IOC Share Price Target has gained the attention of investors looking for growth potential in the oil sector. Indian Oil Corporation (IOC) is one of India’s largest and most prominent public sector companies in the oil and gas industry. With consistent government backing and growing operational performance, the IOC Share Price Target has become a significant point of interest for investors. This article explores the future share price targets for 2026 to 2050 based on financial analysis and market trends.

Company Overview

Indian Oil Corporation (IOC) is the largest state-owned oil refining and fuel retailing company in India. It plays a vital role in meeting the country’s growing energy demand by refining, transporting, and marketing petroleum products. IOC’s dominant position in the market, its extensive infrastructure, and its focus on renewable energy and sustainable growth make it a key player in India’s energy sector. The IOC Share Price Target reflects the company’s strong market standing and continuous efforts to improve operational performance.

Financial Overview

Current Share Price

Revenue and Profit Growth

Indian Oil Corporation has shown fluctuating yet significant growth in revenue and profit over the past few years, as detailed below:

| Year | Revenue (₹ Cr) | Net Profit (₹ Cr) |

|---|---|---|

| 2020 | 4,86,537 | -1,876 |

| 2021 | 3,67,449 | 21,762 |

| 2022 | 5,92,418 | 25,727 |

| 2023 | 8,46,018 | 11,704 |

| 2024 | 7,80,195 | 43,161 |

| 2025 | 7,61,620 | 13,789 |

IOC recorded a massive profit recovery, rising from losses in 2020 to a record profit of ₹43,161 crore in 2024. This reflects improved refining margins, better fuel pricing, and strong demand recovery. These fundamentals strongly support the long-term IOC Share Price Target.

Fundamental Metrics (As of February 2026)

IOC’s key financial metrics highlight its market position and stability:

| Metric | Value |

|---|---|

| Market Cap | ₹2,56,018 Cr |

| P/E Ratio (TTM) | 6.94 |

| P/B Ratio | 1.30 |

| ROE | 12.62% |

| EPS (TTM) | ₹26.11 |

| Dividend Yield | 1.61% |

| Book Value | ₹139.82 |

| Debt to Equity | 0.74 |

| 52-Week High | ₹182.25 |

| 52-Week Low | ₹110.72 |

| Website | Indian Oil Corporation Ltd |

IOC is trading at a low P/E multiple, making it one of the most undervalued large-cap PSU stocks. A stable ROE, strong cash flows, and consistent dividends make IOC highly attractive for long-term and income-focused investors.

Factors Influencing IOC Share Price Target

Crude Oil Price Fluctuations

IOC’s performance is heavily influenced by global crude oil prices. As crude oil prices fluctuate, so do the company’s margins and profitability. An increase in crude prices usually benefits oil refiners like IOC, although it may pose challenges for fuel marketing.

Government Policies and Subsidies

Being a public sector enterprise, IOC is influenced by government policies, particularly in fuel pricing and subsidies. Supportive government policies can drive growth and revenue, positively impacting the IOC Share Price Target.

Expansion into Renewable Energy

IOC has been expanding its focus on renewable energy to diversify its portfolio and meet sustainability goals. This strategic shift will likely play a significant role in the company’s long-term growth, influencing its share price over time.

IOC Share Price Target 2026

The IOC share price target for 2026 is expected to be in the range of ₹240 to ₹255.

This growth is supported by:

-

Strong refining margins

-

Stable domestic fuel demand

-

High cash flows

-

Government support

-

Growing renewable investments

IOC remains a low-risk large-cap energy stock for long-term investors.

IOC Share Price Target 2030

Looking ahead to 2030, the IOC Share Price Target is expected to reach between ₹350 and ₹375. As IOC continues to invest in infrastructure, new refineries, and renewable energy projects, the company’s long-term prospects are solid. By 2030, the expansion of electric vehicle (EV) charging infrastructure and alternative fuels will also contribute to the company’s revenue streams.

