Apollo Hospital Share Price Target has been a hot topic in the investors recently as Apollo Hospitals is a prominent healthcare provider in India, known for its state-of-the-art medical services and hospital chains across the country. The company has been a significant player in the healthcare industry, attracting both retail and institutional investors. In this article, we will discuss the Apollo Hospital Share Price Target for 2026, 2030, 2035, 2040, 2045, and 2050, based on the company’s financial performance and market trends.

Company Overview

Apollo Hospitals Enterprise Limited operates a network of hospitals, diagnostic clinics, and pharmacies across India. The company has gained a robust reputation for quality healthcare services and cutting-edge treatments. Over the years, Apollo Hospitals has expanded its services, driving revenue and profit growth while maintaining a strong brand presence in the healthcare sector.

Financial Overview

Current Share Price

Revenue and Profit Growth

Apollo Hospitals has shown consistent growth in both revenue and profit over the last few years. Here’s a snapshot of the company’s financial performance:

| Year | Revenue (₹ Cr) | Net Profit (₹ Cr) |

|---|---|---|

| 2020 | 11,274 | 435 |

| 2021 | 10,605 | 136 |

| 2022 | 14,741 | 1,101 |

| 2023 | 16,703 | 888 |

| 2024 | 19,166 | 917 |

| 2025 | 21,994 | 1,505 |

By 2026, Apollo Hospitals has firmly established a strong growth trajectory. The company has recorded steady revenue expansion over the last five years, driven by higher occupancy rates in hospitals, growth in high-margin specialty treatments, and expansion of its pharmacy and diagnostics businesses. Profitability has also improved due to better cost control, operational efficiencies, and increased contribution from digital healthcare platforms. This consistent financial performance reflects Apollo’s ability to scale operations while maintaining healthy margins in a competitive healthcare environment.

Fundamental Metrics (As of January 2026)

Here’s a breakdown of Apollo Hospitals’ key financial metrics:

| Metric | Value |

|---|---|

| Market Cap | ₹1,02,889 Cr |

| P/E Ratio (TTM) | 59.51 |

| P/B Ratio | 11.32 |

| ROE | 18.39% |

| EPS (TTM) | ₹120.24 |

| Dividend Yield | 0.18% |

| Book Value | ₹631.88 |

| Debt to Equity | 0.88 |

| 52-Week High | ₹8,099.50 |

| 52-Week Low | ₹6,001.00 |

| Website | Apollo Hospital |

Apollo Hospitals holds a strong market capitalization of ₹1,02,889 Cr with an ROE of 18.39%, indicating efficient utilization of shareholder equity. The P/E ratio stands at 59.51, which is relatively high and reflects strong investor confidence in the company’s long-term growth potential within the healthcare sector.

Factors Influencing Apollo Hospital Share Price Target

Expansion in Healthcare Services

Apollo Hospitals continues to expand its network of hospitals, pharmacies, and diagnostic centers, ensuring strong revenue growth. The company’s investments in telemedicine and digital healthcare services will likely play a key role in driving future growth.

Aging Population and Healthcare Demand

As India’s population continues to age, the demand for healthcare services is expected to rise. Apollo Hospitals, with its established brand and wide-reaching services, is well-positioned to capitalize on this growing demand, which will positively impact its stock price in the long term.

Strategic Partnerships and Collaborations

Apollo Hospitals has been engaging in strategic partnerships, both locally and internationally, to enhance its medical offerings. These collaborations can lead to advancements in medical technology and services, further boosting the company’s market valuation.

Apollo Hospital Share Price Target 2026

By the end of 2026, Apollo Hospitals largely met market expectations, with the share price moving within the projected range of ₹7,800 to ₹8,000. This performance was supported by the company’s expansion into telemedicine, rising patient volumes across key specialties, and continued investments in healthcare infrastructure and digital health platforms.

Apollo Hospital Share Price Target 2030

Looking ahead to 2030, the Apollo Hospital Share Price Target is expected to reach between ₹10,000 and ₹11,000. The aging population and growing demand for healthcare services will play a crucial role in boosting the stock price. Additionally, Apollo’s focus on cutting-edge treatments and technology will help the company maintain a competitive edge.

