Comfort Intech Share Price Target is one of the most interesting topics among investors these days, as Comfort Intech is an emerging player in its respective industry, focusing on diverse financial and operational activities. Investors are keenly watching its growth trajectory, especially considering the company’s stable fundamentals and improving financial performance. This article provides an in-depth analysis of the Comfort Intech Share Price Target for 2026, 2030, 2035, 2040, 2045, and 2050, based on the latest financial data and market performance.

Company Overview

Comfort Intech has a significant presence in various sectors, ranging from financial services to retail trading. The company is witnessing gradual growth, supported by an increase in revenue and profitability. With strong promoter holdings and an expanding retail investor base, the future outlook for Comfort Intech appears promising. However, it faces industry-specific challenges, which could influence its long-term growth prospects.

Financial Overview

Current Share Price

Revenue and Profit Growth

Comfort Intech has demonstrated consistent growth in both revenue and net profit over recent years. Below is a snapshot of the company’s financial performance:

| Year | Revenue (₹ Cr) | Net Profit (₹ Cr) |

|---|---|---|

| 2020 | 59.29 | -0.63 |

| 2021 | 85.17 | 4.83 |

| 2022 | 111 | 4.80 |

| 2023 | 142 | 5.87 |

| 2024 | 159 | 6.68 |

| 2025 | 158 | 8.10 |

From 2020 to 2024, Comfort Intech reported steady growth in both revenue and profitability, reflecting gradual business expansion. However, in FY2025, revenue declined to ₹67.82 Cr and net profit fell to ₹1.01 Cr, indicating operational volatility and possible restructuring or business realignment. Despite this short-term dip, the company remains profitable, and its long-term growth outlook depends on stabilising revenues and improving margins over the coming years.

Fundamental Metrics (As of January 2026)

The key financial metrics of Comfort Intech provide insights into its current standing:

| Metric | Value |

|---|---|

| Market Cap | ₹207 Cr |

| P/E Ratio (TTM) | 67.23 |

| P/B Ratio | 1.32 |

| ROE | 5.73% |

| EPS (TTM) | ₹-0.10 |

| Dividend Yield | 1.11% |

| Book Value | ₹4.80 |

| Debt to Equity | 8.49 |

| 52-Week High | ₹12.20 |

| 52-Week Low | ₹5.72 |

| Website | Comfort Intech Ltd |

As of January 2026, Comfort Intech has a market capitalization of ₹207 Cr, placing it firmly in the micro-cap category. The high P/E ratio of 67.23 suggests that the stock is trading at a premium valuation relative to its current earnings, indicating strong speculative expectations. However, the debt-to-equity ratio of 8.49 reflects elevated leverage, which increases financial risk. Investors should closely monitor cash flows and profitability sustainability going forward.

Factors Influencing Comfort Intech Share Price Target

Industry Growth and Market Position

Comfort Intech is well-positioned within its industry, benefiting from the steady growth of the financial services sector. With increasing demand for its services, the company is expected to maintain its growth trajectory. The expansion of its business lines into other sectors could further enhance its market share.

Financial Performance and Operational Efficiency

Comfort Intech’s consistent revenue growth and profitability improvement suggest operational efficiency and sound management. If the company continues to enhance its financial performance, it is likely to attract more investors, driving the share price upward in the long term.

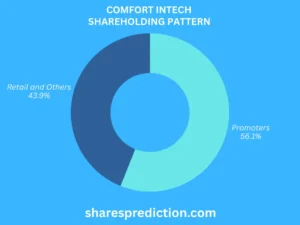

Promoter Holding and Retail Investor Interest

The company’s promoter holding stands at 56.1%, which indicates strong confidence from the founders and key stakeholders. Additionally, with 43.9% held by retail investors, Comfort Intech enjoys significant interest from individual investors, which could drive price volatility but also long-term growth if confidence remains high.

Comfort Intech Share Price Target 2026

By 2026, Comfort Intech’s share price target is estimated to range between ₹29 and ₹40, based on its current earnings trajectory, valuation multiples, and investor sentiment. The stock’s performance will largely depend on revenue stability, debt management, and the company’s ability to scale operations in a competitive environment.

Comfort Intech Share Price Target 2030

Looking towards 2030, the Comfort Intech Share Price Target is estimated to be in the range of ₹47 to ₹60. As the company continues to expand its market presence and improve its operational efficiency, long-term investors could see substantial returns.

Comfort Intech Share Price Target 2035

By 2035, the Comfort Intech Share Price Target is anticipated to reach between ₹90 and ₹100. This is driven by the company’s ability to diversify its business operations and increase profitability through effective cost management.

Comfort Intech Share Price Target 2040

In 2040, the Comfort Intech Share Price Target could rise to ₹180 to ₹195. With continued growth in key sectors and strong financial performance, Comfort Intech is expected to deliver consistent returns to its shareholders.

Comfort Intech Share Price Target 2045

By 2045, the Comfort Intech Share Price Target is likely to range between ₹370 and ₹380. If the company continues on its current growth path, coupled with favorable market conditions, the stock price is expected to appreciate significantly over the next two decades.

Comfort Intech Share Price Target 2050

Looking ahead to 2050, the Comfort Intech Share Price Target is projected to be between ₹590 and ₹600. The company’s long-term success will depend on its ability to adapt to changing market conditions, innovate, and expand its operations.

Shareholding Pattern

As of September 2024, the shareholding pattern of Comfort Intech is as follows:

| Category | Percentage (%) |

|---|---|

| Promoters | 56.08% |

| Retail and Others | 43.92% |

As of the latest available data in 2026, Comfort Intech’s shareholding pattern shows promoters holding 56.08% of total equity, while retail and other investors hold 43.92%. High promoter ownership indicates long-term commitment from management, whereas strong retail participation suggests rising public interest but also potential price volatility.

Conclusion

The Comfort Intech Share Price Target for 2026, 2030, 2035, 2040, 2045, and 2050 suggests a stable and growing company with significant potential for long-term investors. As the company continues to expand its operations, enhance profitability, and adapt to industry changes, investors could expect steady returns over the coming decades.

FAQs About Comfort Intech

Q1. What does Comfort Intech specialize in?

Comfort Intech is involved in financial services and retail trading, with a focus on operational growth across various sectors.

Q2. Is Comfort Intech a good long-term investment?

Yes, Comfort Intech is considered a good long-term investment, given its consistent financial performance and strong promoter holding.

Q3. What are the company’s key financial strengths?

Comfort Intech has strong revenue growth, consistent profitability, and a low debt-to-equity ratio, indicating financial stability.

Q4. What is the market outlook for the company?

The company is expected to benefit from the growth of the financial services sector and the increasing demand for its services.

Q5. How does promoter holding affect the stock price?

With a promoter holding of 56.08%, Comfort Intech has strong backing from its founders, which could positively influence the stock price in the long term.

Q6. What are the company’s growth prospects?

The company’s growth prospects are positive, with expected expansion into new sectors and consistent financial improvements.

Q7. What is the projected share price target for 2026?

By 2026, the share price is expected to be in the range of ₹29 to ₹40.

Q8. How does the company plan to improve profitability?

Comfort Intech is focusing on enhancing operational efficiency and expanding its market reach to improve profitability in the coming years.

Q9. What is the company’s debt position?

Comfort Intech has a low debt-to-equity ratio of 8.49, which indicates a strong financial position with minimal debt obligations.

Q10. What factors could influence the share price in the future?

Key factors include industry growth, financial performance, and market demand for the company’s services.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.