GRSE Share Price Target has gained the attention of investors looking for growth potential in the defence sector. Garden Reach Shipbuilders & Engineers Ltd. (GRSE) has been a pivotal player in India’s defense shipbuilding sector. With a growing focus on expanding its operations and improving profitability, the GRSE Share Price Target for 2025 to 2050 is worth analyzing. This article takes a detailed look at the company’s financials and market trends to predict its future share prices.

Company Overview

Garden Reach Shipbuilders & Engineers Ltd. (GRSE) is a key player in India’s shipbuilding industry, primarily catering to the defense sector. GRSE is involved in designing and constructing vessels for the Indian Navy and Coast Guard, among other operations. The company’s reputation for delivering cutting-edge shipbuilding technology places it at the forefront of this highly specialized industry. With its growing portfolio and consistent focus on innovation, GRSE’s long-term growth outlook is promising, supporting a strong GRSE Share Price Target.

Financial Overview

Current Share Price

Revenue and Profit Growth

GRSE has witnessed substantial growth in both revenue and profit over the last few years, as shown in the following table:

| Year | Revenue (₹ Cr) | Net Profit (₹ Cr) |

|---|---|---|

| 2020 | 1,659 | 163 |

| 2021 | 1,327 | 153 |

| 2022 | 1,916 | 190 |

| 2023 | 2,763 | 228 |

| 2024 | 3,892 | 357 |

The company’s revenue grew significantly from ₹1,659 Cr in 2020 to ₹3,892 Cr in 2024. Likewise, net profit surged from ₹163 Cr to ₹357 Cr in the same period, showing strong financial health and consistent growth. This upward trend in revenue and profits is a strong indicator for an optimistic GRSE Share Price Target in the coming years.

Fundamental Metrics (As of September 2024)

GRSE’s financial fundamentals provide insight into its current market position:

| Metric | Value |

|---|---|

| Market Cap | ₹22,474 Cr |

| P/E Ratio (TTM) | 61.10 |

| P/B Ratio | 13.43 |

| ROE | 21.35% |

| EPS (TTM) | ₹32.11 |

| Dividend Yield | 0.48% |

| Book Value | ₹146.09 |

| Debt to Equity | 0.04 |

| 52-Week High | ₹2,833.80 |

| 52-Week Low | ₹648.30 |

| Website | Garden Reach Shipbuilders & Engineers |

The company’s high price-to-earnings (P/E) ratio of 61.10 and a strong return on equity (ROE) of 21.35% highlight its profitability. GRSE’s financial metrics, such as the low debt-to-equity ratio of 0.04 and solid EPS (₹32.11), indicate robust financial management, further supporting a positive outlook for the GRSE Share Price Target.

Factors Influencing GRSE Share Price Target

Government Contracts and Defense Sector Growth

Being a government-owned company, GRSE is heavily involved in defense projects, particularly with the Indian Navy and Coast Guard. The continuous investment by the Indian government in bolstering the nation’s naval fleet will play a pivotal role in driving revenue growth, positively impacting the GRSE Share Price Target.

Technological Advancements in Shipbuilding

GRSE has a reputation for technological innovation and modernization in shipbuilding. Its ability to stay ahead in the sector by integrating the latest technology into its operations is a key factor that will influence its future share price.

Financial Performance and Expansion

GRSE’s improving financial performance, with revenue and profit growth year-on-year, strengthens its position in the market. The company’s efforts to expand operations, improve efficiency, and maintain profitability will continue to influence its share price positively.

GRSE Share Price Target 2025

By 2025, the GRSE Share Price Target is expected to be in the range of ₹2,450 to ₹2,600. This projection is based on GRSE’s ability to secure more defense contracts and its consistent revenue growth. As the company continues to build upon its expertise in shipbuilding, its share price is likely to experience moderate growth in the short term.

GRSE Share Price Target 2030

Looking towards 2030, the GRSE Share Price Target is projected to reach between ₹3,200 and ₹3,500. With ongoing government support for defense projects and GRSE’s expanding portfolio of services, the company is well-positioned to see significant appreciation in its share price over the next decade.

