IRB Infra share price target is vital for investors seeking long-term gains in India’s growing infrastructure sector. IRB Infrastructure Developers Ltd., a leader in road and highway construction, has shown significant financial resilience and growth potential. This article examines the factors influencing the IRB Infra share price target and provides projections for the company’s future performance.

Company Overview

IRB Infrastructure Developers Ltd., based in Mumbai, is a prominent player in India’s infrastructure landscape. Established in 1998, the company specializes in the development, construction, and operation of roadways and highways, primarily through the Build-Operate-Transfer (BOT) model. With a strong presence on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), IRB Infra is a crucial component of India’s infrastructure development, making the IRB Infra share price target a key focus for investors.

Profits and Revenue

IRB Infra has demonstrated consistent growth in revenue and net profit, highlighting its robust market position and operational efficiency.

Revenue and Net Profit Growth

The following table details IRB Infra’s revenue and net profit over recent years:

| Year | Net Profit (₹ Cr) | Revenue (₹ Cr) |

|---|---|---|

| 2019 | 850 | 6,903 |

| 2020 | 721 | 7,047 |

| 2021 | 117 | 5,488 |

| 2022 | 361 | 6,355 |

| 2023 | 720 | 6,703 |

From a long-term viewpoint, IRB Infra demonstrated strong recovery after the pandemic-led slowdown. Net profit rebounded sharply from ₹117 crore in 2021 to ₹720 crore in 2023, reflecting improved project execution, higher toll collections, and better cost control. This financial turnaround strengthens confidence in the IRB Infra Share Price Target for the next two decades.

Current Share Price

Financial Overview

| Metric | Value (As of February 2026) |

|---|---|

| Market Cap | ₹37,991 Cr |

| P/E Ratio (TTM) | 62.29 |

| P/B Ratio | 2.76 |

| ROE | 4.41% |

| EPS (TTM) | 1.01 |

| Dividend Yield | 0.48% |

| Debt to Equity | 1.36 |

| 52-Week High | ₹78.15 |

| 52-Week Low | ₹25.60 |

| Industry P/E | 35.32 |

| Book Value | 22.76 |

| Face Value | 1 |

| Website | IRB Infrastructure Developers Ltd. |

From a 2026 valuation perspective, IRB Infra trades at a premium multiple due to its strong order book, operational asset base, and leadership in the highway segment. While the P/E ratio appears elevated, infrastructure stocks typically command higher valuations during long-term capex cycles, supporting the IRB Infra Share Price Target.

Factors Influencing IRB Infra Share Price Target

Government Policy and Infrastructure Development

- National Infrastructure Pipeline (NIP): The Indian government’s infrastructure push under the NIP is a significant growth driver for IRB Infra. Increased spending on roadways and highways will directly benefit the company, enhancing the IRB Infra share price target.

- Public-Private Partnerships (PPP): IRB Infra’s expertise in PPP models ensures its ability to secure large-scale projects, supported by favorable government policies, driving future growth.

Economic Growth and Urbanization

- Urbanization: As urbanization in India accelerates, the demand for developed infrastructure increases, which is a positive indicator for the IRB Infra share price target. The company is well-positioned to capitalize on this demand.

- Economic Stability: A stable economy ensures ongoing investment in infrastructure, which in turn supports the IRB Infra share price target. Stability also bolsters investor confidence in the company.

Technological Advancements and Innovation

- Construction Technologies: IRB Infra’s adoption of advanced construction techniques enhances efficiency and reduces costs, contributing to a positive IRB Infra share price target. These innovations are crucial for maintaining a competitive edge.

- Sustainability: IRB Infra’s commitment to sustainable practices not only boosts its market reputation but also attracts environmentally conscious investors, further supporting the IRB Infra share price target.

Financial Stability and Debt Management

- Financial Strength: IRB Infra’s solid financial position, despite a higher debt-to-equity ratio, ensures the company can fund new projects and expand operations. This stability is crucial for a positive IRB Infra share price target.

- Debt Management: Prudent management of debt levels supports investor confidence and positively influences the IRB Infra share price target.

IRB Infra Share Price Target 2026

From a 2026 outlook, the IRB Infra Share Price Target is projected in the range of ₹50 to ₹115. This is supported by strong project execution, rising toll revenues, and continued government infrastructure spending.

