Adani Power, a subsidiary of the Adani Group, is one of India’s leading private power producers. Known for its significant contributions to India’s energy sector, Adani Power operates several thermal power plants nationwide. This article uses technical analysis, historical data, and market trends to provide a detailed analysis of Adani Power share price target for 2026, 2030, 2035, 2040, 2045, and 2050.

Overview of Adani Power

Company Background

Adani Power was established in 1996 and has become a major player in India’s energy sector. The company operates multiple thermal power plants and has a combined installed capacity of over 12,450 MW. Adani Power is known for its innovative approaches and significant contributions to India’s power generation capabilities.

Current Market Position

As of February 2026, Adani Power remains one of the most actively tracked power sector stocks in India. The company benefits from strong electricity demand, stable long-term contracts, and strategic positioning within the Adani Group’s integrated energy ecosystem.

Despite operating primarily in thermal power, Adani Power continues to maintain strong revenue visibility due to India’s base-load power requirements, where coal-based generation still plays a dominant role.

Financial table for Adani Power

| Company Name | Adani Power |

|---|---|

| Market Cap | ₹ 28.885 Cr (As of February 2026) |

| P/E Ratio | 25.56 |

| Industry P/E | 23.67 |

| Debt to Equity Ratio | 0.83 |

| ROE | 20.58% |

| Dividend Yield | 0.00% |

| 52 Week High | 182.70 |

| 52 Week Low | 92.40 |

| Official Website | Adani Power |

From a financial standpoint in 2026, Adani Power shows healthy profitability and strong return on equity, indicating efficient asset utilisation. Although debt levels remain moderate, stable cash flows from long-term contracts provide financial comfort.

Future Prospects

Growth Overview

Over the past five years, Adani Power has delivered exceptional financial growth driven by higher power demand, improved plant utilisation, and acquisition-led expansion.

Performance Metrics

The company’s revenue and profitability surged significantly between 2021 and 2024, reflecting strong operational leverage.

Past 5 Years Growth Analysis

Growth Overview

Over the past five years, Adani Power has delivered exceptional financial growth driven by higher power demand, improved plant utilisation, and acquisition-led expansion.

Performance Metrics

The company’s revenue and profitability surged significantly between 2021 and 2024, reflecting strong operational leverage.

Growth Percentage Table

| Year | Revenue Growth | Profit Growth | Market Share Growth |

|---|---|---|---|

| 2021 | 28,150 | 1,270 | 13,113 |

| 2022 | 31,686 | 4,912 | 18,703 |

| 2023 | 43,041 | 10,727 | 29,876 |

| 2024 | 60,281 | 20,829 | 43,145 |

| 2025 | 58,906 | 12,750 | 57,674 |

Adani Power Share Price Target 2026

From a short-term 2026 perspective, Adani Power is expected to remain fundamentally strong due to stable demand for base-load power and long-term PPAs.

Estimated Target (2026): ₹200 – ₹450

This range reflects continued earnings stability, strong operating margins, and steady sector growth.

Risks and Considerations

-

Coal price volatility

-

Regulatory changes in emission norms

-

Interest rate environment

Adani Power Share Price Target 2030

By 2030, India’s energy sector is expected to transform significantly, focusing more on renewable energy sources.

The share price target 2030 is projected to be INR 1200, based on anticipated growth in renewable energy capacity and strategic expansions.

Investment Opportunities

Given its strategic positioning and growth potential, investors can expect substantial returns by investing in Adani Power.

Adani Power Share Price Target 2035

The energy sector’s long-term trends, including technological advancements and shifts towards sustainable energy, will impact Adani Power.

The target price for 2035 is INR 1500, reflecting the company’s anticipated growth and market dominance.

Strategic Considerations

Adani Power’s strategic initiatives, such as expanding its renewable energy portfolio and enhancing operational efficiency, are critical to achieving this target.

Adani Power Share Price Target 2040

By 2040, renewable energy sources and innovative technologies will likely dominate the global energy landscape.

The projected share price in 2040 is INR 1800, considering the company’s investments in sustainable energy and technological advancements.

Long-term Risks and Challenges

Potential challenges include regulatory changes, technological disruptions, and geopolitical factors.

Adani Power Share Price Target 2045

Technological innovations and advancements in energy production will play a significant role in shaping Adani Power’s future.

The target price for 2045 is estimated to be INR 2100, based on the company’s strategic initiatives and market trends.

Strategic Planning

Adani Power’s long-term strategic planning, including investments in research and development, will be crucial in achieving this target.

Adani Power Share Price Target 2050

Adani Power’s vision for 2050 aligns with global trends towards sustainability and renewable energy.

