Olectra Greentech share price target is expected to rise further in the coming years, with analysts forecasting a significant increase by 2050. Olectra Greentech Limited, India’s largest manufacturer of all-electric buses, has spearheaded the electric vehicle revolution. Investors are keeping a close eye on the company’s future prospects, given its strong market presence and innovative advances in the e-mobility sector. Let’s look at the company’s data and forecast some future values.

Company Overview

Hyderabad-based Olectra Greentech Limited is the largest manufacturer of pure electric buses in India. Olectra has nationwide deployed all electric bus variants as the nation’s inaugural electric bus manufacturer. The company is currently expanding its operations to include electric trucks and tippers, which are part of its e-mobility initiative. Olectra, which is publicly traded on the BSE and NSE, is ISO-9001:2008 certified and has an R&D Centre that has been recognised by the Department of Scientific and Industrial Research. The organisation’s objective is to become a significant player in the electric vehicle industry by offering environmentally friendly travel solutions.

Current Share Price

Past 5-Year Analysis: Revenue and Profit

Below is a table that summarises Olectra Greentech’s growth over the last five years in order to give a better understanding of the company’s performance:

| Year | Revenue | Profit / Loss |

|---|---|---|

| 2020 | 421.92 | 13.35 (Profit) |

| 2021 | 288.65 | 15.99 (Profit) |

| 2022 | 593.30 | 52.07 (Profit) |

| 2023 | 1,145.85 | 91.11 (Profit) |

| 2024 | 1,126.19 | 98.71 (Profit) |

| 2025 | 1,814.00 | 139.00 (Profit) |

From 2020 to 2025, Olectra Greentech demonstrated exceptional growth, with revenue increasing from ₹421.92 Cr to ₹1,814 Cr and net profit rising from ₹13.35 Cr to ₹139 Cr. This growth reflects large-scale adoption of electric buses by government transport bodies and successful execution of long-term supply contracts. By 2026, Olectra has established itself as a structurally growing EV company rather than a cyclical manufacturer.

Financial Table (as of February 2026)

| Company Name | Olectra Greentech Limited. |

|---|---|

| Market Cap | ₹ 8,700 Cr (As of February 2026) |

| P/E Ratio | 60.91 |

| Industry P/E | 28.82 |

| Debt to Equity Ratio | 0.33 |

| ROE | 12.73% |

| Dividend Yield | 0.04% |

| 52 Week High | INR 1714.20 |

| 52 Week Low | INR 965.10 |

| P/B Ratio | 7.75 |

| EPS (TTM) | 17.40 |

| Official Website | Olectra Greentech Ltd. |

As of 2026, Olectra Greentech’s financial performance reflects a high-growth business model supported by government-backed demand for electric mobility. The company’s ability to scale revenues while maintaining consistent profitability highlights strong operational execution and demand visibility through long-term contracts with public transport authorities.

Performance Analysis

As of February 2026, Olectra trades at a P/E ratio of 60.91, which is significantly higher than the industry average, indicating strong growth expectations priced into the stock. The ROE of 12.73% reflects moderate capital efficiency, while the debt-to-equity ratio of 0.33 suggests manageable leverage. Overall, the valuation implies that the market is discounting aggressive future growth in EV adoption.

Factors Influencing Olectra Greentech Share Price Target

- Market Demand for Electric Vehicles (EV):

- Government Policies and Incentives: Increases EV adoption and Olectra revenue.

- Environmental Concerns: Increases demand for environmentally friendly transportation.

- Technological Advances:

- R&D investments: Improve product efficiency and competitiveness.

- Battery Technology: Enhances battery performance and product appeal.

- Financial Performance:

- Revenue and profit growth: Boosts investor confidence and share prices.

- Cost Management: Increases profit margins.

- Market Expansion:

- Geographic diversification: Promotes revenue growth and market share.

- Product Line Expansion: Reaches a larger customer base.

- Strategic partnerships and collaborations:

- Industry alliances: Increases product offerings and market penetration.

- Government contracts: Provide consistent revenue streams.

- Economic conditions:

- Inflation and interest rates: Impact consumer spending and EV investment.

- Global economic stability: Influences EV demand.

Conclusion:

Olectra Greentech share price target is determined by market demand, technology, financial performance, market expansion, partnerships, economic conditions, competition, and regulatory factors that influence the company’s growth and profitability.

Olectra Greentech Share Price Target 2026

Olectra Greentech share price target for 2026 is expected to be between INR 1,000 and INR 3000, supported by a strong order pipeline in electric buses, expansion into electric commercial vehicles, and favourable government EV policies. Rising urban transport electrification is expected to be the key growth catalyst.

