HDFC Share Price Target is a topic of interest among traders and investors because HDFC is one of India’s premier financial institutions. HDFC Ltd. has been a cornerstone of the banking and housing finance sectors. HDFC, known for its strong financial health and strategic market presence, remains a popular investment choice. This article examines HDFC’s share price target for the years 2026, 2030, 2035, 2040, 2045, and 2050, providing insights into the factors that may drive its future growth.

Company Overview

HDFC Ltd., headquartered in Mumbai, is a key player in India’s financial services sector, with a primary focus on home finance. Established in 1977, HDFC has a strong track record of financial performance, driven by its diverse range of financial products and services. Known for its innovative housing finance solutions and outstanding customer service, the company is publicly listed on prominent stock exchanges including the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

Current Share Price

Past 5-Year Analysis: Revenue and Profit

Below is a table that summarises HDFC’s growth over the last five years in order to give a better understanding of the company’s performance:

| Year | Revenue (in Cr.) | Profit / Loss (in Cr.) |

|---|---|---|

| 2021 | 1,46,063.12 | 88,608.93 (Profit) |

| 2022 | 1,57,263.02 | 110,614.15 (Profit) |

| 2023 | 1,92,800.36 | 137,294.38 (Profit) |

| 2024 | 4,07,995 | 177,342.38 (Profit) |

| 2025 | 4,70,916 | 73,440 (Profit) |

HDFC has delivered strong revenue growth over the past five years, with turnover rising sharply from ₹1.38 lakh crore in 2020 to ₹4.70 lakh crore in 2025, driven by higher electric bus orders and project execution. Profitability remained positive throughout, although profits moderated in 2025 due to rising costs and execution challenges. From a 2026 perspective, the company’s long-term outlook remains optimistic, supported by India’s EV push, government contracts, and expanding sustainable mobility demand.

Financial Table (as of January 2026)

| Company Name | HDFC Bank |

|---|---|

| Market Cap | ₹ 14,26,937 Cr (As of January 2026) |

| P/E Ratio | 18.43 |

| Industry P/E | 13.76 |

| Debt to Equity Ratio | NA |

| ROE | 13.29% |

| Dividend Yield | 1.18% |

| 52 Week High | INR 1020.50 |

| 52 Week Low | INR 830.55 |

| P/B Ratio | 2.55 |

| EPS (TTM) | 50.32 |

| Official Website | HDFC Bank |

The following financial indicators provide a snapshot of HDFC’s valuation and overall financial health based on the most recent publicly available data. These metrics help investors assess the company’s market position, profitability, and return potential in 2026.

Performance Analysis

HDFC Ltd.’s financial performance over the past five years reflects consistent growth in both revenue and profitability, highlighting the company’s strong execution capabilities and resilient business model. The steady rise in earnings demonstrates HDFC’s ability to adapt to changing market conditions while maintaining operational efficiency, further reinforcing its position as a leading player in India’s financial services sector.

The improvement in revenue and profit between 2020 and 2024 indicates sustained demand for housing finance and related financial products, supported by effective cost management and prudent risk assessment. This performance underscores HDFC’s long-term growth potential and strengthens investor confidence, positioning the company well for continued expansion and value creation in the coming years.

Key Factors Influencing HDFC Share Price Performance

- Market Demand for Housing Financing

- Government Policies and Incentives: Favourable policies that improve housing affordability and accessibility.

- Urbanisation: As populations grow, so does the demand for home finance.

- Technological advancements:

- Digital transformation: Improves the customer experience and operational effectiveness.

- Fintech Innovations: The implementation of fintech solutions to streamline procedures.

- Financial performance:

- Sustained growth in revenue and profitability: Increases investor trust by demonstrating the company’s financial stability.

- Cost Management: Effective cost management increases profit margins.

- Marketing Expansion:

- Geographic diversification: Involves expanding into new regions and markets.

- Product Line Expansion: The expansion of financial products and services.

- Strategic partnerships and collaborations:

- Industry Alliances: Collaborations with technology businesses help HDFC expand its market reach and technological capabilities.

- Government contracts: Include collaboration with government housing programmes.

- Economic conditions:

- Interest rates: Affect borrowing costs and housing loan demand.

- Economic stability: Refers to overall economic health, which influences consumer spending.

HDFC Share Price Target 2026

HDFC share price target for 2026 is projected based on the company’s consistent financial performance, stable asset quality, and long-term growth prospects in the housing finance sector. The target range reflects expectations of steady loan book expansion, improving operational efficiency, and sustained demand for residential real estate in India.

The company’s strong balance sheet, brand trust, and leadership position in the housing finance market make HDFC a fundamentally strong stock for long-term investors seeking stability and compounding returns.

