GTL Infra share price target has been a hot topic among the investors as GTL Infrastructure Ltd. is a prominent player in the Indian telecom infrastructure industry, specializing in providing tower infrastructure to leading telecom service providers. The company has faced several financial challenges due to its high debt levels, but as the telecom sector expands with the 5G rollout, the potential for growth in the company’s stock has increased. This blog will provide a detailed analysis of GTL Infra share price target from 2026 to 2050, along with its past five-year performance and investor holdings.

Company Overview

Current Market Performance

5-Year Growth Performance

Below is a table summarizing GTL Infra’s growth over the last five years in terms of Revenue Growth, Profit Growth, and Market Share Growth.

| Year | Revenue Growth (%) | Profit Growth (%) | Market Share Growth (%) |

|---|---|---|---|

| 2020 | -5.55% | -51.7% | Stable |

| 2021 | -0.51% | -27.5% | Slight Decline |

| 2022 | 3.76% | -12.3% | Slight Increase |

| 2023 | -0.33% | -8.5% | Stable |

| 2024 | -5.89% | -18.9% | Decline |

| 2025 |

The company’s revenue growth has been inconsistent over the past five years, with declining profitability largely due to its high debt load and operational challenges. Its market share has fluctuated slightly but remains stable due to its position as a major telecom infrastructure provider in India.

Financial Table for GTL Infrastructure Ltd.

| Company Name | GTL Infrastructure Ltd. |

|---|---|

| Market Cap | ₹1,447 Cr (As of February 2026) |

| P/E Ratio (TTM) | -1.64 |

| Industry P/E | 18.35 |

| Debt to Equity Ratio | -0.54 |

| ROE (Return on Equity) | 13.86% |

| EPS (TTM) | -₹0.69 |

| Dividend Yield | 0.00% |

| Book Value | -₹4.99 |

| Face Value | ₹10 |

| P/B Ratio | 0.00 |

| 52 Week High | ₹2.17 |

| 52 Week Low | ₹0.98 |

| Official Website | GTL Infrastructure |

As of February 2026, GTL Infrastructure has a market capitalization of ₹1,447 Cr, but continues to report negative earnings with an EPS of -₹0.69. The company’s negative P/E ratio and negative book value of -₹4.99 indicate sustained financial stress and erosion of shareholder value. Despite a reported ROE of 13.86%, the negative equity base distorts traditional profitability ratios. Overall, the financial metrics suggest that GTL Infra remains fundamentally weak with high financial risk in 2026.

GTL Infra Share Price Target for 2026

Based on GTL Infra’s current financial condition, negative earnings, and weak balance sheet, the share price target for 2026 is expected to remain largely speculative. Since the company is loss-making with a negative EPS of -₹0.69 and negative book value, no meaningful fundamental valuation can be applied.

From a realistic financial perspective, GTL Infra’s 2026 share price is likely to trade in the range of ₹1.20 to ₹2.50, driven primarily by market sentiment, trading volumes, and expectations around telecom sector developments rather than intrinsic business value. Any movement beyond this range would be speculative and not supported by financial fundamentals.

GTL Infra Share Price Target for 2030

By 2030, we anticipate further technological advancements, such as the adoption of 6G networks. However, whether GTL Infra can leverage these advancements to its benefit will depend largely on how well it can manage its finances and grow its operational capacity.

Projected Share Price Targets for 2030:

- Optimistic Target: ₹10.50

- Moderate Target: ₹8.00

- Pessimistic Target: ₹5.00

GTL Infra Share Price Target for 2035

By 2035, the telecom sector will have evolved substantially, with likely advancements beyond 6G. GTL Infra’s position in the market will depend on its ability to innovate and manage its operational challenges. Long-term investors should be aware of the company’s ongoing financial restructuring.

Projected Share Price Targets for 2035:

- Optimistic Target: ₹15.00

- Moderate Target: ₹12.50

- Pessimistic Target: ₹6.00

GTL Infra Share Price Target for 2040

The year 2040 may see a fully developed telecom infrastructure in India, and GTL Infra’s growth will be determined by its ability to diversify and expand its offerings.

