Adani Transmission share price target over the coming years is crucial For investors aiming to secure substantial returns. Adani Transmission Limited, now rebranded as Adani Energy Solutions Limited, continues to be a significant player in India’s power transmission and distribution sector, showing strong growth potential and financial resilience. This article explores the factors influencing the Adani Transmission share price target and provides a detailed forecast for the company’s future trajectory.

Company Overview

Adani Energy Solutions Limited, formerly known as Adani Transmission Limited, is part of the Adani Group and is one of the largest private sector power transmission and distribution companies in India. With a presence across several states, the company plays a key role in India’s energy infrastructure, ensuring the efficient transmission of electricity across vast regions. The company is listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). Despite the name change, the Adani Transmission share price target remains a focal point for investors due to the company’s strategic importance and growth prospects in India’s energy sector.

Profits and Revenue

Adani Energy Solutions has demonstrated consistent growth in both revenue and net profit, underscoring its robust market position and operational efficiency.

The following table highlights the revenue and net profit growth of Adani Transmission (Adani Energy Solutions) over the last five years:

| Year | Net Profit (₹ Cr) | Revenue (₹ Cr) |

|---|---|---|

| 2020 | 706 | 11,681 |

| 2021 | 1,290 | 10,459 |

| 2022 | 1,236 | 11,861 |

| 2023 | 1,281 | 13,840 |

| 2024 | 1,196 | 17,218 |

| 2025 | 922 | 24,447 |

The revenue and profit trend highlights Adani Energy Solutions’ strong long-term growth trajectory. The company has consistently scaled its operations through new transmission projects, distribution assets, and smart infrastructure initiatives. The latest available financial data up to FY2025–FY2026 indicates that Adani Energy Solutions continues to benefit from increasing electricity demand, renewable energy integration, and government-led infrastructure spending.

Current Share Price

As of February 2026, Adani Energy Solutions Limited is trading around ₹1032.50 on the NSE/BSE. The stock has shown drastic movement over the past year, reflecting investor sentiment towards the company’s expansion plans, financial performance, and overall outlook for the Indian power infrastructure sector.

Financial Overview

| Metric | Value (As of February 2026) |

|---|---|

| Market Cap | ₹1,22,188 Cr |

| P/E Ratio (TTM) | 51.27 |

| P/B Ratio | 5.23 |

| ROE | 9.65% |

| EPS (TTM) | 19.84 |

| Dividend Yield | 0.00% |

| Debt to Equity | 1.95 |

| 52-Week High | ₹1,067.70 |

| 52-Week Low | ₹639.45 |

| Industry P/E | 23.55 |

| Book Value | 194.66 |

| Face Value | 10 |

| Website | Adani Energy Solutions |

Factors Influencing Adani Transmission Share Price Target

Government Policy and Energy Sector Developments

- National Energy Policy: The Indian government’s focus on expanding and modernizing power transmission infrastructure provides significant growth opportunities for Adani Energy Solutions. Government initiatives to integrate renewable energy into the grid will drive demand for efficient transmission systems, positively impacting the Adani Transmission share price target.

- Infrastructure Development: The ongoing development of infrastructure projects, especially in underserved and rural areas, will increase the demand for reliable power transmission. As a leader in the sector, Adani Energy Solutions is well-positioned to benefit from these developments, enhancing the share price outlook.

Economic Growth and Urbanization

- Urbanization: Rapid urbanization in India is leading to increased electricity demand, which in turn requires robust transmission networks. Adani Energy Solutions’ extensive network across the country positions it well to capitalize on this demand, positively affecting the Adani Transmission share price target.

- Economic Stability: A stable and growing economy ensures continued investment in infrastructure, including power transmission. This economic stability supports the Adani Transmission share price target by fostering investor confidence and maintaining strong demand for the company’s services.

Technological Advancements and Innovation

- Grid Modernization: Adani Energy Solutions’ investment in grid modernization and smart grid technologies improves efficiency, reduces transmission losses, and enhances service reliability. These advancements contribute positively to the Adani Transmission share price target by ensuring the company remains at the forefront of the industry.

- Sustainable Energy Integration: As India moves towards greater reliance on renewable energy sources, Adani Energy Solutions’ role in integrating these sources into the national grid will be crucial. The company’s commitment to sustainability and innovation will attract environmentally conscious investors, further supporting the Adani Transmission share price target.

Financial Stability and Debt Management

- Financial Performance: Despite a high P/E ratio and significant debt levels, Adani Energy Solutions’ robust revenue growth and strong market position ensure financial stability. Effective debt management and the company’s ability to generate consistent cash flow are crucial for maintaining a positive Adani Transmission share price target.

- Strategic Investments: Adani Energy Solutions’ strategic investments in expanding its transmission network and acquiring new assets will drive future growth. These investments, coupled with careful debt management, support a positive outlook for the Adani Transmission share price target.

Adani Transmission Share Price Target 2026

Based on the company’s latest financial performance, order book strength, and expansion into smart grid and renewable energy infrastructure, Adani Energy Solutions’ share price target for 2026 is estimated to be in the range of ₹900 to ₹1200.

This projection takes into account the company’s revenue growth trend, current earnings per share (EPS), debt levels, and overall valuation in comparison to industry peers. Continued government support for power infrastructure, rising electricity demand, and large-scale transmission projects are expected to remain key growth drivers in 2026.