HDFC Share Price Target 2030

HDFC share price target for 2030 is anticipated to fall within the range of INR 4,350 to INR 4,800, driven by its expanded market reach, digital transformation, and sustained profitability. HDFC’s strategic initiatives and robust financial health are anticipated to generate substantial stock value appreciation as urbanisation and housing finance demand continue to expand.

HDFC Share Price Target 2035

HDFC’s share price target for 2035 is predicted to be between INR 7,500 and INR 8,000, driven by robust financial growth, strategic collaborations, and market leadership in home financing. Continued innovation and market expansion will generate tremendous long-term value for investors.

HDFC Share Price Target 2040

HDFC’s share price target for 2040 is expected to be between INR 10,000 and INR 10,500, underpinned by ongoing innovation, significant market expansion, and a stable economic climate. The company’s outstanding financial performance and strategic vision are projected to dramatically raise HDFC’s share price goal.

HDFC Share Price Target 2045

By 2045, HDFC share price target is forecast to be between INR 12,000 and INR 12,500, driven by its long-term commitment to growth, innovation, and strategic collaborations. The growing demand for housing finance and HDFC’s market leadership are anticipated to strengthen its stock value significantly.

HDFC Share Price Target 2050

HDFC share price target for 2050 is predicted to be in the range of INR 15,000 to INR 16,000. This estimate is supported by the company’s steady growth, continued innovation, and strong market position in the financial industry. HDFC’s strategic goals and excellent financial performance are projected to offer significant long-term value to investors.

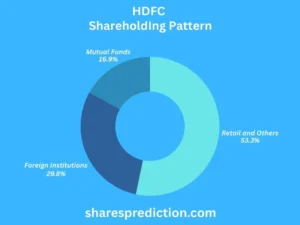

HDFC Shareholding Pattern

| Investor Type | Percentage of Shares (%) |

|---|---|

| Foreign Institutes | 47.67 |

| Mutual Funds | 26.66 |

| Retail and Others | 15.14 |

The shareholding structure of HDFC in 2026 reflects strong participation from institutional investors, indicating high confidence in the company’s long-term growth potential. A significant portion of shares is held by foreign institutional investors (FIIs) and domestic mutual funds, while retail investors also maintain a healthy stake.

This diversified ownership structure enhances stock liquidity, improves corporate governance standards, and provides long-term financial stability to the company.

Conclusion

HDFC remains one of the most fundamentally strong and reliable financial institutions in India as of 2026. Its dominant position in the housing finance sector, combined with consistent financial performance, digital innovation, and strong asset quality, positions the company well for sustained long-term growth.

The share price targets for 2026 to 2050 reflect optimistic but realistic expectations driven by India’s expanding real estate market, rising housing demand, and HDFC’s strategic focus on technology-led lending solutions. For long-term investors, HDFC continues to represent a high-quality stock with strong compounding potential.

FAQs About HDFC

1. Who is the Chairman of HDFC Ltd?

The Chairman of HDFC Ltd. is Mr. Deepak Parekh.

2. Who is the CEO of HDFC Ltd.?

The CEO of HDFC Ltd. is Mr. Keki Mistry.

3. When was HDFC Ltd. established?

HDFC Ltd. was established in 1977.

4. Where is HDFC Ltd. headquartered?

HDFC Ltd. is headquartered in Mumbai, India.

5. What are the main services offered by HDFC Ltd.?

HDFC Ltd. primarily offers housing finance, but it also provides a range of other financial services including insurance, banking, and asset management through its subsidiaries.

6. How does HDFC Ltd. contribute to corporate social responsibility (CSR)?

HDFC Ltd. engages in various CSR activities, including initiatives in education, healthcare, community development, and environmental sustainability.

7. What awards and recognitions has HDFC Ltd. received?

HDFC Ltd. has received numerous awards for excellence in housing finance, corporate governance, and customer service, including accolades from prestigious organizations and publications.

8. What is the vision and mission of HDFC Ltd.?

HDFC Ltd.’s vision is to enhance residential housing stock in the country through the provision of affordable housing finance and its mission is to provide housing finance to individuals in a seamless and transparent manner.

9. What is HDFC Ltd.’s approach to digital transformation?

HDFC Ltd. is committed to digital transformation, leveraging technology to enhance customer experience, streamline operations, and offer innovative digital solutions for housing finance.

10. What are some key milestones in HDFC Ltd.’s history?

Key milestones include being the first specialized housing finance institution in India, the launch of HDFC Bank in 1994, and numerous strategic partnerships and acquisitions to expand its service offerings.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.