Jio Financial Services has been making waves in the financial sector with its innovative approach and strong backing from Reliance Industries. Understanding the future share price targets of such a company is crucial for investors who are looking to make informed decisions. This blog aims to provide a comprehensive analysis of Jio Financial Services share price targets for the years 2025, 2030, 2035, 2040, 2045, and 2050.

Current Market Position

Jio Financial Services a subsidiary of Reliance Industries, was established to revolutionize the financial services sector in India. With a focus on leveraging technology to provide seamless and efficient financial solutions, Jio Financial Services offers a range of products including digital banking, insurance, investment services, and more. The company has seen rapid growth since its inception, driven by its innovative offerings and strategic partnerships.

Past 5 Years Growth Analysis

| Year | Revenue Growth | Profit Growth | Share Price Growth |

|---|---|---|---|

| 2023 | 44.84 | 31.25 | 1,14,120 |

| 2024 | 1,855 | 1,605 | 1,39,148 |

| 2025 | 2,079 | 1,613 | 1,23,497 |

Jio Financial Services has demonstrated rapid financial expansion over the past three years, marked by a sharp acceleration in both revenue and profit after 2023. The strong jump in 2024 reflects the company’s aggressive scaling of financial services and growing product portfolio. Although share price growth moderated in 2025, it still indicates strong investor confidence. From a 2026 perspective, this trend positions Jio Financial as a high-growth fintech player with long-term potential in India’s evolving financial ecosystem.

Jio Financial Services Financial Table (As of January 2026)

| Company Name | Jio Financial Services Limited |

|---|---|

| Market Cap | ₹ 1,55,175 Cr |

| P/E Ratio (TTM) | 96.54 |

| P/B Ratio | 1.15 |

| Industry P/E | 19.51 |

| Debt to Equity Ratio | 0.08 |

| ROE | 1.21% |

| Dividend Yield | 0.20% |

| 52 Week High | ₹ 338.60 |

| 52 Week Low | ₹ 198.65 |

| EPS (TTM) | 2.53 |

| Book Value | 212.08 |

| Face Value | 10 |

| Official Website | Jio Financial Services |

The broader market environment in 2026 is influenced by global economic trends, inflation levels, interest rate movements, and regulatory developments. The financial and industrial sectors, in particular, are experiencing increased competition and stricter compliance requirements. As a result, companies are focusing more on cost efficiency, technology adoption, and strategic partnerships to maintain growth momentum.

Market Analysis

Currently, Jio Financial Services holds a strong position in the market, thanks to its parent company’s extensive network and resources. The company faces competition from established financial institutions like HDFC, ICICI, and SBI, but its tech-driven approach gives it a competitive edge. The financial services industry is evolving with advancements in fintech, regulatory changes, and shifting consumer preferences, all of which play a crucial role in shaping Jio Financial Services’ market dynamics.

Factors Influencing Share Price

Internal Factors

- Management: The leadership team of Jio Financial Services brings a wealth of experience and vision, driving the company’s strategic initiatives.

- New Products: Continuous innovation in product offerings helps the company stay ahead in the competitive market.

- Financial Health: Strong financial performance and a robust balance sheet enhance investor confidence.

External Factors

- Economic Conditions: Macroeconomic factors such as inflation, interest rates, and GDP growth impact the financial services sector.

- Regulatory Changes: Compliance with regulatory standards and policies affects operational flexibility and costs.

- Technological Advancements: Adoption of new technologies can drive efficiency and customer satisfaction.

SWOT Analysis

- Strengths: Strong brand, extensive network, technological expertise.

- Weaknesses: Dependency on the parent company, regulatory risks.

- Opportunities: Expanding market, increasing demand for digital financial services.

- Threats: Intense competition, economic volatility.

Jio Financial Services Share Price Targets

Share Price Target for 2026

Share price targets mentioned for future years are based on current market trends, historical performance, and long-term growth assumptions. However, in 2026, investors are advised to treat these targets as indicative projections rather than guaranteed outcomes. Stock performance can be influenced by macroeconomic conditions, company-specific developments, regulatory changes, and overall market sentiment.

Share Price Target for 2030

Looking towards 2030, Jio Financial Services aims to leverage emerging technologies like AI, blockchain, and big data to enhance its offerings. The company is expected to expand its customer base significantly, both domestically and internationally. Experts forecast the share price to reach approximately INR 3,000 by 2030.

Share Price Target for 2035

In 2035, Jio Financial Services is anticipated to be a major player in the global financial market. The company’s innovative solutions and expansion strategies will likely drive substantial growth. The share price target for 2035 is estimated to be around INR 4,500.