The comprehensive target price for 2050 is projected to be INR 2400, considering the company’s growth potential and market positioning.

Sustainability and Growth

Adani Power’s commitment to sustainability and strategic growth initiatives are key to its long-term success.

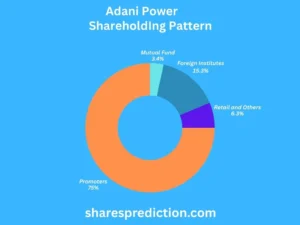

Investor Types and Shareholding Ratios

Investor Types Overview

Adani Power’s investor base comprises various types of investors, including retail investors, institutional investors, government holdings, and public holding post-IPO.

Shareholding Table

| Investor Type | Shareholding Ratio (%) |

|---|---|

| Promoters | 74.96 |

| Other Domestic Institutions | 0.03 |

| Foreign Institutions | 15.29 |

| Retail and Others | 6.33 |

| Mutual Funds | 3.39 |

High promoter holding reflects strong internal confidence.

High promoter holding reflects strong internal confidence.

Methodologies Used for Forecasting

Technical Analysis

Technical analysis involves studying historical price movements and trading volumes to predict future price trends. Key indicators include moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence).

Historical Data Analysis

Historical data analysis examines past performance to identify trends and patterns. This method considers revenue growth, profit margins, and market share over time.

Market Trends and Economic Factors

Broader economic factors such as GDP growth, inflation rates, and sector-specific trends are crucial in forecasting share prices. For Adani Power, trends in the energy sector, including the shift towards renewable energy, are significant.

Conclusion

Summary of Predictions

From a 2026 standpoint, Adani Power shows strong long-term potential with projected targets:

-

2026: ₹200 – ₹450

-

2030: ₹1,200 – ₹1,350

-

2035: ₹1,500 – ₹1,700

-

2040: ₹1,800 – ₹2,050

-

2045: ₹2,100 – ₹2,300

-

2050: ₹2,400 – ₹2,700

Final Thoughts

Adani Power remains one of the most structurally important companies in India’s power ecosystem. While thermal dependency remains a risk, strong cash flows and strategic evolution make it a compelling long-term infrastructure play.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analyses and insights can help you make informed investment decisions.

Additional Resources

FAQs

1. Who is the Chairman of Adani Power?

Answer: Gautam Adani is the Chairman of Adani Power. He is also the founder and chairman of the Adani Group, a diversified organization with interests in energy, resources, logistics, agribusiness, real estate, financial services, and defense.

2. Who is the CEO of Adani Power?

Answer: The CEO of Adani Power is Anil Sardana. He has extensive experience in the power and energy sector and has held various leadership roles in prominent companies.

3. When was Adani Power founded?

Answer: Adani Power was founded in 1996. It has since grown to become one of the largest private power producers in India.

4. What is the installed capacity of Adani Power?

Answer: Adani Power has an installed capacity of over 12,450 MW, making it one of the largest private power producers in India. The company operates thermal power plants across various locations in India.

5. What types of power plants does Adani Power operate?

Answer: Adani Power primarily operates thermal power plants that use coal as a fuel source. However, the company is also involved in renewable energy projects, including solar and wind power.

6. Where are Adani Power’s power plants located?

Answer: Adani Power’s major power plants are located in Gujarat, Maharashtra, Rajasthan, Karnataka, and Chhattisgarh. Each location is strategically chosen for its proximity to fuel sources and power demand centers.

7. What is the mission and vision of Adani Power?

Answer: Adani Power’s mission is to provide reliable and affordable power to support economic growth and improve the quality of life for people. The company’s vision is to be a world-class leader in energy production, focusing on sustainable and innovative energy solutions.

8. What are some of Adani Power’s notable projects?

Answer: Some notable projects of Adani Power include the Mundra Thermal Power Plant in Gujarat, which is the largest single-location coal-based power plant in India, and the Tiroda Thermal Power Plant in Maharashtra. The company is also expanding its footprint in renewable energy with significant investments in solar and wind power projects.

9. How does Adani Power contribute to sustainability and environmental protection?

Answer: Adani Power is committed to sustainability and environmental protection through various initiatives such as reducing carbon emissions, improving energy efficiency, and investing in renewable energy sources. The company follows strict environmental norms and has implemented state-of-the-art technologies to minimize its environmental impact.

10. What is the official website of Adani Power?

Answer: The official website of Adani Power is www.adanipower.com. The website provides detailed information about the company’s operations, projects, sustainability initiatives, and latest updates

Comments and Discussion

User Engagement

We value your feedback! Leave your comments below and share your thoughts on Adani Power’s future.

Community Interaction

Join the discussion and interact with other investors to exchange ideas and insights.