IOC Share Price Target 2035

By 2035, the IOC Share Price Target is anticipated to reach ₹500 to ₹550. With a steady shift towards sustainability and renewable energy, coupled with the company’s ongoing dominance in the oil refining sector, IOC is likely to see robust growth. The increasing global focus on clean energy will further benefit the company’s diversification efforts, boosting its share price.

IOC Share Price Target 2040

In 2040, the IOC Share Price Target is projected to rise to ₹700 to ₹750. The company’s successful transition to cleaner energy solutions and continued profitability from its traditional oil and gas operations will likely drive this growth. Additionally, its ability to adapt to changing market dynamics, such as global oil price fluctuations, will positively impact its long-term share price.

IOC Share Price Target 2045

By 2045, the IOC Share Price Target is expected to be between ₹1000 and ₹1250. As the global energy landscape continues to evolve, IOC’s ability to maintain its leadership in the energy sector while expanding into renewables will contribute to strong share price appreciation. The company’s diversified portfolio will position it well for future growth.

IOC Share Price Target 2050

Looking towards 2050, the IOC Share Price Target is forecasted to reach ₹1500 to ₹1650. By this time, IOC is expected to be a leading player not just in traditional energy but also in renewable and alternative energy sources. The company’s consistent financial performance and market adaptability will make it a strong contender for long-term investors, offering substantial returns.

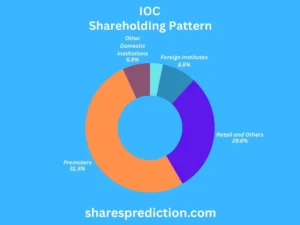

Shareholding Pattern

As of February 2026, the shareholding pattern of Indian Oil Corporation is as follows:

| Category | Percentage (%) |

|---|---|

| Promoters | 51.50% |

| Retail and Others | 29.81% |

| Foreign Institutions | 8.58% |

| Other Domestic Institutions | 6.89% |

| Mutual Funds | 3.22% |

High promoter holding ensures policy stability, while FII and institutional participation reflects long-term market confidence.

Conclusion

The IOC Share Price Target for 2026, 2030, 2035, 2040, 2045, and 2050 indicates a promising growth trajectory. With strong financial performance, government support, and a strategic shift towards renewable energy, IOC is well-positioned to offer substantial returns to investors over the long term. The company’s diversified portfolio and adaptability to market changes make it a favorable investment for those seeking stable growth in the energy sector.

FAQs About Indian Oil Corporation (IOC)

Q1. What does Indian Oil Corporation specialize in?

Indian Oil Corporation (IOC) is India’s largest oil refining and fuel retailing company, focusing on petroleum products and renewable energy.

Q2. Where is Indian Oil Corporation headquartered?

IOC is headquartered in New Delhi, India.

Q3. What products does IOC offer?

IOC offers a range of products, including petroleum, diesel, natural gas, and renewable energy solutions.

Q4. How is IOC involved in renewable energy?

IOC has been expanding its portfolio to include renewable energy, such as solar power and electric vehicle (EV) charging stations.

Q5. What role does the government play in IOC?

As a public sector enterprise, IOC is majority-owned by the government of India, which plays a key role in shaping its policies and operations.

Q6. Who are IOC’s main competitors?

IOC’s main competitors include Bharat Petroleum (BPCL) and Hindustan Petroleum (HPCL), both of which operate in the oil and gas sector.

Q7. What is IOC’s long-term growth strategy?

IOC aims to diversify into renewable energy, expand its refinery capacity, and increase its market share in the fuel retailing sector.

Q8. How does IOC contribute to India’s energy security?

IOC ensures a consistent supply of fuel to meet India’s growing energy demands, playing a crucial role in the country’s energy security.

Q9. What are IOC’s plans for electric vehicle infrastructure?

IOC has been actively expanding its EV charging infrastructure to support the growing demand for electric vehicles in India.

Q10. What is IOC’s dividend policy?

IOC has a strong dividend policy, providing attractive yields to its shareholders. In 2024, the dividend yield stood at 6.46%.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.