Share Price Target for 2040

By 2040, the financial services landscape will be highly competitive, with Jio Financial Services leading the charge. The company’s sustained growth and ability to adapt to market changes will play a crucial role. Analysts predict the share price to be approximately INR 6,000.

Share Price Target for 2045

As we move towards 2045, Jio Financial Services is expected to maintain its growth trajectory, supported by a strong technological backbone and a diverse portfolio of financial products. The share price target for 2045 is projected to be around INR 7,500.

Share Price Target for 2050

Looking ahead to 2050, Jio Financial Services is likely to be a dominant force in the financial industry, both in India and globally. With continuous innovation and strategic expansion, the share price is expected to reach approximately INR 10,000.

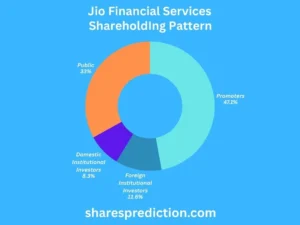

Shareholding Ratio

| Shareholder Type | Percentage (%) |

|---|---|

| Promoters | 47.12% |

| Foreign Institutional Investors (FIIs) | 11.55% |

| Domestic Institutional Investors (DIIs) | 8.30% |

| Public | 33.03% |

The shareholding pattern indicates the ownership structure of the company and reflects investor confidence. A higher promoter stake generally signals strong management commitment, while institutional holdings indicate trust from professional investors. Retail participation shows public interest and liquidity in the stock. Overall, a balanced shareholding structure is considered positive for long-term stability and governance.

Investment Considerations

Investing in Jio Financial Services involves assessing various risks and opportunities. While the company’s strong growth potential is attractive, investors should also consider market volatility, regulatory changes, and competitive pressures. Diversification and a long-term investment approach can help manage risks and optimize returns.

Conclusion

Jio Financial Services is poised for significant growth in the coming decades, with promising share price targets for 2025, 2030, 2035, 2040, 2045, and 2050. Investors should stay informed about the company’s performance and market trends to make well-informed investment decisions.

Additional Resources

Stay updated with the latest financial news and insights by subscribing to our newsletter. Share your thoughts and predictions in the comments below and join the discussion on the future of Jio Financial Services shares.

FAQs

-

Who is the Chairman/CEO of Jio Financial Services?

- As of the latest update, Mukesh Ambani is the Chairman of Jio Financial Services. The CEO is yet to be officially announced. For the latest updates, please visit the Jio Financial Services official website.

-

When was Jio Financial Services founded?

- Jio Financial Services was incorporated in 1999 as a non-deposit-taking, non-banking financial company, part of the Reliance Group.

-

What services does Jio Financial Services offer?

- Jio Financial Services provides a comprehensive range of financial solutions, including lending, asset management, and insurance, leveraging both physical and digital platforms to enhance accessibility and convenience.

-

Where is Jio Financial Services’ headquarters located?

- The headquarters of Jio Financial Services is located at Maker Chambers IV, Nariman Point, Mumbai, India.

-

What is Jio Financial Services’ vision and mission?

- The vision of Jio Financial Services is to empower every Indian with accessible financial services. The mission is to use technology to provide inclusive and efficient financial solutions across India.

-

How does Jio Financial Services leverage technology in its operations?

- Jio Financial Services uses advanced digital platforms and technology to streamline operations, enhance customer experience, and provide seamless financial services, from lending to insurance.

-

What are Jio Financial Services’ recent strategic initiatives?

- Recently, Jio Financial Services has been focusing on expanding its digital footprint, entering new financial segments, and forming strategic partnerships to enhance its service offerings.

-

Is Jio Financial Services a part of Reliance Industries?

- Yes, Jio Financial Services is a subsidiary of Reliance Industries, leveraging the extensive network and resources of the Reliance Group to provide its financial services.

-

What is Jio Financial Services’ corporate social responsibility (CSR) focus?

- Jio Financial Services is committed to various CSR activities, focusing on financial literacy, digital inclusion, and community development, aligning with its mission to empower every Indian with accessible financial services.

-

What are Jio Financial Services’ key achievements in the past five years?

- Over the past five years, Jio Financial Services has significantly expanded its service portfolio, launched innovative digital financial products, and achieved robust growth in customer base and financial performance.

Disclaimer

This blog provides a thorough analysis to help investors understand the potential future share price targets of Jio Financial Services, offering valuable insights to make informed investment decisions. It is not intended to be a recommendation or an offer to buy or sell any securities. The information provided is based on publicly available data and should not be considered as investment advice. It is important to consult with a financial advisor before making any investment decisions. It is important to consult with a financial advisor before making any investment decisions, as they can provide personalized guidance based on your individual financial situation.

THANK YOU FOR THE SUGGESTION. I THINK THE SAME.