RVNL share price target 2045 offers a forward-looking perspective of Rail Vikas Nigam Limited’s future potential as one of India’s major government-backed railway infrastructure firms. Over the years, RVNL has established itself as a cornerstone of India’s infrastructure development, powered by stable order inflows, solid execution skills, and a rising international reach.

As India continues its infrastructure growth journey, RVNL is well-positioned to profit from this continued momentum. By 2045, given its existing financial health, planned revenue growth, and strategic diversification ambitions, the firm might enter a mature development phase – perhaps turning into a significant global infrastructure behemoth.

This article gives a thorough, data-backed prognosis of RVNL’s long-term performance outlook and the anticipated RVNL share price objective for 2045.

RVNL’s Current Position (as of 2025)

Before projecting long-term targets, it is important to understand RVNL’s current financial base.

| Metric | Value (FY2025) |

|---|---|

| Market Cap | ₹68,806 crore |

| P/E Ratio | 57.69 |

| ROE | 13.39% |

| Debt-to-Equity | 0.57 |

| Government Holding | 72.84% |

| Revenue | ₹23,064 crore (FY2024) |

These fundamentals form the base on which long-term forecasts for 2040–2045 are built.

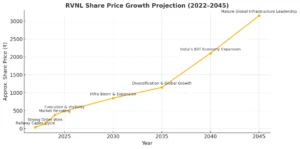

RVNL’s Growth Trajectory So Far

| Year | Approx. Share Price | Growth Driver |

|---|---|---|

| 2022 | ₹40 | Railway Capex Cycle |

| 2023 | ₹130 | Strong Order Wins |

| 2024 | ₹380 | Market Re-rating |

| 2025 | ₹470–₹510 | Execution & Visibility |

| 2030 | ₹820–₹880 | Infra Boom & Expansion |

| 2035 | ₹1,100–₹1,200 | Diversification & 4.4× Revenue Growth |

| 2040 | ₹1,900–₹2,300 | Global Expansion Phase |

| 2045 (Projected) | ₹3,000–₹3,300 | Mature Global Infrastructure Footprint |

RVNL Share Price Target 2045

Considering anticipated revenue increases, the company’s expansion into international markets, and India’s ongoing infrastructure projects, the RVNL share price target 2045 is estimated to be in the range of: ₹3,000 – ₹3,300

This forecast assumes:

- Stable project inflow via government-supported rail and metro expansion

- Ongoing overseas operations throughout Asia, Africa, and the Middle East.

- Margin improvement is expected to rise from the current 9–10% as technology becomes more widely embraced.

- Stronger contribution from metro, high-speed rail, and turnkey global EPC projects

Growth Expectations for 2045

| Scenario | Price Target | Key Assumptions |

|---|---|---|

| Base Case | ₹3,000 | 10% CAGR from 2040, stable margins |

| Optimistic Case | ₹3,300 | 10.5–11% CAGR, stronger global revenue |

RVNL is projected to move from being a domestic PSU contractor to a globally competitive infrastructure enterprise by 2045.

Key Drivers Behind RVNL Share Price Target 2045

1. Larger and Diverse Infrastructure Portfolio

By 2045, RVNL is expected to expand beyond Indian Railways into:

- Metro and urban transport systems

- International railway and highway EPC contracts

- Renewable and green mobility infrastructure

This diversification reduces dependence on a single sector and improves earnings stability.

2. Consistent Government Support

With over 72% government ownership, RVNL is likely to continue receiving:

- Steady project allocations

- Funding security

- Strategic priority in national infrastructure missions

This ensures predictable long-term growth.

3. Rising International Presence

RVNL is expected to win more overseas contracts by 2045, potentially contributing 18–20% of total revenue, improving margins and global credibility.

4. Technology-Driven Efficiency

Adoption of:

- AI project monitoring

- Digital rail construction

- IoT-powered signaling upgrades

…may lead to stronger execution and better margins.

5. Higher Dividend Potential

As RVNL matures by 2045, dividend yield is projected to rise to 2–2.5%, attracting long-term and institutional investors.

Projected Financial Outlook for 2045

| Financial Metric | 2025 Estimate | 2045 Projection |

|---|---|---|

| Revenue | ₹25,000 Cr | ₹3.5–4 lakh crore |

| Net Profit | ₹1,600 Cr | ₹25,000–₹30,000 Cr |

| Operating Margin | 6.5% | 10–10.5% |

| ROE | 13% | 18–20% |

| Dividend Yield | 0.52% | 2–2.5% |

RVNL is expected to evolve into a high-scale, stable, globally diversified PSU by 2045.

Shareholding Pattern (2025 Base Year)

| Investor Type | Holding (%) |

|---|---|

| Promoters (Government) | 72.84% |

| Retail Investors | 16.10% |

| Domestic Institutions | 6.24% |

| FIIs | 4.82% |

This structure indicates steady government backing with rising institutional participation — both essential for long-term growth.

RVNL Share Price Forecast (2025–2045)

| Year | Target Range | Growth Phase |

|---|---|---|

| 2025 | ₹470–₹510 | Execution Phase |

| 2030 | ₹820–₹880 | Expansion Phase |

| 2035 | ₹1,100–₹1,200 | Diversification Phase |

| 2040 | ₹1,900–₹2,300 | Global Expansion |

| 2045 | ₹3,000–₹3,300 | Mature Global Leadership |

FAQs on RVNL Share Price Target 2045

1. What is the RVNL share price target 2045?

The anticipated rvnl share price goal 2045 is ₹3,000–₹3,300.

2. What will fuel RVNL’s growth by 2045?

International diversification, metro growth, high-speed rail projects, and enhanced profits.

3. How much profit can RVNL create by 2045?

RVNL might earn ₹3.5–₹4 lakh crore in yearly income by 2045.

4. Will RVNL stay government-backed?

Yes, the government is likely to keep dominant ownership.

5. Is RVNL a solid long-term stock until 2045?

Yes – RVNL has long-term compounding potential owing to consistent demand, visibility, and government assistance.

6. Can RVNL achieve ₹5,000 before 2045?

Reaching ₹5,000 by 2045 would need RVNL to compound at 14–15% CAGR, which is much higher than current forecasts. While not implausible, this would require on unprecedented global growth, substantially greater margins, and a large sector-wide re-rating.

7. What industries will RVNL be active in by 2045?

By 2045, RVNL is projected to operate across metro rail systems, high-speed rail, logistics corridors, expressways, multinational EPC projects, and green mobility infrastructure, diminishing its dependency on Indian Railways alone.

8. Will RVNL face competition from private enterprises by 2045?

Yes. As India exposes additional infrastructure projects to private involvement, RVNL may face competition from major private EPC businesses and foreign competitors. However, its government support and execution track record offer it a substantial competitive edge.

Conclusion

By 2045, RVNL is projected to evolve into a mature, globally diversified infrastructure PSU with strong cash flows, increasing international projects, and a powerful presence in metro, high-speed rail, and turnkey EPC segments.

With a projected RVNL share price target 2045 of ₹3,000–₹3,300, the company represents long-term structural growth aligned with India’s infrastructure transformation.

To view projections for all years — 2025, 2030, 2035, 2040, and 2050 — explore the complete analysis here:

RVNL Share Price Target 2025–2050: Long-Term Forecast & Vision

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analyses and insights can help you make informed investment decisions.