The IREDA share price target 2045 is being debated among investors who perceive India’s renewable energy transformation as a multi-decade opportunity rather than a short-term topic. Indian Renewable Energy Development Agency (IREDA), a government-backed PSU under the Ministry of New and Renewable Energy (MNRE), has grown into a crucial finance organization supporting India’s renewable energy objectives.

As the energy ecosystem grows to encompass storage, green hydrogen, and grid-scale solutions, IREDA’s role is likely to transition from fast growth to scaled, predictable compounding. This article gives a forward-looking evaluation of the IREDA share price target 2045, anchored upon previous performance, predicted growth, and structural demand.

IREDA Share Price Target 2045

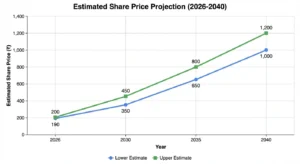

Based on long-term renewable financing demand, balance sheet scaling, and gradual profitability improvement, the IREDA share price target 2045 is projected as follows:

IREDA Share Price Target 2045

- Conservative Case: ₹1,400

- Base Case: ₹1,550

- Optimistic Case: ₹1,700

By 2045, IREDA is expected to function as a mature renewable finance PSU with stable cash flows, strong policy alignment, and predictable earnings visibility.

Renewable Energy Outlook and IREDA’s Strategic Role

By the mid-2040s, renewable energy is predicted to dominate India’s power production and storage mix. Financing needs will expand beyond capacity growth to encompass asset replacement, grid optimization, storage systems, and next-generation clean technologies.

IREDA’s sector-specific emphasis enables it to profit throughout the renewable value chain, enhancing the long-term case for the IREDA share price target 2045.

Current Market Overview

IREDA Fundamentals

| Fundamental Metric | Value |

|---|---|

| Market Capitalisation | ₹38,262 Cr |

| P/E Ratio (TTM) | 22.22 |

| P/B Ratio | 2.96 |

| Industry P/E | 21.16 |

| Debt to Equity | 5.41 |

| Return on Equity (ROE) | 13.34% |

| EPS (TTM) | ₹6.13 |

| Dividend Yield | 0.00% |

| Book Value | ₹46.00 |

| Face Value | ₹10 |

Projected Growth Path From 2026 to 2045

The IREDA share price target 2045 is derived from a structured compounding trajectory rather than isolated assumptions. Alongside share price appreciation, key financial metrics are expected to scale as the business matures.

Long-Term Growth Projection

| Year | Est. Share Price (₹) | Revenue Outlook | EPS Potential | ROE Trend |

|---|---|---|---|---|

| 2026 | 190 – 200 | Stable expansion | Low-mid growth | Improving |

| 2030 | 350 – 450 | Strong growth | Rising steadily | ~14–15% |

| 2035 | 650 – 800 | Accelerated scale | Meaningful expansion | ~15–16% |

| 2040 | 1,000 – 1,200 | Mature growth | High stability | ~16–17% |

| 2045 | 1,400 – 1,700 | Predictable compounding | Sustained earnings | ~17–18% |

What This Indicates

- Share price growth reflects long-term earnings compounding, not speculation

- Revenue expansion tracks renewable financing demand over decades

- EPS and ROE improvement support valuation stability

- By 2045, IREDA is expected to operate with institutional-grade predictability

This progression forms the financial basis for the IREDA share price target 2045.

IREDA Shareholding Pattern

| Shareholder Category | Shareholding (%) |

|---|---|

| Promoters (Govt. of India) | 71.76% |

| Retail & Others | 23.75% |

| Other Domestic Institutions (DII) | 2.35% |

| Foreign Institutions (FII) | 1.92% |

| Mutual Funds | 0.22% |

High promoter ownership promotes policy consistency and finance stability. Over time, steady increases in institutional involvement might support value growth as earnings scale.

IREDA Growth vs Risk

🚀 Growth Positives

- Rising demand for renewable, storage, and clean energy financing

- Expansion into green hydrogen and hybrid energy projects

- Access to low-cost global climate funding

- Recurring opportunities from refinancing and asset life-cycle funding

- Strong policy and government backing ensures long-term relevance

⚠️ Key Risks

- Margin pressure during prolonged high interest rate cycles

- Asset quality volatility during large-scale project execution

- PSU stocks may underperform in weak market phases

Bottom Line:

IREDA offers steady long-term compounding backed by policy support, with risks that are more cyclical than structural.

Conclusion: IREDA Share Price Target 2045

The IREDA share price target 2045 of ₹1,400–₹1,700 represents a balanced, fundamentals-driven view matched with India’s long-term clean energy strategy. With stable financing demand, rising profitability measures, and governmental support, IREDA seems positioned as a solid long-term compounder rather than a speculative growth company.

Investors wanting a larger multi-decade view may refer to our thorough analysis on IREDA share price target 2026 to 2050, which encompasses extended estimates over many horizons.

FAQs

1. What is the IREDA share price target 2045?

The projected IREDA share price target 2045 ranges between ₹1,400 and ₹1,700, depending on growth and valuation assumptions.

2. What drives IREDA’s long-term growth till 2045?

Renewable capacity expansion, storage financing, green hydrogen projects, and policy-backed funding demand.

3. Is IREDA suitable for very long-term investors?

Yes, IREDA is best suited for investors with a multi-decade horizon seeking stable compounding.

4. How will earnings grow alongside the share price?

EPS is expected to rise steadily as the loan book expands and profitability improves over time.

5. Does high leverage pose a long-term risk?

Leverage is structural to IREDA’s financing model and supported by asset-backed lending.

6. Can institutional ownership increase by 2045?

As earnings scale and visibility improves, institutional participation may rise, supporting valuations.

7. Is IREDA dependent on government policy?

Yes, policy support is central, but India’s long-term renewable commitments reduce uncertainty.

8. Can IREDA become a multibagger by 2045?

IREDA is more likely to deliver steady compounding than extreme multibagger returns.

9. What risks could impact the IREDA share price target 2045?

Interest rate volatility, asset quality stress, and PSU market sentiment.

10. Should investors track anything specific over time?

Quarterly earnings, NPA trends, funding costs, and renewable policy developments.

⚠️ Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice.

Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analyses and insights can help you make informed investment decisions.