Introduction

Infosys Share Price Target is a big topic of interest in the share market, so in this article we are going to discuss the Infosys price target in the coming years. Infosys Limited is an Indian multinational information technology firm that offers business consulting, IT, and outsourced services. The firm was started in Pune and has its headquarters in Bangalore. According to 2020 sales projections, Infosys is the second-largest Indian IT business, behind only Tata Consultancy Services.

On August 24, 2021, Infosys became the fourth Indian business to achieve US$100 billion in market value. It is one of the leading Big Tech (India) firms.

Infosys Share Current Market Performance

As of the current market, Infosys Share Price Target is trading around ₹1,454.20, reflecting the company’s strong momentum in the technology sector of India. The stock has delivered impressive returns, with around consistentnt 10% growth in the last six months and around 15% returns in the past year beating the index stocks of India. This consistent performance can be attributed to Infosys’s best business consulting, IT, and outsourced services.

Infosys’ Growth Over the Past 5 Years

| Year | Revenue Growth | Profit Growth | Net Worth Growth |

|---|---|---|---|

| 2021 | 1,02,673 | 19,423 | 76,782 |

| 2022 | 1,23,936 | 22,146 | 75,736 |

| 2023 | 1,49,468 | 24,108 | 75,795 |

| 2024 | 1,58,381 | 26,248 | 88,461 |

| 2025 | 1,66,590 | 26,750 | 96,203 |

Over the past five years, the company has delivered consistent revenue and profit growth, indicating strong operational performance and expanding business scale. Revenue increased steadily from ₹1.02 lakh crore in 2021 to ₹1.66 lakh crore in 2025, while profits also improved year-on-year. The sharp rise in net worth after 2023 reflects balance sheet strengthening. From a 2026 perspective, this trend signals improving financial stability and long-term growth potential.

Financial table for Infosys Energy Ltd

| Company Name | Infosys Limited (As of February 2026) |

|---|---|

| Market Cap | ₹ 6,07,674 Cr |

| P/E Ratio (TTM) | 21.70 |

| P/B Ratio | 8.13 |

| Industry P/E | 23.93 |

| Debt to Equity Ratio | 0.11 |

| ROE | 33.69% |

| EPS (TTM) | 69.06 |

| Dividend Yield | 2.94% |

| Book Value | 184.31 |

| Face Value | 5 |

| 52 Week High | ₹ 1,905.00 |

| 52 Week Low | ₹ 1,307.00 |

| Official Website | Infosys |

As per the latest financial data in 2026, Infosys shows strong fundamentals and balance sheet stability, making it one of the most fundamentally sound IT stocks in India.

Infosys has a market capitalization of ₹6,07,674 crore, supported by a healthy ROE of 33.69%, which reflects excellent capital efficiency. The company trades at a P/E ratio of 21.70, which is slightly below the industry average of 23.93, indicating reasonable valuation.

With a low debt-to-equity ratio of 0.11, strong EPS of ₹69.06, and an attractive dividend yield of 2.94%, Infosys remains a financially strong and investor-friendly company in 2026.

Infosys Share Price Target 2026

In 2026, Infosys Share Price is expected to trade in the range of ₹1,650 to ₹1,900, driven by stable revenue growth, rising demand for digital services, and strong institutional participation.

The company’s focus on AI, cloud computing, automation, and cybersecurity, along with consistent client additions and high operating margins, is likely to support steady stock performance.

With solid fundamentals, low debt, and strong return ratios, Infosys is well-positioned to deliver moderate but stable returns in 2026.

Infosys Share Price Target 2030

By 2030, Infosys Share Price Target is expected to reach between ₹2,900 – ₹3,125. This goal analysis focuses on Infosys’ vast size and worldwide presence, as well as its excellent financial growth, brand awareness, and innovative capabilities. However, it also highlights the company’s reliance on major customers, regulatory concerns, and difficulties in talent retention. Additionally, it emphasises the importance of continuously diversifying revenue streams and investing in R&D to ensure long-term sustainability and growth.

Infosys Share Price Target 2035

For the year 2035, Infosys Share Price Target is expected to reach in the range of ₹4,500 – ₹4,900. This target is based on the company’s long-term growth prospects and its increasing involvement in the Indian tech sector. The company’s ability to adapt to changing market conditions and its role in strong financial growth, brand recognition, and commitment to innovation are key factors that contribute to its growth prospects.

Infosys Share Price Target 2040

For the year 2040, Infosys Share Price Target is expected to reach ₹8,700 – ₹9,000. This target analysis focuses on Infosys’ large size and international presence, as well as its great financial growth, brand recognition, and innovative skills. However, it also shows the company’s dependence on key clients, regulatory problems, and challenges in talent retention.