IRB Infra Share Price Target 2030

Looking ahead to 2030, the IRB Infra share price target is expected to reach between ₹270 and ₹280. This growth forecast is fueled by sustained profitability, expansion into new infrastructure projects, and advanced construction technologies. As IRB Infra solidifies its leadership in the sector, investor interest is likely to increase, driving the share price upward.

IRB Infra Share Price Target 2035

By 2035, the IRB Infra share price target is anticipated to be between ₹460 and ₹480. This significant growth is expected as IRB Infra experiences strong financial growth, forms strategic partnerships, and strengthens its position as a leader in infrastructure development.

IRB Infra Share Price Target 2040

In 2040, the IRB Infra share price target is projected to rise to approximately ₹900 to ₹1025. This target reflects the company’s ongoing commitment to innovation, expansion into new markets, and the growing demand for infrastructure. IRB Infra’s strategic vision is expected to drive the share price higher.

IRB Infra Share Price Target 2045

By 2045, the IRB Infra share price target is forecasted to reach between ₹1950 and ₹2275. This projection is based on the company’s long-term growth strategies, including strategic partnerships and maintaining a strong project pipeline. As IRB Infra continues to grow, its share price is expected to reflect this success.

IRB Infra Share Price Target 2050

Looking further ahead to 2050, the IRB Infra share price target is anticipated to be between ₹3300 and ₹3325. This ambitious target is supported by decades of sustained growth, technological improvements, and IRB Infra’s leadership in infrastructure development. The company’s focus on innovation and sustainability is expected to create significant long-term value for shareholders.

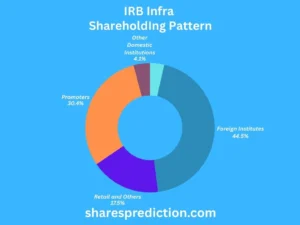

Shareholding Pattern

| Category | Percentage (%) |

|---|---|

| Foreign Institutions | 44.47% |

| Promoters | 30.42% |

| Retail and Others | 17.46% |

| Other Domestic Institutions | 4.10% |

| Mutual Funds | 3.56% |

The high foreign institutional ownership reflects strong global confidence in India’s infrastructure growth story and in IRB Infra’s long-term business model.

Conclusion

The IRB Infra share price target for 2026, 2030, 2035, 2040, 2045, and 2050 indicates a promising future for the company, marked by steady financial growth, ongoing innovation, and strategic expansion. As global demand for infrastructure continues to rise, IRB Infra’s commitment to excellence positions it well for long-term success. Investors can anticipate significant value appreciation, making IRB Infra an attractive investment in the infrastructure sector.

FAQs About IRB Infrastructure Developers Ltd.

Q1. Who is the Chairman of IRB Infrastructure Developers Ltd.?

- The Chairman of IRB Infrastructure Developers Ltd. is Mr. Virendra D. Mhaiskar.

Q2. When was IRB Infrastructure Developers Ltd. established?

- IRB Infrastructure Developers Ltd. was established in 1998.

Q3. Where is IRB Infrastructure Developers Ltd. headquartered?

- IRB Infrastructure Developers Ltd. is headquartered in Mumbai, Maharashtra, India.

Q4. What are the main projects undertaken by IRB Infrastructure Developers Ltd.?

- IRB Infra specializes in the development and management of roadways, highways, and other infrastructure projects, primarily under the Build-Operate-Transfer (BOT) model.

Q5. What sustainability initiatives is IRB Infrastructure Developers Ltd. involved in?

- IRB Infra is engaged in sustainability initiatives including green construction and resource-efficient practices.

Q6. What certifications does IRB Infrastructure Developers Ltd. hold?

- IRB Infra holds certifications such as ISO 9001 for quality management and ISO 14001 for environmental management.

Q7. What is IRB Infrastructure Developers Ltd.’s approach to corporate social responsibility (CSR)?

- IRB Infra actively participates in CSR activities focused on education, healthcare, and community development.

Q8. What awards and recognitions has IRB Infrastructure Developers Ltd. received?

- IRB Infra has received numerous awards for excellence in infrastructure development and project management from industry bodies.

Q9. What is the vision and mission of IRB Infrastructure Developers Ltd.?

- IRB Infra’s vision is to be a globally recognized leader in infrastructure development. Its mission is to deliver high-quality projects through sustainable practices and customer-centric approaches.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.