The IREDA share price target 2026 is generating great attention from investors as the firm continues to profit from India’s rapid drive toward renewable energy finance. Indian Renewable Energy Development Agency (IREDA) is a government-backed PSU that plays a significant role in supporting solar, wind, hydro, and other renewable energy projects.

After seeing substantial volatility post-listing, IREDA’s share price has now settled at ₹135, leading investors to review its near-term potential based on fundamentals, growth visibility, and industry tailwinds.

This article presents a detailed study of the IREDA share price target 2026, backed by current fundamentals and the company’s financial performance over the previous five years.

IREDA Share Price Target 2026: Price Outlook

Considering the current market price of around ₹135, the IREDA share price target 2026 reflects moderate upside driven by steady earnings growth and continued loan book expansion.

IREDA Share Price Target 2026

-

Conservative Case: ₹155

-

Base Case: ₹165

-

Optimistic Case: ₹175

This projection assumes:

-

Stable asset quality

-

No major policy disruption

-

Gradual improvement in profitability

IREDA is not a momentum-driven stock; instead, it rewards investors who align with India’s long-term renewable financing story.

Current Market Overview

IREDA Fundamentals

| Fundamental Metric | Value |

|---|---|

| Market Capitalisation | ₹38,262 Cr |

| P/E Ratio (TTM) | 22.22 |

| P/B Ratio | 2.96 |

| Industry P/E | 21.16 |

| Debt to Equity | 5.41 |

| Return on Equity (ROE) | 13.34% |

| EPS (TTM) | ₹6.13 |

| Dividend Yield | 0.00% |

| Book Value | ₹46.00 |

| Face Value | ₹10 |

Fundamentals Insight

-

Valuation is now closer to industry averages, reducing downside risk

-

High leverage is structural for a PSU financier, not a red flag by itself

-

Improving EPS and ROE support the IREDA share price target 2026 outlook

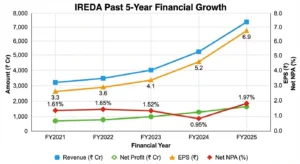

IREDA Past 5-Year Financial Growth

| Financial Year | Revenue (₹ Cr) | Net Profit (₹ Cr) | EPS (₹) | Net NPA (%) | Key Highlight |

|---|---|---|---|---|---|

| FY2021 | ~3,200 | ~760 | 3.3 | 1.61% | Stable base year, improving asset quality |

| FY2022 | ~3,500 | ~810 | 3.6 | 1.65% | Consistent growth, controlled NPAs |

| FY2023 | ~4,000 | ~1,000 | 4.1 | 1.52% | Strong profit expansion |

| FY2024 | ~5,200 | ~1,350 | 5.2 | 0.95% | Sharp improvement in asset quality |

| FY2025 | ~6,600 | ~1,700 | 6.9 | 1.97% | Record revenue & profit despite NPA uptick |

Over the past five years, IREDA has shown consistent expansion without sacrificing asset quality.

-

Revenue has grown sharply as renewable project financing scaled up

-

Profits and EPS have more than doubled

-

NPAs remained largely under control despite rapid growth

This historical performance adds credibility to the IREDA share price target 2026, showing that growth is not theoretical — it’s already happening.

Key Growth Drivers for IREDA in 2026

-

Rising renewable energy capacity additions in India

-

Government-backed financing visibility

-

Expanding loan book across solar, wind, hydro & storage

-

Access to low-cost global climate funding

These factors provide a solid base for near-term price appreciation.

Risks You Should Not Ignore

No stock is without risk, and IREDA is no exception.

Key concerns include:

-

Margin pressure in a high-interest-rate environment

-

Asset quality stress if project execution slows

-

PSU stocks underperforming during weak market sentiment

These risks do not invalidate the long-term story but can influence short-term price movement.

Conclusion: IREDA Share Price Target 2026

The IREDA share price target 2026 of ₹155–₹175 shows a balanced outlook—neither unduly aggressive nor pessimistic. With strengthening fundamentals, solid revenue visibility, and government support, IREDA is a fundamentally viable renewable finance PSU.

For investors with a medium- to long-term vision, IREDA may be regarded a steady compounder rather than a high-risk high-return investment.

For a complete long-term outlook, refer to our detailed guide on IREDA share price target 2026 to 2050.

FAQs

1. What is the IREDA share price target 2026?

The IREDA share price target 2026 is estimated in the range of ₹155 to ₹175, based on current fundamentals, earnings growth, and renewable energy financing demand.

2. Is IREDA a good stock to buy in 2026?

IREDA can be considered a fundamentally strong PSU stock for 2026, supported by government backing, steady revenue growth, and India’s renewable energy expansion. It is more suitable for medium- to long-term investors than short-term traders.

3. What is the current share price of IREDA?

As of the latest available data, the IREDA share price is around ₹135, which forms the base for the 2026 price target projection.

4. What are the key growth drivers for IREDA in 2026?

Key drivers include:

-

Rising renewable energy capacity additions

-

Government support for clean energy financing

-

Expanding loan book across solar, wind, and hydro projects

-

Access to global climate funding

These factors support the IREDA share price target 2026 outlook.

5. Is IREDA a government-owned company?

Yes, IREDA is a government-backed PSU, with the Government of India holding a majority promoter stake. This provides long-term stability and policy support.

6. Does IREDA pay dividends?

Currently, IREDA does not offer a significant dividend yield, as profits are largely reinvested to support growth and balance sheet expansion.

7. How strong are IREDA’s fundamentals?

IREDA’s fundamentals show:

-

P/E ratio near industry average

-

Improving EPS and ROE

-

High debt-to-equity, which is typical for a financing institution

Overall, fundamentals support gradual long-term growth rather than speculative upside.

8. What are the risks associated with investing in IREDA?

Key risks include:

-

Rising interest rates affecting margins

-

Asset quality pressure due to rapid loan growth

-

PSU valuation limitations during weak market sentiment

Investors should monitor quarterly results and NPA trends.

9. Can IREDA become a long-term multibagger?

IREDA is more likely to be a steady compounder than a high-risk multibagger. Its long-term returns depend on consistent execution, asset quality control, and renewable sector growth.

10. Is IREDA suitable for long-term investment beyond 2026?

Yes, investors looking beyond 2026 may find IREDA attractive due to its role in India’s long-term renewable energy transition and policy-backed business model.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analyses and insights can help you make informed investment decisions.