Punjab National Bank (PNB) is one of India’s largest and oldest nationalized banks, established in 1894. Headquartered in New Delhi, PNB offers a wide range of banking and financial services including retail banking, corporate banking, and international banking.This analysis examines PNB’s long-term share price potential for the years 2026, 2030, 2035, 2040, 2045, and 2050, predicated on its financial performance, balance sheet robustness, and long-term growth prospects.

It serves millions of customers through an extensive network of branches and ATMs across India and has a significant presence internationally. PNB has played a crucial role in the Indian banking sector, contributing to economic growth and financial inclusion. Despite facing challenges like the high-profile Nirav Modi fraud case, PNB has been working on strengthening its systems, improving asset quality, and enhancing customer service to maintain its position as a leading bank in the country.

PNB Share Price Current Market Performance

Financial table for PNB

| Metric | Value |

|---|---|

| Market Capitalization | ₹1,52,109 Cr (As of Jan 2026) |

| P/E Ratio (TTM) | 8.89 |

| Industry P/E | 14.40 |

| P/B Ratio | 1.14 |

| ROE | 12.72% |

| EPS (TTM) | 14.89 |

| Dividend Yield | 2.19% |

| Book Value | ₹116.54 |

| Official Website | PNB |

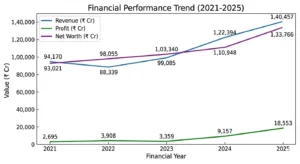

Financial Performance Trend

| Financial Year | Revenue (₹ Cr) | Profit (₹ Cr) | Net Worth (₹ Cr) |

|---|---|---|---|

| 2021 | 94,170 | 2,695 | 93,021 |

| 2022 | 88,339 | 3,908 | 98,055 |

| 2023 | 99,085 | 3,359 | 1,03,340 |

| 2024 | 1,22,394 | 9,157 | 1,10,948 |

| 2025 | 1,40,457 | 18,553 | 1,33,766 |

A sharp rise in profit and net worth from FY2024 onward signals a structural turnaround rather than a temporary recovery.

PNB Share Price Target 2026

The share price of Punjab National Bank (PNB) could range between ₹143 – ₹351 by the end of 2026. These estimates are based on market trends, financial performance, and other influencing factors in the banking sector.

PNB Share Price Target 2030

Analysts forecast that the share price of Punjab National Bank (PNB) could range between ₹384.85 – ₹440.26 by the end of 2030. These forecasts consider the bank’s historical performance, market trends, and strategic initiatives, but are subject to change based on evolving economic conditions and market dynamics.

PNB Share Price Target 2035

Analysts project that the share price of Punjab National Bank (PNB) could range between ₹645.89 – ₹785.27 by 2035. These estimates consider the bank’s growth potential, historical performance, and broader market trends. The optimistic projections are based on the bank’s strategic initiatives and improving financial health.

PNB Share Price Target 2040

By 2040, analysts project that the share price of Punjab National Bank (PNB) could range from ₹1,550.36 to ₹1,645.96. These projections are based on a comprehensive analysis of the bank’s historical performance, growth strategies, and market conditions. The optimistic targets take into account PNB’s efforts to enhance its financial health and expand its services.

PNB Share Price Target 2045

By 2045, PNB’s Share Price is expected to reach ₹2345 to ₹3456.90. Such projections often depend on various factors including macroeconomic conditions, industry trends, company performance, and market sentiment closer to the target year.

PNB Share Price Target 2050

By 2050, PNB’s Share Price is expected to reach ₹4,500 to ₹8,000, providing efficient banking services, fostering economic growth, and contributing to the development of the nation’s financial infrastructure. PNB aims to serve its customers with integrity, professionalism, and innovation, while ensuring sustainable profitability and shareholder value.

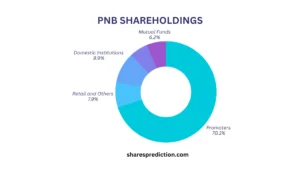

Investor Types and Shareholding Ratios

| Investor Category | Holding (%) |

|---|---|

| Government of India | 70.08% |

| Other Domestic Institutions | 9.88% |

| Mutual Funds | 6.21% |

| Foreign Institutions | 5.94% |

| Retail & Others | 7.90% |

High government ownership provides stability, while increasing institutional participation reflects growing confidence in PNB’s financial recovery.

Conclusion

In conclusion, Punjab National Bank (PNB) stands as a stalwart in India’s banking sector, leveraging its rich heritage and extensive network to provide essential financial services across the nation. Despite navigating challenges such as the infamous Nirav Modi fraud case, PNB remains committed to fortifying its operational frameworks, enhancing asset quality, and enriching customer experiences. Looking ahead, the projected share price targets reflect optimism in PNB’s strategic direction, driven by anticipated growth in revenue and profitability. As PNB continues to evolve, its steadfast focus on financial inclusion and sustainable profitability positions it well for sustained success in the dynamic landscape of Indian banking.

FAQs

1.Where was PNB originally founded?

Punjab National Bank was established on May 19, 1894, in Lahore, which was then part of undivided India (now in Pakistan).

2. Who was the founder of PNB?

PNB was founded by Lala Lajpat Rai along with other leaders such as Lala Harkishen Lal and Sardar Dyal Singh Majithia.

3. Where is the headquarters of PNB located?

The headquarters of PNB is located in New Delhi, India.

4.How many branches and ATMs does PNB have?

PNB operates a vast network of over 7,000 branches and more than 9,900 ATMs across India, serving millions of customers nationwide.

5. Does PNB have an international presence?

Yes, PNB has overseas branches in locations such as Hong Kong, Dubai, Kabul, and a representative office in Shanghai, catering to global customers and businesses.

6. What technological initiatives has PNB introduced?

PNB has embraced technology with offerings like internet banking, mobile banking apps, digital wallets, and biometric authentication to enhance customer convenience and security.

7. Has PNB received any awards or recognitions?

Yes, PNB has been honored with awards for excellence in retail banking, corporate governance, financial inclusion, and customer service, among others.

8. How does PNB contribute to environmental sustainability?

PNB implements green banking initiatives to reduce its carbon footprint, such as promoting paperless transactions and energy-efficient practices in its operations.

9. What are PNB’s initiatives for promoting financial literacy?

PNB conducts financial literacy programs and workshops to educate customers and communities on financial planning, savings, and investments, empowering them with essential financial knowledge.

10. What is PNB’s role in promoting sports?

PNB supports sports by sponsoring various sports events and nurturing young athletes through initiatives like the PNB Hockey Academy.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analyses and insights can help you make informed investment decisions.