Projected Share Price Targets for 2040:

- Optimistic Target: ₹20.00

- Moderate Target: ₹15.00

- Pessimistic Target: ₹8.00

GTL Infra Share Price Target for 2045

By 2045, the telecom infrastructure sector may have consolidated, with only the strongest players surviving. GTL Infra’s ability to survive this long will depend on its ability to overcome its financial challenges and innovate in a rapidly changing technological landscape.

Projected Share Price Targets for 2045:

- Optimistic Target: ₹25.00

- Moderate Target: ₹18.00

- Pessimistic Target: ₹10.00

GTL Infra Share Price Target for 2050

The telecom infrastructure industry in 2050 will likely be unrecognizable compared to today. GTL Infra’s ability to remain relevant in this space will depend on how well it can pivot to meet future demands, including potential satellite infrastructure and space-based communication networks.

Projected Share Price Targets for 2050:

- Optimistic Target: ₹30.00

- Moderate Target: ₹20.00

- Pessimistic Target: ₹12.00

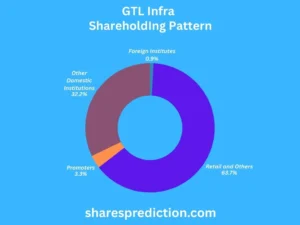

Investor Holdings and Share Distribution

| Investor Type | Percentage of Holdings (%) |

|---|---|

| Retail and Others | 63.67% |

| Other Domestic Institutions | 32.19% |

| Promoters | 3.28% |

| Foreign Institutions | 0.87% |

As of 2026, GTL Infra’s shareholding pattern is heavily dominated by retail investors, who collectively hold 63.67% of the equity. Promoter holding stands at just 3.28%, which is extremely low and reflects weak promoter confidence in the company’s long-term financial prospects. Institutional participation remains limited, indicating cautious sentiment from professional investors. Overall, the ownership structure suggests that the stock is largely driven by retail speculation rather than institutional conviction.

Conclusion: Should You Invest in GTL Infra?

Investing in GTL Infra carries significant risks due to its high debt levels and inconsistent financial performance. While the company may benefit from the 5G rollout in India, long-term investors should be cautious. Monitoring the company’s financial restructuring and operational improvements will be critical for those considering a long-term position in the stock. Investors should weigh the potential rewards against the risks and keep a close eye on how the company manages its financial obligations in the coming years.

For those looking at long-term horizons, the company’s survival and growth will depend heavily on its ability to adapt to future technologies and infrastructure demands.

FAQs

Who is the Chairman of GTL Infrastructure?

The current Chairman of GTL Infrastructure is Manoj Tirodkar, who founded the company and has been a key player in its development.

What services does GTL Infrastructure provide?

GTL Infra is a leading telecom tower company that offers infrastructure solutions to major telecom operators in India, including the installation and maintenance of mobile towers.

What is GTL Infra’s role in the 5G rollout in India?

GTL Infra plays a crucial role in the expansion of telecom infrastructure for 5G services by leasing out its towers to telecom operators for installing 5G equipment.

How many towers does GTL Infra own?

GTL Infra owns and operates around 26,000 telecom towers across all 22 telecom circles in India, making it one of the largest independent tower infrastructure providers.

What are the future growth opportunities for GTL Infra?

The company’s growth opportunities lie in expanding its tower infrastructure to support the deployment of 5G networks and increasing internet penetration in rural areas of India.

Which telecom companies does GTL Infra work with?

GTL Infra provides its tower services to major telecom operators like Bharti Airtel, Vodafone-Idea, Reliance Jio, and BSNL.

Where is GTL Infrastructure headquartered?

GTL Infra’s headquarters is located in Navi Mumbai, Maharashtra, India.

How does GTL Infra contribute to environmental sustainability?

GTL Infra has initiated energy-efficient practices in its operations, including the use of renewable energy sources for its towers, to reduce its carbon footprint.

What is GTL Infra’s stance on digital inclusion?

The company is focused on enhancing digital inclusion by expanding its telecom infrastructure in rural and underserved regions of India, contributing to better connectivity.

What are GTL Infra’s corporate social responsibility (CSR) initiatives?

GTL Infra is involved in various CSR activities, including educational programs, rural development initiatives, and promoting environmental sustainability in communities where it operates.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analyses and insights can help you make informed investment decisions.