IDFC Share Price Current Market Performance

Financial table for IDFC

| Metric | Value |

|---|---|

| Market Capitalization | ₹71,404 Cr |

| P/E Ratio (TTM) | 49.74 |

| Industry P/E | 14.36 |

| P/B Ratio | 1.36 |

| EPS (TTM) | 1.67 |

| ROE | 2.73% |

| Dividend Yield | 0.26% |

| Book Value | ₹61.18 |

| Face Value | ₹10 |

| Official Website | IDFC Bank |

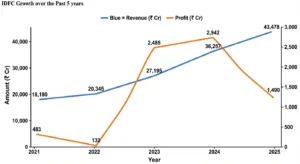

IDFC Growth over the Past 5 years

| Year | Revenue (₹ Cr) | Profit (₹ Cr) |

|---|---|---|

| 2021 | 18,180 | 483 |

| 2022 | 20,345 | 132 |

| 2023 | 27,195 | 2,485 |

| 2024 | 36,257 | 2,942 |

| 2025 | 43,478 | 1,490 |

IDFC has had steady and robust increase in sales, notably after 2022. Profits reached their highest point in 2024 and then went back to normal in 2025. This was due to provisioning cycles and changes in the banking sector. Even while profits are volatile, the long-term trend shows that businesses are getting bigger and their operations are getting stronger.

IDFC Share Price Target 2026

The IDFC share price target for 2026 is expected to range between ₹104 and ₹121. This projection is based on improving earnings visibility, gradual enhancement in return ratios, and steady growth in retail banking operations. As asset quality stabilizes and margins improve, IDFC is expected to see healthy valuation expansion.

IDFC Share Price Target 2030

IDFC Ltd. has set ambitious targets for its share price by 2030, aiming to reach ₹250 – ₹344 by the end of the year. This target reflects the company’s long-term strategic vision to enhance its financial performance and capitalize on growth opportunities within the infrastructure financing sector.

IDFC Share Price Target 2035

By 2035, the share price target is expected to range from ₹490 to ₹700. This ambitious target reflects the bank’s strategic initiatives, which include expanding its digital banking solutions, increasing its customer base, and diversifying its financial products. These efforts are expected to drive significant revenue and profit growth, contributing to a substantial appreciation in the share price over the long term.

IDFC Share Price Target 2040

In 2040, the share price target is projected to be between ₹800 and ₹1000. Their strategic goals likely include expanding their infrastructure financing portfolio, enhancing operational efficiency, and maintaining a strong financial position.

IDFC Share Price Target 2045

For 2045, the target range is projected to be ₹1133.50 to ₹1589.90. Their strategic objectives may include expanding their market presence, optimizing operational efficiencies, and capitalizing on emerging opportunities in the infrastructure sector. The specific share price target for 2045 would be influenced by macroeconomic factors, regulatory environments, and the successful execution of their long-term business strategies

IDFC Share Price Target 2050

The IDFC share price target for 2050 is estimated from ₹1900 to ₹2350. IDFC’s aim for achieving this share price target in 2050 is likely centered around sustained growth, long-term value creation for shareholders, and reinforcing its role as a prominent player in infrastructure financing. Their strategic goals may include expanding into new markets, innovating financial products, maintaining strong asset quality, and adapting to evolving regulatory landscapes.

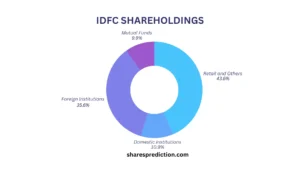

Investor Types and Shareholding Ratios

| Investor Type | Shareholding (%) |

|---|---|

| Retail & Others | 43.62% |

| Foreign Institutions | 35.60% |

| Other Domestic Institutions | 10.91% |

| Mutual Funds | 9.87% |

Conclusion

In conclusion, IDFC’s shareholder base reflects a diverse mix of institutional investors, retail investors, promoters, foreign institutional investors (FIIs), and other strategic stakeholders. Institutional investors, comprising mutual funds, insurance companies, and pension funds, typically hold the largest share, indicating confidence in IDFC’s role in infrastructure financing and long-term investment prospects. Retail investors and strategic stakeholders also play significant roles in shaping IDFC’s shareholder structure, contributing to its governance and strategic direction. Monitoring these dynamics provides valuable insights into IDFC’s investor appeal and its alignment with broader market trends and economic conditions.

FAQ’s

- What is the primary mission of IDFC?

- IDFC aims to promote sustainable infrastructure development in India by providing financing and advisory services for infrastructure projects.

- When was IDFC established and what was its initial focus?

- IDFC was established in 1997, initially focusing on providing financing and advisory services for infrastructure projects in India.

- What are some key areas of focus for IDFC FIRST Bank?

- IDFC FIRST Bank focuses on project finance, corporate loans, retail banking, investment advisory, and digital banking solutions.

- How has IDFC contributed to India’s infrastructure development?

- IDFC has played a pivotal role in financing various critical infrastructure projects, including transportation, energy, and urban development, thus contributing significantly to India’s economic growth.

- Where is IDFC headquartered?

- IDFC is headquartered in Mumbai, India.

- What community initiatives is IDFC involved in?

- IDFC engages in various corporate social responsibility (CSR) activities, including education, healthcare, and community development projects, aiming to positively impact society.

- What is the significance of the merger between IDFC Bank and Capital First?

- The merger between IDFC Bank and Capital First in 2018 marked a strategic expansion into retail banking, broadening the bank’s customer base and product offerings, and enhancing its market presence.

- Is IDFC involved in any environmental initiatives?

- Yes, IDFC is committed to environmental sustainability and supports projects that promote renewable energy and sustainable development.

- What are some notable projects financed by IDFC?

- IDFC has financed numerous infrastructure projects, including highways, power plants, and urban development projects across India.

- What sectors does IDFC primarily support?

- IDFC supports various sectors, including energy, transportation, telecommunications, and urban infrastructure.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analyses and insights can help you make informed investment decisions.