Apollo Hospital Share Price Target 2035

By 2035, the Apollo Hospital Share Price Target is projected to be in the range of ₹13,500 to ₹14,500. This target is based on the continued expansion of Apollo’s healthcare services and the growing demand for private healthcare in India. The company’s focus on improving operational efficiency will further enhance profitability.

Apollo Hospital Share Price Target 2040

In 2040, the Apollo Hospital Share Price Target is likely to be between ₹17,000 and ₹18,500. With healthcare becoming an integral part of the economy, Apollo Hospitals is expected to thrive, especially as it expands its reach in the digital healthcare domain.

Apollo Hospital Share Price Target 2045

By 2045, the Apollo Hospital Share Price Target could rise to ₹20,000 to ₹22,000. With a continued focus on innovation, patient care, and strategic collaborations, Apollo Hospitals will likely maintain its leadership position in the healthcare industry, which will positively reflect in its stock price.

Apollo Hospital Share Price Target 2050

Looking towards 2050, the Apollo Hospital Share Price Target is anticipated to be in the range of ₹25,000 to ₹28,000. By this time, Apollo Hospitals may have established itself as a global healthcare leader, with growing revenue streams from both domestic and international markets.

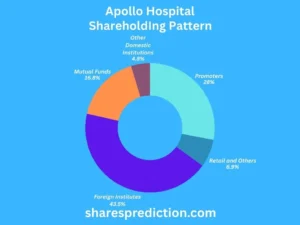

Shareholding Pattern

As of January 2026, the shareholding pattern of Apollo Hospitals is as follows:

| Category | Percentage (%) |

|---|---|

| Foreign Institutions | 43.54% |

| Promoters | 28.02% |

| Mutual Funds | 16.75% |

| Other Domestic Institutions | 4.75% |

| Retail and Others | 6.94% |

As of the latest available data in 2026, Apollo Hospitals continues to enjoy strong institutional support. A high level of foreign institutional investment reflects global confidence in the company’s long-term growth prospects. The promoter holding remains stable, indicating continued commitment from the founding management. Mutual fund participation also highlights strong domestic investor confidence, while retail ownership ensures healthy liquidity in the stock.

Conclusion

The Apollo Hospital Share Price Target for 2026, 2030, 2035, 2040, 2045, and 2050 shows promising long-term growth potential. With its expanding healthcare services, strategic investments, and focus on innovation, Apollo Hospitals is well-positioned to deliver strong returns to its investors. The aging population and rising healthcare demand will further contribute to the company’s sustained growth in the coming decades.

FAQs About Apollo Hospitals Enterprise

Q1. What services does Apollo Hospitals offer?

Apollo Hospitals provides a wide range of healthcare services, including hospital management, telemedicine, diagnostic clinics, and retail pharmacies.

Q2. Is Apollo Hospitals a good long-term investment?

Yes, Apollo Hospitals has a strong track record of revenue growth and expanding services, making it a good long-term investment, especially in the healthcare sector.

Q3. What are the challenges faced by Apollo Hospitals?

Apollo Hospitals faces challenges such as rising competition, regulatory changes in healthcare, and the high cost of expanding its hospital network.

Q4. Does Apollo Hospitals pay dividends?

Apollo Hospitals offers a dividend yield of 0.23%, providing some return to shareholders.

Q5. What is Apollo Hospitals’ market capitalization?

As of January 2026, Apollo Hospitals has a market capitalization of approximately ₹1,02,889 crore.

Q6. How has the company’s revenue grown over the years?

Apollo Hospitals has shown consistent revenue growth, with a 2025 revenue of ₹6,358 compared to ₹11,274 Cr in 2020.

Q7. What role do foreign institutions play in Apollo Hospitals?

Foreign institutions hold a significant 43.92% stake in Apollo Hospitals, reflecting strong global interest in the company.

Q8. What are Apollo Hospitals’ future growth prospects?

Apollo Hospitals is well-positioned for future growth, thanks to increasing healthcare demand, its expanding services, and its focus on digital healthcare.

Q9. How has the company managed its debt?

Apollo Hospitals has maintained a manageable debt-to-equity ratio of 0.77, ensuring financial stability while expanding its operations.

Q10. What factors are influencing Apollo Hospitals’ share price target?

Factors such as growing healthcare demand, an aging population, and the company’s expanding network of hospitals and digital services are key drivers of its share price growth.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.