The IREDA share price target 2030 is becoming an important conversation topic among long-term investors as India’s renewable energy drive reaches a crucial development phase. Indian Renewable Energy Development Agency (IREDA), a government-backed PSU, provides as a financial backbone for India’s clean energy ecosystem by investing solar, wind, hydro, storage, and other green technologies.

With the stock presently trading at ₹135, investor emphasis has turned from post-listing volatility to the company’s capacity to grow financially over the next decade. As renewable energy transfers from policy intent to large-scale implementation, IREDA’s role is projected to rise dramatically.

This article investigates the IREDA share price target 2030 utilizing financial trends, operational performance, and sector-level changes. Let’s deep dive into it.

IREDA Share Price Target 2030: Long-Term Outlook

Unlike short-term price predictions, the IREDA share price target 2030 is based on gradual balance sheet expansion and sustained demand for renewable project financing. The outlook assumes disciplined growth rather than aggressive valuation re-rating.

IREDA Share Price Target 2030

-

Conservative Scenario: ₹350

-

Expected Scenario: ₹400

-

Optimistic Scenario: ₹450

Business & Market Position

IREDA acts under the Ministry of New and Renewable Energy (MNRE) and is uniquely positioned as a sector-focused lender. Unlike diverse lenders, its exposure is closely connected with India’s clean energy aspirations.

By 2030, renewable electricity is predicted to comprise a major part of India’s energy mix. This structural move increases long-term funding visibility for IREDA and boosts its significance within the power finance ecosystem.

Current Market Analysis

IREDA Fundamentals

| Fundamental Metric | Value |

|---|---|

| Market Capitalisation | ₹38,262 Cr |

| P/E Ratio (TTM) | 22.22 |

| P/B Ratio | 2.96 |

| Industry P/E | 21.16 |

| Debt to Equity | 5.41 |

| Return on Equity (ROE) | 13.34% |

| EPS (TTM) | ₹6.13 |

| Dividend Yield | 0.00% |

| Book Value | ₹46.00 |

| Face Value | ₹10 |

What the Fundamentals Indicate

-

Valuation levels have moderated, reducing downside risk

-

Elevated leverage reflects the nature of infrastructure financing, not operational stress

-

Rising earnings metrics provide support to the IREDA share price target 2030

Overall, fundamentals point toward controlled, long-duration growth.

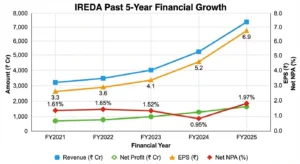

Financial Performance Trend (Last 5 Years)

| Metric | FY2021 | FY2025 | Trend |

|---|---|---|---|

| Revenue (₹ Cr) | ~3,200 | ~6,600 | Strong expansion |

| Net Profit (₹ Cr) | ~760 | ~1,700 | More than doubled |

| EPS (₹) | 3.3 | 6.9 | Consistent improvement |

| Net NPA (%) | 1.61% | 1.97% | Largely under control |

What This Snapshot Indicates

- IREDA has expanded swiftly without losing stability.

- Profit growth has maintained pace with balance sheet expansion.

- Asset quality stays sustainable despite greater loan exposure.

Key Factors Supporting IREDA by 2030

Several structural drivers are expected to shape IREDA’s performance by 2030:

- Accelerated renewable capacity deployment throughout India.

- Continued government emphasis on clean energy finance.

- Diversification into storage, hybrid, and new energy sectors.

- Access to international and global climate funds.

- Long-duration financing visibility for infrastructure projects.

Together, these factors create a strong platform for steady compounding.

Risks to Keep in Mind

While the long-term outlook remains constructive, investors should monitor:

-

Pressure on margins during prolonged high-rate cycles

-

Execution delays impacting borrower cash flows

-

Periodic underperformance of PSU stocks during weak market phases

These risks may influence interim performance but are unlikely to derail the long-term story if managed prudently.

Conclusion

The IREDA share price target 2030 range of ₹350–₹450 represents a balanced long-term view built on fundamentals rather than optimism. With its policy-backed business model, expanding loan book, and alignment with India’s renewable roadmap, IREDA appears positioned as a steady long-term compounder.

Investors looking beyond a single milestone year should also refer to our pillar analysis on IREDA share price target 2026 to 2050, which provides a broader multi-decade growth perspective.

FAQs

1. What factors will influence the IREDA share price target 2030 the most?

The key drivers include renewable capacity additions in India, growth in IREDA’s loan book, asset quality management, interest rate trends, and continued government policy support for clean energy financing.

2. How sensitive is IREDA’s share price to interest rate changes?

As a financing PSU, IREDA’s margins can be affected by interest rate cycles. However, access to long-term, relatively low-cost funding helps cushion the impact over time.

3. Can improving asset quality significantly impact the IREDA share price target 2030?

Yes. Stable or improving NPAs enhance investor confidence and valuation multiples, directly supporting the long-term IREDA share price target 2030.

4. Does IREDA’s government ownership limit its upside potential?

Government ownership provides stability and policy backing but may cap aggressive re-rating. As a result, IREDA is more likely to deliver steady compounding than speculative upside.

5. How important is global climate funding for IREDA’s future growth?

Global climate funding plays a meaningful role by lowering funding costs and expanding financing capacity, which positively supports long-term growth projections.

6. Could diversification into storage and green hydrogen affect the 2030 outlook?

Yes. Entry into energy storage, green hydrogen, and hybrid projects can expand IREDA’s addressable market and strengthen growth visibility by 2030.

7. Is IREDA more suitable for long-term investors than short-term traders?

IREDA’s business model favours long-term investors seeking stable growth rather than short-term traders looking for quick price movements.

8. How does IREDA compare with other PSU financiers in terms of growth potential?

Compared to traditional PSU lenders, IREDA benefits from being aligned with a fast-growing renewable sector, which may offer better long-term growth visibility.

9. Can policy changes negatively affect the IREDA share price target 2030?

Major policy shifts could impact project flows, but India’s long-term renewable commitments reduce the likelihood of abrupt adverse changes.

10. What should investors track regularly to reassess the IREDA share price target 2030?

Investors should monitor quarterly results, loan book growth, NPA trends, cost of funds, and updates on renewable energy policies.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analyses and insights can help you make informed investment decisions.