The IRFC share price target 2040 is a vital consideration for long-term investors who recognize the significant growth prospects of India’s railway industry and the country’s ambition to establish itself as a leading global logistics hub. The Indian Railway Finance Corporation (IRFC) is the Indian Railways’ finance arm. It is very important for getting money for big construction and transformation projects all around the nation.

By 2040, the Indian railway network is predicted to grow a lot. This would include high-speed rail tracks, full electrification, modernized freight infrastructure, and world-class passenger services. IRFC is the main source of financing for rail infrastructure, therefore it stands to gain the most from this long-term structural repair.

This article gives a complete and data-backed look at the IRFC share price target 2040, including valuation estimates, performance insights, growth possibilities, and risk considerations that long-term investors should be aware of.

IRFC Share Price Target 2040

Taking into account IRFC’s strong operational performance, predictable revenue model, long-term financing strategy, asset base growth, and sustained government backing, the irfc share price target 2040 is projected to be:

₹1,750 to ₹2,050

This projection assumes long-term compounding of profits, ongoing investment-led growth in India’s railway development schedule, and value appreciation driven by institutional involvement and global finance prospects.

Current Market Fundamentals Snapshot

| Metric | Current Value |

|---|---|

| Market Cap | ₹1,52,575 Cr |

| P/E Ratio (TTM) | 22.32 |

| Industry P/E | 25.92 |

| P/B Ratio | 2.72 |

| Debt to Equity | 7.25 |

| ROE | 12.16% |

| EPS (TTM) | 5.23 |

| Dividend Yield | 1.37% |

These fundamentals reflect a solid and stable financial base supporting future expansion.

IRFC Growth Journey Over the Years

IRFC has developed dramatically over the last decade, evolving from a low-value PSU stock into a key finance leader with high long-term potential. The company’s rise indicates both financial strength and India’s fast railway construction.

How IRFC Has Grown Over Time

- 2021: Share price traded around ₹20–₹25

- 2025: Expanded strongly to ₹120–₹140, supported by:

- Stable profits and revenue growth

- Government-driven infrastructure spending

- Increased investor confidence

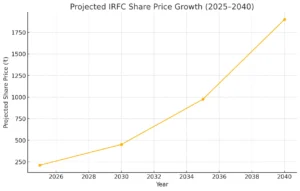

Projected Share Price Milestones

| Year | Estimated Price Range |

|---|---|

| 2030 | ₹420 – ₹480 |

| 2035 | ₹900 – ₹1,050 |

| 2040 | ₹1,750 – ₹2,050 |

The chart below visually represents the projected growth pattern of IRFC based on midpoint estimates of long-term price forecasts:

IRFC Position in India’s Future Railway Vision 2040

By 2040, Indian Railways aims to become one of the world’s fastest, most efficient and most electrified transport systems. Government plans include:

- 100% electrification and expansion of track networks

- Multiple high-speed rail routes operational (Delhi–Varanasi, Mumbai–Ahmedabad, Chennai–Mysuru)

- Expansion of Dedicated Freight Corridors

- Introduction of driverless & smart trains

- AI-based automated signalling systems

- Fully modernized railway stations & logistics hubs

Since financing for these projects will require massive long-term capital, IRFC is expected to retain and expand its role as the primary financial engine of these upgrades.

How IRFC is Positioned for 2040

| Strategic Advantage | Benefit |

|---|---|

| Long-term leasing model | Predictable revenue & profit stability |

| Government-backed financing | Lower credit & operational risk |

| Growing asset portfolio | Compounding balance sheet growth |

| Global borrowing capacity | Reduced borrowing cost and diversification |

| High efficiency OPM (>99%) | Maximum earnings conversion |

This makes IRFC structurally one of the strongest PSU financials for long-term investors.

Shareholding Structure

| Shareholder Category | Shareholding (%) |

|---|---|

| Promoters | 86.36% |

| Retail and Others | 11.67% |

| Foreign Institutions | 1.08% |

| Other Domestic Institutions | 0.71% |

| Mutual Funds | 0.18% |

High promoter holding reflects strong government control and financial confidence.

Risks Investors Should Be Aware Of

- A slowdown in railway capital expenditure could moderate growth

- Increasing interest rates may impact lending spreads

- Profit booking and valuation corrections after strong rallies

- Dependency on Indian Railways as the sole customer

- Policy-driven restructuring could affect revenue timing

However, IRFC remains low-risk due to sovereign support and guaranteed leasing contracts.

Conclusion

IRFC has continually exhibited strong financial performance and long-term development potential backed by substantial infrastructure expenditures and government assistance. With its unique business strategy, robust asset growth, little default risk and key participation in future national projects, IRFC is positioned to generate considerable long-term gains.

Based on strategic growth potential and compounding fundamentals, the IRFC share price target 2040 is estimated to be ₹1,750 to ₹2,050, making IRFC a promising long-horizon investment decision.

For further long-term estimates including 2025, 2030, 2035, 2045 and 2050 projections, you may examine the whole research at:

IRFC Share Price Target 2025–2050

FAQs on IRFC Share Price Target 2040

1. What is the IRFC share price target 2040?

The projected IRFC share price target 2040 is ₹1,750 to ₹2,050.

2. Will IRFC benefit from bullet train and freight corridor projects?

Yes, IRFC will be one of the major financing contributors.

3. Is IRFC a safe long-term investment?

Yes, it is supported by the Government of India and has a low credit-risk model.

4. Can IRFC reach ₹2,000 before 2040?

Yes, if revenue growth accelerates and valuation expands faster.

5. Does IRFC pay dividends?

Yes, IRFC maintains a consistent dividend payout record.

6. What could impact IRFC’s price performance before 2040?

Rising interest cost, regulatory changes or reduced capital budget.

7. Can IRFC become a multi-bagger by 2040?

Very likely from lower price accumulation levels.

8. Is IRFC suitable for SIP investors?

Yes, SIP accumulation benefits from long-term compounding.

9. Why do investors prefer government-backed financing companies?

They offer lower risk, stable income, and strong asset support.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analyses and insights can help you make informed investment decisions.