IFCI share price targets for 2026, 2030, 2035, 2040, 2045, and 2050 have become an essential part of the portfolio of investors, as IFCI Ltd., one of India’s oldest financial institutions, plays a crucial role in providing financial assistance to various sectors of the economy. In this article, we investigate the variables that affect the performance of IFCI’s stock and offer predictions regarding its potential for future expansion.

Company Overview

About IFCI Ltd.

IFCI Ltd., established in 1948, was India’s first Development Financial Institution, created to meet the long-term financing requirements of the industry. Project financing, infrastructure finance, corporate finance, and consulting services are just a few of the many financial goods and services that IFCI offers now after diversifying its operations over the years. The corporation is listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

Current Share Price

As of 2026, IFCI Ltd. remains a small-cap public sector financial company with a market capitalization in the range of ₹15,000–₹16,000 crore. The stock trades at a valuation that reflects both its turnaround potential and the risks associated with legacy stressed assets.

IFCI currently operates with a moderate debt-to-equity ratio, and its return on equity (ROE) remains relatively low compared to private-sector financial institutions, indicating that profitability recovery is still in progress. The company does not offer a regular dividend, as earnings are primarily being reinvested to strengthen the balance sheet and improve capital adequacy.

Financial Table (as of January 2026)

| Metric | Value |

|---|---|

| Market Cap | ₹ 15,471 Cr |

| P/E Ratio | 23.44 |

| Industry P/E | 10.46 |

| Debt to Equity Ratio | 0.40 |

| ROE | 4.28% |

| Dividend Yield | 0.00% |

| 52 Week High | INR 74.50 |

| 52 Week Low | INR 36.20 |

| P/B Ratio | 1.75 |

| EPS (TTM) | 2.45 |

| Official Website | IFCI Ltd. |

The following table highlights IFCI’s key financial indicators based on the most recently available data. These metrics provide insights into the company’s valuation, profitability, and financial stability as of 2026.

Factors Influencing IFCI Share Price Target

Market Demand for Financial Services

- Government Policies and Initiatives: Government policies and initiatives that encourage industrial and infrastructural development.

- Economic Growth: Overall economic growth is boosting up demand for financial services.

Technological Advancements

- Digital Transformation: Implementing digital technology to improve service delivery and operational efficiency.

- Fintech Collaborations: Working with fintech businesses to broaden service offerings and reach new client groups.

Market Expansion

- Geographic diversification entails entering new local and foreign markets to attain a larger consumer base.

- Product Line Expansion: Diversifying financial goods and services to satisfy changing market demands.

Strategic Partnerships and Collaborations

- Industry Alliances: Work with other financial institutions to expand market reach and service offerings.

- Government Contracts: Obtaining government contracts to fund large-scale infrastructure and industrial projects.

Economic Conditions

- Inflation and interest rates affect borrowing costs and demand for financial goods.

- Global Economic Stability: The general health of the economy influences investment in financial services.

IFCI Share Price Targets

IFCI Share Price Target 2026

The share price target for IFCI in 2026 is projected to be in the range of ₹125 to ₹140, based on expectations of gradual financial recovery, improved asset quality, and stable macroeconomic conditions.

This outlook assumes that IFCI continues its restructuring efforts, maintains controlled credit growth, and benefits from government-backed financial initiatives. However, due to the company’s historical volatility and relatively low profitability, IFCI remains a high-risk, high-reward stock suitable primarily for long-term investors with higher risk tolerance.

IFCI Share Price Target 2030

By 2030, IFCI share price target is projected to range from INR 217 to INR 235. This growth will be driven by sustained profitability, technological innovations, and market expansion. Economic growth and increasing demand for long-term finance in the industrial sector will further enhance IFCI’s market value.

IFCI Share Price Target 2035

For 2035, IFCI share price target is anticipated to be between INR 437 and INR 450. Strong financial growth, strategic partnerships, and leadership in development finance will support this increase. Continuous innovation and adaptation to changing market dynamics will ensure competitiveness and long-term value for investors.

IFCI Share Price Target 2040

In 2040, IFCI share price target is expected to be around INR 570 to INR 600. Ongoing innovation, market expansion, and rising demand for infrastructure finance will drive this growth. IFCI’s strategic vision and robust financial performance will continue to boost stock value.

