Investors following India’s capital goods and infrastructure growth story continue to place a high priority on the BHEL Share Price Target. The massive PSU Bharat Heavy Electricals Limited (BHEL) is essential to heavy engineering, railroads, renewable energy projects, and power generation. The long-term prospects of BHEL are receiving more attention as a result of India’s increased investments in infrastructure, manufacturing, and energy security.

Based on financial performance patterns, balance-sheet data, order book visibility, and positive long-term compounding assumptions, this paper offers a thorough forecast on the BHEL Share Price Target from 2026 to 2050.

Company Overview

Bharat Heavy Electricals Limited (BHEL) is an engineering and manufacturing company owned by the Government of India. Its main office is in New Delhi. The corporation is a major provider of industrial systems and power plant equipment, and it has a strong presence in the thermal, hydro, nuclear, and renewable energy sectors.

BHEL is one of India’s most diverse capital goods firms since it works with a wide range of industries, including railways, defense, oil and gas, cement, steel, and refineries.

Current Share Price

BHEL Current Market Snapshot

| Metric | Value |

|---|---|

| Market Capitalisation | ₹86,320 Cr |

| 52-Week High | ₹305.90 |

| 52-Week Low | ₹176.00 |

| P/E Ratio (TTM) | 105.94 |

| Industry P/E | 38.62 |

| P/B Ratio | 3.54 |

| Debt to Equity | 0.45 |

| Return on Equity (ROE) | 2.29% |

| Earnings Per Share (TTM) | ₹2.34 |

| Book Value | ₹70.07 |

| Official Website | Bharat Heavy Electricals Ltd. |

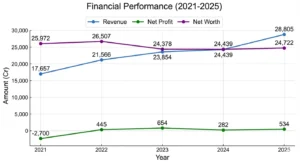

Past Financial Performance

| Year | Revenue | Net Profit | Net Worth |

|---|---|---|---|

| 2021 | 17,657 Cr | -2,700 Cr | 25,972 Cr |

| 2022 | 21,566 Cr | 445 Cr | 26,507 Cr |

| 2023 | 23,854 Cr | 654 Cr | 24,378 Cr |

| 2024 | 24,439 Cr | 282 Cr | 24,439 Cr |

| 2025 | 28,805 Cr | 534 Cr | 24,722 Cr |

BHEL’s financial performance over the past few years highlights a gradual turnaround phase rather than a complete structural recovery. Although revenues have shown steady improvement, profitability remains sensitive to project execution timelines, cost overruns, and pricing pressure in competitive bidding environments. As of 2026, BHEL continues to operate in a margin-constrained capital goods sector, making operational efficiency and order conversion the key determinants of future earnings growth.

BHEL has transitioned from a prolonged loss-making phase to a relatively stable operating position, supported by improved order inflows and gradual revenue recovery. However, profitability remains cyclical and closely linked to execution efficiency, working capital management, and government-led project timelines. In 2026, BHEL’s long-term investment appeal lies more in its strategic importance and order visibility than in consistently high margins.

Key Factors Influencing BHEL Share Price Target

Strong Order Book Visibility

BHEL continues to benefit from a solid order book driven by thermal power resurgence, railway projects, and industrial contracts. Major clients include NTPC, Adani Power, NHPC, and Indian Railways.

Infrastructure & Energy Push

India’s focus on power production, grid modernization, hydrogen, and renewable energy supports long-term need for BHEL’s technical talents.

Operating Leverage Potential

With sales rising and fixed expenses substantially absorbed, incremental growth can dramatically increase margins over the long term.

High Promoter Confidence

Government of India’s large promoter holding reinforces long-term stability and policy support.

BHEL Share Price Target 2026

By 2026, BHEL’s share price performance is expected to remain closely aligned with order book execution, government infrastructure spending, and improvement in operational efficiency. The company’s valuation reflects long-term growth expectations rather than short-term earnings strength.

Predicted Target Price: INR 365 – 390

Analysis:

Technical Analysis: The stock continues to trade in a structurally strong zone, supported by long-term trend momentum and high trading volumes driven by PSU sector interest.

Fundamental Analysis: Gradual revenue recovery, stable order inflows, and improved working capital management are key positive factors, while margin pressures and execution risks remain constraints.

Market Outlook: Investor sentiment in 2026 is influenced more by future growth visibility than by present profitability.

Key Takeaways:

BHEL remains a long-term cyclical play on India’s infrastructure growth.

Short-term volatility should be expected due to project execution dynamics.

BHEL Share Price Target 2030

BHEL’s objective is to reinforce its market position by 2030 by diversifying and expanding into renewable energy. The expansion of BHEL will be facilitated by the increasing demand for clean energy solutions. The company’s robust financial performance and favourable industry outlook have led analysts to predict a share price target of INR 480 to INR 490.

BHEL Share Price Target 2035

Driven by the company’s dominance in the heavy electrical equipment sector and technological advancements, the share price target for 2035 is INR 780 to INR 920. The long-term growth of BHEL will be facilitated by the integration of smart grid solutions, IoT, and AI in power systems.

BHEL Share Price Target 2040

BHEL’s target share price for 2040 is INR 1400 to INR 1500. This projection is predicated on the continuous innovation, expansion of digital solutions, and critical role of BHEL in the development of India’s infrastructure. Consistent growth is anticipated due to the company’s global reach, diverse product portfolio, and solid market position.

BHEL Share Price Target 2045

The share price target for 2045 is INR 1900 to INR 2100. This forecast takes into account BHEL’s expected leadership in renewable energy initiatives and next-generation technologies, as well as its significant contribution to India’s developed infrastructure ecosystem. BHEL’s ability to adapt to changing market needs, as well as its potential to enter new markets, are key growth drivers.

BHEL Share Price Target 2050

By 2050, BHEL’s share price is expected to range between INR 2750 and INR 2900. This long-term forecast is based on BHEL’s expected position as a major player in the global heavy electrical equipment industry, leveraging cutting-edge technologies. Significant growth is expected to be driven by the company’s participation in global projects, market expansion, and ongoing innovation.

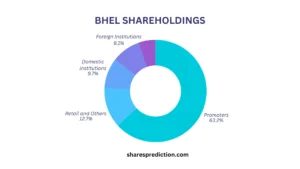

BHEL Shareholding Pattern

| Investor Category | Shareholding (%) |

|---|---|

| Promoters | 63.17% |

| Retail & Others | 12.71% |

| Other Domestic Institutions | 9.66% |

| Foreign Institutions | 9.10% |

| Mutual Funds | 5.36% |

As of 2026, BHEL continues to maintain a high promoter holding through the Government of India, which provides long-term stability and policy-level support. Institutional participation reflects moderate confidence, while retail investor interest remains driven by PSU sector optimism and long-term infrastructure themes rather than short-term financial performance.

High promoter holding provides stability, while increasing institutional participation reflects growing confidence.

Conclusion

BHEL’s share price outlook in 2026 reflects a structurally important PSU positioned within India’s long-term infrastructure and energy development roadmap. While short-term profitability remains sensitive to execution cycles and cost structures, the company’s strategic role in power, railways, and renewable energy provides strong long-term visibility.

For long-term investors, BHEL represents a cyclical infrastructure opportunity rather than a high-margin growth stock, making patience, risk management, and periodic performance review essential.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.