Infibeam Share Price Target has been a hot topic for the investors in recent times, as Infibeam Avenues is a prominent player in the digital payment solutions and e-commerce infrastructure space. With its diverse portfolio and constant innovations, the company’s share price target has become an area of focus for long-term investors. In this article, we will explore the Infibeam Share Price Target for the years 2026, 2030, 2035, 2040, 2045, and 2050, considering key financial metrics and industry trends.

Company Overview

Infibeam Avenues operates in the digital payment and e-commerce infrastructure space, providing platforms for digital payments, online transactions, and e-commerce solutions. Its strong presence in the Indian market and expanding international footprint have attracted considerable attention from investors. The company’s growth is heavily reliant on the ongoing digital transformation in India, and it continues to capitalize on the increasing demand for online payment solutions.

Financial Overview

Current Share Price

Revenue and Profit Growth

Infibeam has demonstrated consistent growth in both revenue and net profit over the years. Below is a summary of its financial performance:

| Year | Revenue (₹ Cr) | Net Profit (₹ Cr) |

|---|---|---|

| 2020 | 644 | 111 |

| 2021 | 686 | 70.25 |

| 2022 | 1,304 | 83.65 |

| 2023 | 2,033 | 136 |

| 2024 | 3,175 | 156 |

| 2025 | 4,066 | 236 |

The data presented shows strong revenue and profit growth up to 2025. In 2026, the focus for Infibeam shifts from pure growth to sustaining profitability and improving margin quality as the business scales. Growth drivers for this phase include increased enterprise contracts, cross-border payment volumes, subscription-based services, and higher average transaction values (ATV) via value-added offerings.

Fundamental Metrics (As of January 2026)

| Metric | Value |

|---|---|

| Market Cap | ₹5,897 Cr |

| P/E Ratio (TTM) | 22.24 |

| P/B Ratio | 1.28 |

| ROE | 5.74% |

| EPS (TTM) | ₹0.71 |

| Dividend Yield | 0.00% |

| Book Value | ₹12.09 |

| Debt to Equity | 0.02 |

| 52-Week High | ₹24.63 |

| 52-Week Low | ₹14.75 |

| Website | Infibeam |

As of 2026, Infibeam’s fundamental metrics suggest a mid-cap growth profile with a valuation anchored in future growth expectations rather than current earnings. A P/E of ~22 reflects optimism around scalable revenue streams, while a low debt-to-equity ratio underscores financial prudence. The absence of a dividend underscores the company’s preference for reinvestment into expansion initiatives. Investors evaluating Infibeam in 2026 are balancing high growth potential with sector competition and evolving regulatory norms.

Factors Influencing Infibeam Share Price Target

Digital Payments Sector Growth

The increasing digitization of financial services is a key factor in Infibeam’s future growth. As more individuals and businesses adopt digital payment solutions, Infibeam stands to benefit from rising transaction volumes and a growing customer base.

International Expansion and Partnerships

Infibeam’s expansion into international markets and strategic partnerships with key players in the digital payments industry will be crucial to sustaining long-term growth. The company is expected to leverage its platform and expertise to capture market share beyond India.

Competition in the Digital Space

Competition from other digital payment providers like Paytm, Razorpay, and PhonePe may pose challenges to Infibeam’s market dominance. The company’s ability to innovate and differentiate itself will determine its long-term success.

Infibeam Share Price Target 2026

Infibeam Share Price Target 2026

By 2026, Infibeam Avenues’ share price is expected to reflect a combination of strong digital payments growth and investor focus on platform monetisation and enterprise scalability.

Predicted Target Price: ₹68 – ₹75

Analysis:

Technical Analysis: The stock continues to trade within an established long-term uptrend supported by institutional and retail interest, with key support and resistance levels forming around historical volatility ranges.

Fundamental Analysis: Continued revenue growth, expanding merchant and enterprise contracts, and a low debt profile support fundamentals, while margin enhancement and competitive dynamics remain watch points.

Market Outlook: In 2026, macro conditions such as digital transaction trends, regulatory clarity, and cost of capital influence valuation more than short-term earnings beats.

Key Takeaways:

-

Infibeam’s growth profile is tied to monetisation of its platforms rather than transaction volume alone.