IFCI Share Price Target 2045

By 2045, IFCI share price target is forecasted to be between INR 750 and INR 790. Long-term growth, innovation, and strategic collaborations will drive this increase. The global shift towards sustainable and resilient infrastructure will strengthen IFCI’s market position and investor confidence.

IFCI Share Price Target 2050

IFCI share price target for 2050 is projected to be between INR 900 and INR 1100. Decades of consistent growth, technological advancements, and leadership in development finance will support this target. IFCI’s focus on innovation, sustainability, and market expansion will deliver substantial long-term shareholder value.

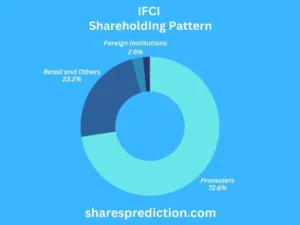

IFCI Shareholding Pattern

| Investor Type | Percentage of Shares (%) |

|---|---|

| Promoters | 72.57 |

| Retail and Others | 23.21 |

| Foreign Institutes | 2.58 |

| Other Domestic Institutes | 1.51 |

| Mutual Funds | 0.12 |

As of 2026, IFCI’s shareholding structure is dominated by promoters holding approximately 72.5% of the total equity, reflecting strong government control and strategic oversight. Retail and other public investors hold around 20–23%, while foreign and domestic institutional investors together account for a relatively small portion of the shareholding.

This ownership structure provides stability and policy backing, but also limits free float and institutional liquidity in the stock.

Conclusion

IFCI’s share price targets from 2026 to 2050 reflect a long-term recovery and growth narrative based on restructuring, financial discipline, and gradual improvement in operational efficiency. While IFCI faces challenges related to legacy assets and low profitability, its strategic importance, government backing, and evolving business model provide a foundation for long-term potential.

For investors, IFCI remains a high-risk, turnaround-driven stock, best suited for those with a long investment horizon and an appetite for volatility in pursuit of long-term capital appreciation.

FAQs About IFCI Ltd.

What is the full form of IFCI?

The full form of IFCI is Industrial Finance Corporation of India. Established in 1948, it was the first Development Financial Institution in India, aimed at providing long-term finance to the industrial sector.

Who is the current Chairman and Managing Director of IFCI Ltd.?

The current Chairman and Managing Director (CMD) of IFCI Ltd. is Mr. Rajeev Bhardwaj. He plays a pivotal role in steering the company’s strategic direction and operations.

What is the history of IFCI Ltd.?

IFCI Ltd. was established in 1948 by the Government of India as the first Development Financial Institution to support industrial growth in the country. Over the years, it has diversified its services to include project finance, infrastructure finance, and advisory services.

Where is IFCI Ltd. headquartered?

IFCI Ltd. is headquartered in New Delhi, India. The central location enables the company to effectively coordinate its operations and provide services across the country.

What are the main services offered by IFCI Ltd.?

IFCI Ltd. offers a range of services including project finance, infrastructure finance, corporate finance, and advisory services. It caters to various sectors such as power, roads, ports, and telecommunications.

What is the role of IFCI Ltd. in India’s development?

IFCI Ltd. has played a crucial role in the development of India’s infrastructure and industrial sectors by providing long-term finance and project advisory services. It has been instrumental in financing several key projects across the country.

What are some notable projects financed by IFCI Ltd.?

IFCI Ltd. has financed numerous significant projects in India, particularly in sectors like power generation, transportation, and industrial infrastructure. These projects have contributed to the nation’s economic growth and development.

What certifications and recognitions has IFCI Ltd. received?

IFCI Ltd. has received several certifications and recognitions for its contribution to the financial sector and its role in supporting India’s infrastructure development. These accolades underscore its commitment to excellence and service.

What is the vision and mission of IFCI Ltd.?

The vision of IFCI Ltd. is to be a leading financial institution in the development finance sector, while its mission is to provide financial products and services that support the nation’s industrial and infrastructure growth.

How does IFCI Ltd. contribute to corporate social responsibility (CSR)?

IFCI Ltd. is actively involved in corporate social responsibility initiatives, focusing on areas such as education, healthcare, and community development. The company’s CSR activities aim to create a positive impact on society and contribute to the overall well-being of communities.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.