Infosys Share Price Target 2045

By 2045, Infosys Share Price Target is expected to reach ₹12,000 to ₹12,500. This aim is based on the company’s long-term development potential and its expanding participation in the Indian IT industry. The company’s capacity to react to changing market circumstances and its involvement in solid financial growth, brand awareness, and dedication to innovation are major aspects that contribute to its growth prospects.

Infosys Share Price Target 2050

By 2050, Infosys Share Price Target is expected to reach ₹15,000 to ₹16,000. This target study focuses on Infosys’ vast size and worldwide presence, as well as its excellent financial growth, brand awareness, and inventive talents. However, it also illustrates the company’s dependency on major customers, regulatory concerns, and difficulty in personnel retention.

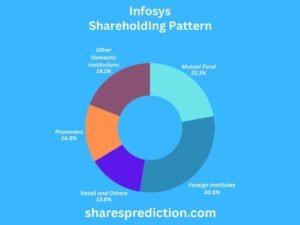

Shareholding Ratio

| Shareholder Category | Percentage (%) |

|---|---|

| Promoters | 14.52% |

| Foreign Institutions | 30.45% |

| Other Domestic Institutions | 19.15% |

| Mutual Funds | 22.12% |

| Retail and Others | 13.76% |

The shareholding structure of Infosys reflects strong institutional confidence, which adds long-term stability to the stock.

Foreign Institutional Investors (FIIs) hold the largest stake at 30.45%, indicating strong global trust in the company’s future. Mutual Funds and other domestic institutions collectively hold over 41%, highlighting heavy participation from long-term investors.

Promoters hold 14.52%, ensuring strategic control, while retail investors hold 13.76%, showing healthy interest from individual shareholders.

This diversified ownership structure makes Infosys a low-risk, institutionally backed large-cap stock.

Conclusion

Lastly, Infosys Share Price is predicted to rise significantly in the next few years, with objectives established for 2026, 2030, 2035, 2040, 2045, and 2050. The organisation’s ability to adapt to new technology, as well as its role in expanding into the international market, are critical components of its growth potential. As the Indian IT sector grows and evolves, Infosys is well-positioned to capitalise on these trends and preserve its position as a key player in the field.

FAQ’s

1. Who is the current Chairman of Infosys?

The current Chairman of Infosys is Nandan Nilekani, who co-founded the company and returned as Chairman in August 2017.

2. Who is the CEO of Infosys?

The CEO of Infosys is Salil Parekh, who took over the role in January 2018. He has been instrumental in driving the company’s strategy and growth.

3. When was Infosys founded?

Infosys was founded on July 2, 1981, by seven engineers in Pune, Maharashtra, India. The founders are N. R. Narayana Murthy, Nandan Nilekani, S. Gopalakrishnan, S. D. Shibulal, K. Dinesh, N. S. Raghavan, and Ashok Arora.

4. What are the key services offered by Infosys?

Infosys offers a wide range of services including IT consulting, software development and maintenance, business process outsourcing (BPO), and digital transformation services. They serve various industries such as financial services, manufacturing, healthcare, and retail.

5. Where is the headquarters of Infosys located?

The headquarters of Infosys is located in Bengaluru, Karnataka, India. The campus is known for its state-of-the-art facilities and sustainable practices.

6. What is Infosys known for in terms of corporate culture and values?

Infosys is known for its strong corporate culture and values, which emphasize integrity, transparency, and ethical business practices. The company is also renowned for its commitment to employee development and community initiatives.

7. How many employees does Infosys have?

As of 2024, Infosys has over 340,000 employees globally, making it one of the largest IT service providers in the world. The company is known for its diverse and inclusive work environment.

8. What are some of the major achievements of Infosys?

Infosys has several major achievements, including being the first Indian IT company to be listed on NASDAQ in 1999. The company has also been recognized for its innovative solutions, sustainability initiatives, and contributions to the IT industry.

9. What initiatives does Infosys undertake in terms of sustainability and corporate social responsibility (CSR)?

Infosys is committed to sustainability and CSR through various initiatives. The company has achieved carbon neutrality, promotes education through the Infosys Foundation, and invests in renewable energy projects. They also focus on empowering local communities and supporting healthcare initiatives.

10. Can you name some key clients of Infosys?

Infosys serves a broad range of clients across various industries. Some of their key clients include major global companies like Apple, Google, Microsoft, and many leading banks and financial institutions.

Disclaimer

This blog post is for educational and informational purposes only. It is not intended to be a recommendation or an offer to buy or sell any securities. The information provided is based on publicly available data and should not be considered as investment advice. It is important to consult with a financial advisor before making any investment decisions. It is important to consult with a financial advisor before making any investment decisions, as they can provide personalized guidance based on your individual financial situation.

For more informational and up to date news and predictions of share price targets of your favourite companies, stay tuned with SharesPrediction.com