Olectra Greentech Share Price Target 2030

Olectra Greentech’s share price target for 2030 ranges between INR 7670.41 and INR 8,007.98, considering expected advancements in battery technology, expanded global market reach, and sustained profitability. As environmental regulations tighten and demand for electric vehicles grows, Olectra’s strategic initiatives and innovation are expected to significantly increase its market value.

Olectra Greentech Share Price Target 2035

By 2035, Olectra Greentech’s share price target is expected to be around INR 14,501.44 and INR 14,864.93, reflecting the company’s leadership in the field of electric vehicles, continued expansion into new markets, and successful transition to evolving technologies. A business’s dedication to sustainability and strong financial growth is expected to generate significant long-term value for investors.

Olectra Greentech Share Price Target 2040

Olectra Greentech share price target for 2040 should be between INR 21,000 and INR 22,000, driven by the company’s continued innovation in electric vehicle technology, strong market expansion, and strategic global partnerships. As the demand for sustainable transport solutions grows, Olectra’s strong financials and market leadership are expected to significantly boost its stock price.

Olectra Greentech Share Price Target 2045

Olectra Greentech share price target for 2045 is between INR 28,452 and INR 30,392, reflecting the company’s long-term commitment to innovation, strong presence in the electric vehicle market, and effective strategic partnerships. The growing global shift towards sustainable transport will strengthen Olectra’s market position and boost its stock value.

Olectra Greentech Share Price Target 2050

Olectra Greentech’s share price target for 2050 is projected to be between INR 35,824 and INR 36,734, reflecting decades of consistent growth, continuous technological advancements, and global market leadership in electric vehicles. As the world shifts towards sustainable transportation, Olectra’s strong financial health and strategic vision are likely to drive significant long-term shareholder value.

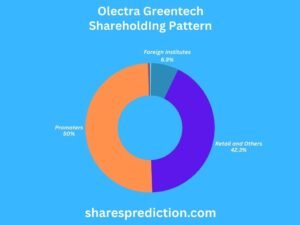

Olectra Greentech Shareholding Pattern

| Investor Type | Percentage of Shares (%) |

|---|---|

| Promoters | 50.02 |

| Retail and Others | 42.27 |

| Foreign Institutes | 6.90 |

| Other Domestic Institutions | 0.53 |

| Mutual Funds | 0.28 |

This table indicates a mix of institutional and retail investors, with the promoters holding a significant stake. This diverse ownership structure provides stability and long-term support for the company’s growth strategies.

Conclusion

Olectra Greentech share price targets for 2026, 2030, 2035, 2040, 2045, and 2050 are consistent with the company’s strong growth prospects and favourable industry outlook. Olectra Greentech Limited’s strong financial performance, strategic expansion, and leadership in the electric vehicle market position the company for significant growth in the coming decades. Investors can be optimistic about the company’s future, given that projected share price targets indicate significant value appreciation. Olectra’s commitment to innovation, sustainability, and market expansion ensures that it remains a key player in the e-mobility sector, with strong long-term prospects.

FAQs About Olectra Greentech

1. Who is the Chairman of Olectra Greentech Ltd.?

The Chairman of Olectra Greentech Ltd. is Mr. K.V. Pradeep.

2. Who is the CEO of Olectra Greentech Ltd.?

The CEO of Olectra Greentech Ltd. is Mr. N. Nagasatyam.

3. When was Olectra Greentech Ltd. established?

Olectra Greentech Ltd. was established in 2000.

4. Where is Olectra Greentech Ltd. headquartered?

Olectra Greentech Ltd. is headquartered in Hyderabad, India.

5. What are the main products offered by Olectra Greentech Ltd.?

Olectra Greentech Ltd. primarily manufactures electric buses and is expanding its product line to include electric trucks and tippers.

6. What are some of Olectra Greentech Ltd.’s contributions to sustainability?

Olectra Greentech Ltd. focuses on reducing carbon emissions through its electric vehicles, promoting eco-friendly transportation solutions.

7. What certifications does Olectra Greentech Ltd. hold?

Olectra Greentech Ltd. is ISO-9001:2008 certified and its R&D Centre is recognized by the Department of Scientific and Industrial Research, Government of India.

8. What awards and recognitions has Olectra Greentech Ltd. received?

Olectra Greentech Ltd. has received several awards for its innovation and leadership in the electric vehicle industry, including recognition for its contributions to sustainable transportation.

9. What is the vision and mission of Olectra Greentech Ltd.?

Olectra Greentech Ltd.’s vision is to be a major player in the electric vehicles segment, and its mission is to provide safe, comfortable, and environmentally friendly commuting experiences.

10. What are some key milestones in Olectra Greentech Ltd.’s history?

Key milestones include being the first company in India to manufacture electric buses, expanding its product line to electric trucks and tippers, and achieving significant market presence in the e-mobility sector.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.