Adani Transmission Share Price Target 2030

Looking ahead to 2030, the Adani Transmission share price target is expected to reach between ₹1,900 and ₹2,150. This growth forecast is fueled by Adani Energy Solutions’ sustained profitability, expansion into new transmission projects, and the adoption of advanced technologies. As the company continues to build its reputation as a leader in power transmission, investor interest is likely to increase, driving the share price towards the higher end of this range.

Adani Transmission Share Price Target 2035

By 2035, the Adani Transmission share price target is anticipated to be between ₹2,980 and ₹3,370. This significant increase is expected as Adani Energy Solutions experiences strong financial growth, forms strategic partnerships, and solidifies its position as a leader in the global power transmission sector. The company’s continuous efforts in innovation and market expansion are likely to result in substantial value creation for shareholders.

Adani Transmission Share Price Target 2040

In 2040, the Adani Transmission share price target is projected to rise to approximately ₹4,500 to ₹4,800. This target reflects the company’s ongoing commitment to innovation, its expansion into new markets, and the growing global demand for efficient power transmission. Adani Energy Solutions’ strategic vision, combined with its ability to adapt to changing market dynamics, is expected to drive the share price upward, making it a promising investment for the long term.

Adani Transmission Share Price Target 2045

By 2045, the Adani Transmission share price target is forecasted to reach between ₹6,000 and ₹6,200. This projection is based on the company’s long-term growth strategies, including forming strategic partnerships, increasing its transmission capacity, and maintaining a strong pipeline of projects. As Adani Energy Solutions continues to execute its vision of becoming a global leader in power transmission, its share price is expected to reflect this success, offering significant returns to investors.

Adani Transmission Share Price Target 2050

Looking even further ahead to 2050, the Adani Transmission share price target is anticipated to be between ₹7,500 and ₹7,800. This ambitious target is supported by decades of sustained growth, technological improvements, and Adani Energy Solutions’ leadership in the power transmission sector. The company’s focus on innovation, sustainability, and market expansion is likely to create significant long-term value for shareholders, making Adani Energy Solutions a standout investment in the energy industry.

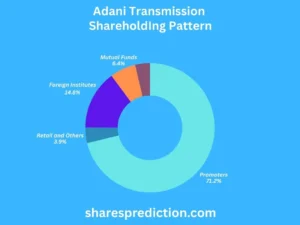

Shareholding Pattern

| Category | Percentage (%) |

|---|---|

| Promoters | 71.19% |

| Foreign Institutions | 14.77% |

| Retail and Others | 3.89% |

| Other Domestic Institutions | 3.70% |

| Mutual Funds | 6.44% |

The shareholding pattern of Adani Energy Solutions Limited as of [Quarter 2026] reflects strong promoter confidence and sustained institutional interest. Promoters continue to hold a majority stake, indicating long-term commitment to the company’s growth. The presence of foreign institutional investors and mutual funds further strengthens the stock’s credibility among long-term investors.

Conclusion

The Adani Transmission share price target for 2026, 2030, 2035, 2040, 2045, and 2050 suggests a promising future for the company, characterized by steady financial growth, ongoing innovation, and strategic expansion. As global demand for efficient power transmission continues to rise, Adani Energy Solutions’ commitment to excellence positions it well for long-term success. Investors can look forward to significant value appreciation, making Adani Transmission (Adani Energy Solutions) an appealing investment opportunity in the expanding energy sector.

FAQs About Adani Transmission Limited (Adani Energy Solutions Limited)

Q1. Who is the Chairman of Adani Transmission Limited (Adani Energy Solutions Limited)?

- The Chairman is Mr. Gautam Adani.

Q2. When was Adani Transmission Limited (Adani Energy Solutions Limited) established?

- Adani Transmission Limited was established as part of the Adani Group’s expansion into the power transmission sector.

Q3. Where is Adani Transmission Limited (Adani Energy Solutions Limited) headquartered?

- The company is headquartered in Ahmedabad, Gujarat, India.

Q4. What are the main services offered by Adani Transmission Limited (Adani Energy Solutions Limited)?

- The company specializes in the development, operation, and maintenance of power transmission systems across India.

Q5. What sustainability initiatives is Adani Transmission Limited (Adani Energy Solutions Limited) involved in?

- The company is involved in various sustainability initiatives, including reducing carbon emissions and increasing the use of renewable energy sources.

Q6. What certifications does Adani Transmission Limited (Adani Energy Solutions Limited) hold?

- The company holds several certifications related to quality management, safety, and environmental management.

Q7. What awards and recognitions has Adani Transmission Limited (Adani Energy Solutions Limited) received?

- The company has received numerous awards for excellence in power transmission and sustainability practices from prestigious industry bodies.

Q8. What is Adani Transmission Limited (Adani Energy Solutions Limited)’s approach to corporate social responsibility (CSR)?

- The company actively engages in CSR activities, focusing on environmental sustainability, education, and community development to contribute positively to society.

Q9. What is the vision and mission of Adani Transmission Limited (Adani Energy Solutions Limited)?

- The company’s vision is to be a globally recognized leader in the power transmission sector. Its mission is to deliver reliable and sustainable energy solutions through innovative practices and customer-centric approaches.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.