The IREDA share price target 2035 is attracting attention among long-term investors who are relying on India’s multi-decade renewable energy revolution. Indian Renewable Energy Development Agency (IREDA) acts as a specialist government-backed lender focused only on renewable energy projects, making it a vital institution in India’s climate and energy plan.

As renewable energy transitions from capacity production to system-wide integration—including storage, grid stability, and green hydrogen—IREDA’s financial role is projected to expand. This places the firm as a long-term beneficiary of policy stability and structural demand rather than short-term market fluctuations.

This article gives a forward-looking study of the IREDA share price target 2035, based on fundamentals, past performance, growth drivers, valuation assumptions, and risks important for long-horizon investors.

IREDA Share Price Target 2035

Considering IREDA’s expanding loan book, government backing, improving profitability metrics, and sustained demand for renewable energy financing, the IREDA share price target 2035 is projected in the following range:

IREDA Share Price Target 2035

-

Conservative Case: ₹650

-

Base Case: ₹725

-

Optimistic Case: ₹800

This range reflects steady compounding rather than aggressive valuation expansion. By 2035, IREDA is expected to operate as a mature renewable finance institution with predictable earnings and stable asset quality.

Business Position & Sector Outlook

IREDA serves under the Ministry of New and Renewable Energy (MNRE) and focuses on funding solar, wind, hydro, biomass, storage, and developing clean energy technologies. Unlike diverse NBFCs, its business strategy is firmly connected with national renewable energy goals.

By 2035, renewable energy is predicted to comprise a dominating percentage of India’s power generating mix. This structural adjustment enhances long-term funding clarity for IREDA and boosts confidence in the IREDA share price goal 2035.

Current Market Overview

IREDA Fundamentals

| Fundamental Metric | Value |

|---|---|

| Market Capitalisation | ₹38,262 Cr |

| P/E Ratio (TTM) | 22.22 |

| P/B Ratio | 2.96 |

| Industry P/E | 21.16 |

| Debt to Equity | 5.41 |

| Return on Equity (ROE) | 13.34% |

| EPS (TTM) | ₹6.13 |

| Dividend Yield | 0.00% |

| Book Value | ₹46.00 |

| Face Value | ₹10 |

Fundamentals Interpretation

-

Valuation remains reasonable relative to growth visibility

-

Higher leverage is inherent to infrastructure financing models

-

Gradual improvement in ROE and EPS supports long-term projections

These fundamentals provide a stable base for long-duration compounding rather than speculative upside.

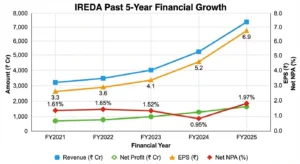

IREDA’s Financial Execution: Last 5 Years

Over the past five years, IREDA has demonstrated its ability to scale without materially compromising asset quality.

- Revenue grew from ~₹3,200 Cr to ~₹6,600 Cr

- Net profit more than quadrupled, demonstrating operating leverage

- EPS rise signals increasing shareholder value generation

- NPAs were generally controllable despite strong loan book expansion

This execution track record strengthens the credibility of the IREDA share price target 2035, as projections are backed by demonstrated performance.

IREDA Shareholding Pattern

| Shareholder Category | Shareholding (%) |

|---|---|

| Promoters (Govt. of India) | 71.76% |

| Retail & Others | 23.75% |

| Other Domestic Institutions (DII) | 2.35% |

| Foreign Institutions (FII) | 1.92% |

| Mutual Funds | 0.22% |

High promoter ownership ensures long-term policy backing and funding support, while increasing retail and institutional participation suggests growing investor confidence. Over time, any rise in FII or mutual fund holdings could act as a valuation catalyst for the IREDA share price target 2035.

How IREDA Makes Money

IREDA operates as a specialised renewable energy financier rather than a traditional power producer. Its revenue model is built around long-term lending and financing solutions for clean energy projects across India.

Key Revenue Streams

-

Interest Income:

Earned from loans extended to renewable energy developers across solar, wind, hydro, biomass, and storage projects. -

Project Financing & Term Loans:

Long-duration loans for large-scale renewable infrastructure projects provide predictable interest income. -

Refinancing & Lines of Credit:

Funding support through multilateral agencies and global climate institutions helps lower cost of capital and improve margins. -

Fee & Other Income:

Includes processing fees, commitment charges, and consultancy-related income.

Why This Model Supports Long-Term Growth

-

Demand for renewable financing is structural, not cyclical

-

Government-backed mandate reduces credit risk

-

Long-term projects ensure earnings visibility

-

Scale improves margins as the loan book expands

This predictable and scalable revenue model underpins confidence in the IREDA share price target 2035, making the stock more suitable for long-term compounding rather than short-term trading.

Risks to Monitor

While the long-term outlook remains constructive, investors should be aware of potential risks:

- Margin pressure during lengthy high interest rate cycles

- Asset quality stress if renewable project implementation slows

- PSU stocks failing amid poor market mood

These risks may influence interim valuations but do not necessarily undermine the long-term thesis if managed prudently.

Conclusion: IREDA Share Price Target 2035

The IREDA share price target 2035 of ₹650–₹800 indicates a balanced, fundamentals-driven forecast rather than an ambitious growth assumption. With solid policy coherence, improved financial indicators, and a defined role in India’s renewable transformation, IREDA is positioned as a stable long-term compounder.

Investors wanting a wider view over different time horizons may refer to our analysis of IREDA share price target 2026 to 2050, which incorporates extended forecasts and scenario-based expectations.

FAQs on IREDA Share Price Target 2035

1. What is the IREDA share price target 2035?

The projected IREDA share price target 2035 ranges between ₹650 and ₹800, depending on growth and valuation assumptions.

2. Is IREDA suitable for long-term investment till 2035?

Yes, IREDA is more suited for long-term investors seeking stable compounding backed by government policy.

3. What will drive IREDA’s growth over the next decade?

Renewable capacity expansion, new clean energy segments, and sustained financing demand.

4. Does IREDA face high risk due to leverage?

Higher leverage is structural for its financing model and supported by asset-backed lending.

5. Can IREDA become a multibagger by 2035?

IREDA is more likely to deliver steady compounding rather than speculative multibagger returns.

6. How important is government support for IREDA?

Government backing is central to its stability, funding access, and long-term relevance.

7. Does IREDA pay dividends?

Dividend payouts are currently minimal as profits are largely reinvested for growth.

8. What are the key risks for IREDA till 2035?

Interest rate cycles, asset quality pressure, and PSU market sentiment.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analyses and insights can help you make informed investment decisions.