomes more urbanized, there will likely be a greater need for building and real estate developments.

Technological Advancements

- Innovations in Project Management: Using cutting-edge technology improves project management’s efficacy and economy.

- Sustainable Construction: The use of environmentally friendly building techniques is in line with current worldwide sustainability trends.

Financial Performance

- Growth in Revenue and Profit: Investor trust is increased when revenue and profitability show steady growth.

- Cost management: Higher profit margins are a result of effective cost management techniques.

Market Expansion

- Geographic Diversification: Expanding into new domestic and international markets to reach a broader customer base.

- Service Line Expansion: Diversifying project management and real estate services to meet changing market needs.

Strategic Partnerships and Collaborations

- Government Contracts: Revenue streams are improved by securing government contracts for large-scale infrastructure initiatives.

- Industry Alliances: Market expansion is facilitated by partnerships with other construction and real estate organizations.

Financial Fundamentals

Here are the key financial metrics for NBCC (India) Ltd. as of January 2026:

| Metric | Value (As of January 2026) |

|---|---|

| Market Cap | ₹26,168 Crores |

| P/E Ratio (TTM) | 41.86 |

| P/B Ratio | 9.65 |

| Industry P/E | 36.03 |

| Debt to Equity Ratio | 0.00 |

| ROE | 25.10% |

| EPS (TTM) | 2.28 |

| Dividend Yield | 0.70% |

| Book Value | 9.89 |

| Face Value | 1 |

| 52 Week High | 130.70 |

| 52 Week Low | 70.80 |

| Official Website | NBCC |

These fundamental metrics reflect NBCC’s strong market positioning and financial efficiency. With a market capitalization of ₹26,168 Cr and an impressive ROE of 25.10%, the company demonstrates effective utilization of shareholder capital. The P/E ratio of 41.86 (TTM), which is slightly higher than the industry average of 36.03, indicates that the stock is trading at a premium, supported by its consistent performance and growth expectations.

Notably, NBCC maintains a debt-to-equity ratio of 0.00, highlighting a debt-free balance sheet, which significantly reduces financial risk. Supported by an EPS of ₹2.28 and a dividend yield of 0.70%, these fundamentals provide a solid base for projecting a positive NBCC Share Price Target for 2026 and beyond.

NBCC Share Price Targets

NBCC Share Price Target 2026

By 2026, the NBCC share price target is projected to be in the range of ₹285 to ₹300, supported by the company’s expanding portfolio of government-backed infrastructure and redevelopment projects. Strong policy support, along with NBCC’s strategic focus on scaling its execution capabilities and market reach, is expected to drive sustained growth. The company’s debt-free balance sheet, robust operational track record, and expertise in project management and consultancy services further strengthen its position as a reliable long-term investment offering both stability and growth potential.

NBCC Share Price Target 2030

By 2030, NBCC share price target is projected to range from INR 548 to INR 576. The growth is anticipated to be fueled by sustained profitability, increased urbanization, and continued expansion into new markets. As NBCC continues to innovate and collaborate on large-scale projects, its market value and investor confidence are expected to rise.

NBCC Share Price Target 2035

For 2035, NBCC share price target is anticipated to be between INR 870 and INR 900. This increase is likely to be supported by strong financial performance, ongoing government contracts, and leadership in infrastructure development. As the demand for urban construction grows, NBCC’s ability to adapt to market needs will drive long-term value.

NBCC Share Price Target 2040

In 2040, NBCC share price target is expected to be around INR 1300 to INR 1380. This projection reflects continued innovation, market expansion, and rising demand for sustainable construction practices. NBCC strategic initiatives and robust financial health will likely enhance its market position, making it a strong contender in the infrastructure sector.

NBCC Share Price Target 2045

By 2045, NBCC share price target is forecasted to be between INR 1800 and INR 1900. Long-term growth, innovation, and strategic collaborations are expected to drive this increase. As NBCC strengthens its market presence and adapts to changing economic conditions, its share price is likely to reflect its sustained performance and growth potential.

NBCC Share Price Target 2050

NBCC share price target for 2050 is projected to be between INR 2450 and INR 2500. Decades of consistent growth, advancements in technology, and leadership in infrastructure development will underpin this target. NBCC’s commitment to innovation and market expansion positions it well for long-term success, making it a valuable investment for the future.