-

Risk remains moderate due to fintech competition and the evolving policy environment.

Infibeam Share Price Target 2030

Looking forward to 2030, the Infibeam Share Price Target could reach between ₹115 and ₹175. The company’s international expansion and increasing adoption of digital solutions across various sectors will contribute to its growth, with sustained demand driving higher valuations.

Infibeam Share Price Target 2035

By 2035, the Infibeam Share Price Target is projected to be between ₹385 and ₹425. The continued rise in digital transactions, along with potential innovations in e-commerce and fintech, will help Infibeam maintain a strong growth trajectory.

Infibeam Share Price Target 2040

In 2040, the Infibeam Share Price Target is expected to range from ₹735 to ₹780. By this time, the company will likely have further strengthened its international presence and diversified its product offerings, making it a dominant player in the global digital payments landscape.

Infibeam Share Price Target 2045

By 2045, the Infibeam Share Price Target could reach between ₹930 and ₹1150. As digital payments continue to grow globally, Infibeam is expected to remain at the forefront of this transformation, driving steady growth in its share price.

Infibeam Share Price Target 2050

Looking toward 2050, the Infibeam Share Price Target is projected to reach ₹1375 to ₹1500. By this time, Infibeam’s innovations and sustained market leadership in the digital payments space will likely drive further share price appreciation, providing long-term value to investors.

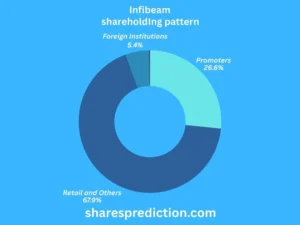

Shareholding Pattern

As of September 2025, the shareholding pattern of Infibeam Avenues is as follows:

| Category | Percentage (%) |

|---|---|

| Retail and Others | 66.82% |

| Promoters | 27.29% |

| Foreign Institutions | 5.67% |

| Mutual Funds | 0.16% |

| Other Domestic Institutions | 0.07% |

As of 2026, Infibeam’s shareholding pattern reflects a retail-heavy base, indicating strong individual investor interest. The promoter stake demonstrates alignment with long-term strategy, while limited institutional ownership suggests the stock is still in a discovery phase among institutional allocators. For 2026, changes in institutional participation could be a key signal of evolving market confidence.

Conclusion

The Infibeam Share Price Target for 2026, 2030, 2035, 2040, 2045, and 2050 points to a promising growth trajectory. With strong financials, a low debt-to-equity ratio, and expanding market opportunities, Infibeam is well-positioned for long-term growth in the digital payments industry. Investors with a long-term horizon can expect steady returns as the company continues to innovate and capture market share.

FAQs About Infibeam Avenues

Q1. What does Infibeam Avenues specialize in?

Infibeam Avenues specializes in digital payment solutions and e-commerce infrastructure services.

Q2. Is Infibeam Avenues a good long-term investment?

Yes, Infibeam Avenues shows steady growth potential, making it a viable long-term investment option, especially in the digital payments sector.

Q3. What challenges does Infibeam face?

The primary challenges include competition from other digital payment providers and the need to continually innovate to stay ahead in the market.

Q4. Does Infibeam Avenues offer dividends?

As of 2026, Infibeam Avenues offers a dividend yield of 0.24%, providing some income for shareholders.

Q5. What is Infibeam’s market capitalization?

Infibeam Avenues has a market cap of ₹5897 Cr as of 2026.

Q6. What role do promoters play in Infibeam Avenues?

Promoters hold a 27.29% stake in the company, indicating significant involvement in its strategic direction.

Q7. What is Infibeam’s international expansion strategy?

Infibeam is expanding into global markets, leveraging its expertise in digital payments and e-commerce infrastructure.

Q8. What factors are influencing Infibeam’s share price growth?

Key factors include the growth of digital payments, international expansion, and competition in the fintech space.

Q9. What is Infibeam’s debt position?

Infibeam Avenues has a low debt-to-equity ratio of 0.02, indicating strong financial health.

Q10. What are Infibeam’s growth prospects in the next decade?

With the increasing adoption of digital payments and e-commerce solutions, Infibeam Avenues is expected to continue its upward growth trajectory over the next decade.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.