The irfc share price target 2050 has attracted great attention among investors who regard IRFC as a long-term compounder linked with India’s multi-decade infrastructure makeover. Indian Railway Finance Corporation (IRFC), the finance arm of Indian Railways, plays a significant role in generating funding for national railway development projects. With India rapidly upgrading its transportation network, IRFC is perfectly positioned to serve long-duration capex needs that will determine the next 25 years of infrastructure expansion.

As the government accelerates transportation growth, freight logistics upgrading, and advanced rail technology adoption, IRFC is projected to continue a major position in large-scale finance contributions. With a steady, predictable lease income model and strong governmental backing, IRFC stands out as one of the most trusted PSU finance institutions for long-term investors.

This article gives a thorough future prognosis for the IRFC share price target 2050, backed by performance expectations, predicted valuation indicators, financial stability insights, and investment considerations.

IRFC Share Price Target 2050

Considering IRFC’s compounding growth potential, infrastructure expansion beyond 2040, strengthened financial base, increasing asset portfolio, and stable business model, the irfc share price target 2050 is projected to reach:

₹4,200 to ₹4,700

This estimate implies multi-decade earnings growth, better valuation development, increased profitability, and expanding national and worldwide financing possibilities.

Current Market Performance Snapshot

| Metric | Current Value |

|---|---|

| Market Cap | ₹1,52,575 Cr |

| P/E Ratio (TTM) | 22.32 |

| Industry P/E | 25.92 |

| P/B Ratio | 2.72 |

| Debt to Equity | 7.25 |

| ROE | 12.16% |

| EPS (TTM) | 5.23 |

| Dividend Yield | 1.37% |

These financial metrics reflect IRFC’s strong operational position and disciplined financial structure.

Projected IRFC Valuation Metrics for 2050

| Metric | Current | Estimated 2050 |

|---|---|---|

| Share Price | ₹120–₹140 | ₹4,200–₹4,700 |

| EPS | 5.23 | 60–70 |

| P/E Ratio | 22.32 | 60–72 |

| Book Value | ₹43 | ₹350–₹420 |

| ROE | 12.16% | 20–22% |

| Market Cap | ₹1.52 Lakh Cr | ₹40–₹48 Lakh Cr |

These projections imply consistent earnings compounding, asset scaling, and valuation increase driven by India’s economic boom.

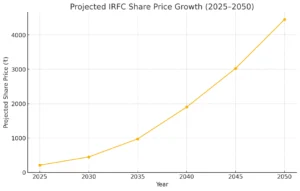

IRFC Long-Term Growth Trend Overview

IRFC’s journey demonstrates high compounding potential and long-term scalability supported by India’s growing infrastructure investment pipeline.

| Year | Estimated Share Price |

|---|---|

| 2025 | ₹200 – ₹220 |

| 2030 | ₹420 – ₹480 |

| 2035 | ₹900 – ₹1,050 |

| 2040 | ₹1,750 – ₹2,050 |

| 2045 | ₹2,850 – ₹3,200 |

| 2050 | ₹4,200 – ₹4,700 |

The sustained upward trend highlights IRFC’s potential to remain a valuable compounding stock across decades.

Future Growth Opportunities for IRFC Through 2050

India’s transportation and logistics development is expected to undergo massive transformation by 2050. This includes:

Major Future Growth Drivers

- Rapid expansion of high-speed & bullet train networks across India

- Increased freight rail share to reduce logistics costs

- Fully automated railway systems with AI-powered infrastructure

- Smart logistics hubs integrated with global supply chains

- Electrification & renewable energy adoption in rail operations

- Modern passenger station development comparable to airports

How This Impacts IRFC

| Strategic Factor | Impact |

|---|---|

| Financing demand from mega projects | Higher asset leasing volume |

| Technology-transforming upgrades | More long-term capital support |

| Increased borrowing capacity | Improved profitability margins |

| National logistics optimisation | Revenue visibility for decades |

With these opportunities, IRFC remains strongly positioned for sustained growth till 2050.

Risks Investors Should Consider

- Capital expenditure slowdown due to macroeconomic or budgetary pressure

- Higher global and domestic interest rates impacting profit spreads

- Overdependence on Indian Railways as a single client

- Possible correction phases after extended rallies

- Regulatory and policy shifts impacting project timelines

Even with these risks, IRFC maintains lower financial risk compared to traditional NBFCs due to government guarantees.

Conclusion

IRFC has grown into a crucial national financial institution with a stable, scalable, and predictable business model matched with India’s infrastructure development program. Its involvement in growing and upgrading the railway ecosystem positions it firmly for multi-decade compounding growth.

Based on structural growth considerations, reliable income sources, valuation improvement, and future infrastructure investment, the irfc share price target 2050 is anticipated at ₹4,200 to ₹4,700, making IRFC an appealing alternative for long-term wealth accumulation.

For detailed long-term estimates covering 2025, 2030, 2035, 2040 and 2045, explore the whole analysis:

IRFC Share Price Target 2025–2050

FAQs on IRFC Share Price Target 2050

1. What is the IRFC share price target 2050?

The projected IRFC share price target 2050 is ₹4,200 to ₹4,700.

2. Can IRFC cross ₹5,000 by 2050?

Yes, if profits scale faster and valuation re-rates significantly.

3. Is IRFC a safe long-term stock?

Yes, backed by the Government of India with predictable cash flow.

4. Will IRFC benefit from high-speed rail expansion?

Absolutely, as major financing is expected to route through IRFC.

5. What may impact IRFC before 2050?

Capex slowdown, interest rate rises, and policy changes.

6. Will IRFC remain a dividend-paying company?

Yes, IRFC is expected to maintain stable dividend payouts.

7. Can IRFC become a multibagger by 2050?

Very likely for early investors holding over long durations.

8. Is IRFC suitable for SIP-based investing?

Yes, SIP accumulation helps benefit from long-term CAGR returns.

9. What makes IRFC different from other NBFCs?

Sovereign-backed security, guaranteed leases, and minimal default risk.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analyses and insights can help you make informed investment decisions.