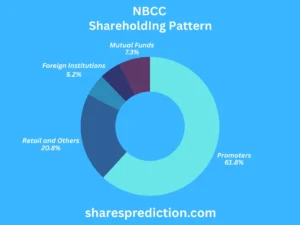

Shareholding Pattern (January 2026)

The shareholding pattern of NBCC (India) Ltd. as of January 2026 is as follows:

| Category | Percentage (%) |

|---|---|

| Promoters | 61.75% |

| Retail and Others | 20.80% |

| Other Domestic Institutions | 4.95% |

| Foreign Institutions | 5.19% |

| Mutual Funds | 7.30% |

The shareholding pattern of NBCC (India) Ltd. reflects a well-balanced ownership structure, with promoters holding a majority stake of 61.75%, indicating strong government ownership and long-term strategic control. Retail and other investors account for 20.80%, demonstrating healthy participation from individual investors, while Mutual Funds hold 7.30%, Foreign Institutions 5.19%, and Other Domestic Institutions 4.95%.

This diversified shareholding mix highlights sustained institutional confidence and retail interest, which together strengthen NBCC’s credibility and support its long-term growth outlook heading into 2026 and beyond.

Conclusion

NBCC share price target for 2026, 2030, 2035, 2040, 2045, and 2050 suggest a promising future driven by strong financial growth, continuous innovation, and strategic expansion. As the demand for infrastructure development intensifies, NBCC’s commitment to supporting these sectors positions it well for long-term success. Investors can expect significant value appreciation, making NBCC (India) Ltd. a compelling investment choice in the evolving infrastructure sector.

FAQs About NBCC (India) Ltd.

What does NBCC (India) Ltd. specialize in?

NBCC (India) Ltd. specializes in Project Management Consultancy (PMC), Real Estate Development, and Engineering, Procurement, and Construction (EPC) contracting. The company is known for its expertise in managing large-scale infrastructure projects, both in India and internationally.

When was NBCC (India) Ltd. established?

NBCC (India) Ltd. was established in 1960. Over the decades, it has evolved into a Navratna public sector enterprise under the Ministry of Housing and Urban Affairs, playing a pivotal role in the nation’s infrastructure development.

Who is the current Chairman and Managing Director of NBCC?

The current Chairman and Managing Director (CMD) of NBCC (India) Ltd. is Mr. Pawan Kumar Gupta. He leads the company’s strategic initiatives and oversees its operations.

What are some notable projects undertaken by NBCC?

NBCC has been involved in several iconic projects, including the redevelopment of government colonies in Delhi, construction of the National Institute of Disaster Management, and the redevelopment of Pragati Maidan. The company is also engaged in international projects in countries like Mauritius and Maldives.

What is NBCC’s role in the redevelopment of government colonies?

NBCC (India) Ltd. is responsible for the redevelopment of government colonies in Delhi, which includes the construction of modern residential complexes with eco-friendly designs, smart amenities, and sustainable infrastructure. This project is one of the largest urban redevelopment initiatives in the country.

What sustainability practices does NBCC follow in its projects?

NBCC (India) Ltd. emphasizes sustainable construction practices, incorporating green building technologies, energy-efficient systems, and environmentally friendly materials. The company’s commitment to sustainability is reflected in its adherence to green building standards in various projects.

What is the significance of NBCC’s Project Management Consultancy (PMC) services?

NBCC’s PMC services are one of its core strengths, where the company manages the entire lifecycle of a project from concept to completion. This includes planning, design, procurement, construction, and post-construction management, ensuring timely and cost-effective delivery of projects.

What awards and recognitions has NBCC received?

NBCC (India) Ltd. has received numerous awards and recognitions for its excellence in project management, quality construction, and sustainability practices. Some of these include the “Navratna Status” by the Government of India and various industry awards for outstanding performance in the infrastructure sector.

What is NBCC’s vision and mission?

NBCC’s vision is to be a world-class construction and infrastructure company committed to total customer satisfaction, quality, and sustainable development. Its mission is to create value for stakeholders by consistently delivering superior construction and project management services through innovative practices and responsible management.

What are some of NBCC’s international projects?

NBCC (India) Ltd. has expanded its footprint internationally with projects in countries like Mauritius, Maldives, Libya, and Nepal. These projects include the construction of educational institutions, hospitals, and government buildings, showcasing NBCC’s expertise on a global platform.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.