GRSE Share Price Target 2035

By 2035, the GRSE Share Price Target is anticipated to be between ₹4,200 and ₹4,900. As the demand for advanced naval vessels grows, GRSE’s involvement in cutting-edge shipbuilding projects will likely boost its market valuation. Investors can expect strong returns driven by both domestic and international growth.

GRSE Share Price Target 2040

In 2040, the GRSE Share Price Target is expected to rise to ₹6,700 to ₹6,900. The company’s consistent focus on innovation, coupled with the growing global demand for naval defense systems, will be crucial drivers of this share price target. Expansion into new markets could further enhance the company’s revenue streams.

GRSE Share Price Target 2045

By 2045, the GRSE Share Price Target is forecasted to be between ₹7,800 and ₹9,200. GRSE’s long-term strategy of expanding its shipbuilding operations and leveraging advanced technologies will contribute to steady share price appreciation. The company’s position as a key defense contractor ensures strong market demand for its products.

GRSE Share Price Target 2050

Looking ahead to 2050, the GRSE Share Price Target is anticipated to reach between ₹10,400 and ₹12,600. The company’s role in shaping the future of naval defense technology, both in India and abroad, will drive substantial growth in its share price. Over the long term, GRSE is expected to be a dominant force in the global shipbuilding market.

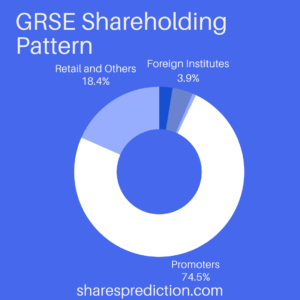

Shareholding Pattern

As of September 2024, the shareholding pattern of Garden Reach Shipbuilders & Engineers Ltd. is as follows:

| Category | Percentage (%) |

|---|---|

| Promoters | 74.50% |

| Retail and Others | 18.39% |

| Foreign Institutions | 3.91% |

| Mutual Funds | 2.52% |

| Other Domestic Institutions | 0.68% |

The large promoter holding of 74.50% reflects strong insider confidence in the company’s long-term growth prospects. The presence of foreign institutions and mutual funds further supports the credibility and future potential of GRSE in the market.

Conclusion

The GRSE Share Price Target for 2025, 2030, 2035, 2040, 2045, and 2050 paints an optimistic picture for long-term investors. With strong financial growth, a clear focus on innovation, and a growing portfolio of defense contracts, GRSE is well-positioned to offer substantial returns to investors over the coming decades. The company’s key role in India’s defense sector and its ability to adapt to market trends will likely drive its share price upwards in the long term.

FAQs About Garden Reach Shipbuilders & Engineers Ltd.

Q1. What does GRSE specialize in?

GRSE specializes in shipbuilding, primarily for the Indian Navy and Coast Guard, and is a key player in the defense sector.

Q2. Where is GRSE headquartered?

GRSE is headquartered in Kolkata, West Bengal, India.

Q3. What types of ships does GRSE build?

GRSE builds naval vessels, including frigates, corvettes, and patrol vessels for the Indian Navy and Coast Guard.

Q4. Does GRSE export its ships?

Currently, GRSE focuses on domestic defense contracts, but there is potential for international collaborations in the future.

Q5. How does GRSE maintain its competitive edge?

GRSE stays competitive by integrating advanced shipbuilding technology and consistently modernizing its infrastructure.

Q6. Who are GRSE’s main competitors?

Key competitors of GRSE include Mazagon Dock Shipbuilders and Cochin Shipyard, both of which operate in the defense shipbuilding industry.

Q7. What are GRSE’s future growth prospects?

GRSE’s growth is expected to be driven by defense sector investments and technological advancements in shipbuilding.

Q8. Does GRSE have plans for expansion?

GRSE is focused on expanding its capabilities to handle more complex and advanced shipbuilding projects in the coming years.

Q9. What is GRSE’s role in India’s defense sector?

GRSE plays a vital role in India’s defense sector by building advanced ships and naval systems for the Indian Navy and Coast Guard.

Q10. What is GRSE’s market strategy for the future?

GRSE aims to maintain its leadership in the shipbuilding sector by investing in R&D, expanding its portfolio, and exploring global opportunities.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.