Reliance Power, a subsidiary of the Reliance Group, has established itself as a significant player in the Indian power sector. As an investor, understanding the future potential of Reliance Power’s share price is crucial for making informed decisions. This blog provides comprehensive predictions for Reliance Power share price target for 2026, 2030, 2035, 2040, 2045, and 2050 based on rigorous analysis and reliable data.

Current Market Analysis (February 2026)

As of February 2026, Reliance Power trades as a small-to-mid cap power stock that has shown renewed interest among retail and speculative investors. After a long period of operational stress and debt-related challenges, the company has started stabilising its balance sheet and realigning its strategy towards asset optimisation and renewable energy participation.

The stock remains highly volatile but attractive for long-term investors who are willing to take calculated risk in turnaround stories within the Indian power sector.

Financial Table

| Company Name | Reliance Power Limited |

|---|---|

| Market Cap | ₹11,419 Cr (As of February 2026) |

| P/E Ratio | 40.60 |

| Industry P/E | 23.67 |

| Debt to Equity Ratio | 0.92 |

| ROE | 1.81% |

| Dividend Yield | 0.00% |

| 52 Week High | INR 76.49 |

| 52 Week Low | INR 25.92 |

| Official Website | Reliance Power |

As of February 2026, Reliance Power trades as a small-to-mid cap power stock that has shown renewed interest among retail and speculative investors. After a long period of operational stress and debt-related challenges, the company has started stabilising its balance sheet and realigning its strategy towards asset optimisation and renewable energy participation.

The stock remains highly volatile but attractive for long-term investors who are willing to take calculated risk in turnaround stories within the Indian power sector.

Past 5 Years Growth Analysis

To understand the potential future performance, looking at Reliance Power’s growth over the past five years is essential.

| Year | Revenue Growth | Profit Growth | Market Share Growth |

|---|---|---|---|

| 2021 | 8,389 | 427 | 13,814 |

| 2022 | 7,687 | -923 | 13,385 |

| 2023 | 7,854 | -343 | 13,287 |

| 2024 | 8,260 | -2,242 | 11,614 |

| 2025 | 8,257 | 2,947 | 16,337 |

The data clearly shows that Reliance Power went through a prolonged loss phase until 2024, followed by a notable turnaround in 2025, where profitability improved significantly. This recovery phase becomes a critical base for projecting growth from 2026 onwards.

Methodology

Technical Analysis

Our price predictions utilize technical indicators such as the Relative Strength Index (RSI), Moving Averages (MA), and Moving Average Convergence Divergence (MACD) to understand historical price movements and predict future trends.

Fundamental Analysis

We consider fundamental factors such as revenue growth, market conditions, and industry trends. This includes analyzing the company’s financial statements, debt levels, and market position.

Expert Opinions

Our analysis is supplemented by insights from financial analysts and market experts who provide forecasts and their rationale behind these predictions.

Reliance Power Share Price Target 2026

-

Target 1: ₹40.50

-

Target 2: ₹45.50

-

Target 3: ₹50.00

Supporting Analysis

From a 2026 perspective, Reliance Power’s near-term growth depends largely on operational efficiency, financial discipline, and gradual improvement in earnings quality. Technical indicators suggest consolidation with moderate upside, assuming stable power demand and no major financial shocks.

Key Factors Influencing 2026 Price

- Growing electricity demand in India

- Improved cash flows after restructuring

- Increasing interest in renewable power assets

- Supportive government policies for energy sector

Reliance Power Share Price Target 2030

- Target 1: INR 70.15

- Target 2: INR 72.50

- Target 3: INR 75.00

Supporting Analysis

Several factors, including advancements in renewable energy, economic conditions, and competitive landscape, influence the share price target for 2030. Technical indicators and fundamental analysis suggest a potential rise to INR 70.15 – INR 75.00 by 2030.

Key Factors Influencing 2030 Price

- Advancements in Renewable Energy: Continued investment in renewable energy projects.

- Economic Conditions: Overall economic growth in India and the global market.

- Competitive Landscape: Reliance Power’s ability to maintain a competitive edge in the power sector.

Reliance Power Share Price Target 2035

- Target 1: INR 95.00

- Target 2: INR 98.50

- Target 3: INR 102.00

Supporting Analysis

By 2035, Reliance Power is expected to capitalize on technological advancements and favorable policy changes. This can push the share price from INR 95.00 to INR 102.00.

Key Factors Influencing 2035 Price

- Technological Advancements: Innovations in power generation and distribution.

- Policy Changes: Supportive government policies and subsidies.

- Market Dynamics: Changes in supply and demand dynamics in the power sector.

Reliance Power Share Price Target 2040

- Target 1: INR 120.00

- Target 2: INR 125.00

- Target 3: INR 130.00

Supporting Analysis

Global energy demand and environmental regulations influence the expected share price range for 2040. Strategic moves by the company can further bolster this growth.

Key Factors Influencing 2040 Price

- Global Energy Demand: Increasing energy needs worldwide.

- Environmental Regulations: Stricter environmental regulations driving the shift to renewable energy.

- Strategic Moves: Company’s long-term strategic initiatives and partnerships.

Reliance Power Share Price Target 2045

- Target 1: INR 150.00

- Target 2: INR 155.00

- Target 3: INR 160.00

Supporting Analysis

By 2045, Reliance Power is expected to continue its growth trajectory, with share prices potentially reaching between INR 150.00 and INR 160.00.

Key Factors Influencing 2045 Price

- Industry Shifts: Major shifts in the power industry towards sustainable energy sources.

- Geopolitical Factors: Stability and policies affecting the energy sector.

- Innovation in Energy Technologies: Advances in energy storage and efficiency.

Reliance Power Share Price Target 2050

- Target 1: INR 180.00

- Target 2: INR 185.00

- Target 3: INR 190.00

Supporting Analysis

Overall economic trends, sustainability efforts, and strategic direction influence the long-term target for 2050. Share prices could range from INR 180.00 to INR 190.00.

Key Factors Influencing 2050 Price

- Long-term Economic Trends: Global economic growth and market stability.

- Sustainability Efforts: Increased focus on sustainable and renewable energy.

- Strategic Direction: The company’s vision and execution of long-term strategies.

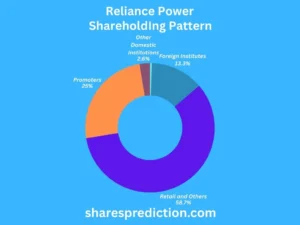

Investor Types and Shareholding Structure

To provide clarity on the ownership of Reliance Power, here is a breakdown of the different types of investors and their shareholding ratios:

| Investor Type | Shareholding Ratio (%) |

|---|---|

| Promoters | 24.98% |

| Foreign Institutions | 13.25% |

| Mutual Funds | 0.46% |

| Retail Investors | 58.70% |

| Other Domestic Institutions | 2.60% |

The high retail holding indicates strong speculative interest, while relatively low institutional ownership suggests the stock is still considered risky by large funds.

Risks and Challenges

Market Risks

- Volatility: The power sector can be highly volatile, influenced by global oil prices and geopolitical events.

- Economic Downturns: Economic slowdowns can affect energy demand and profitability.

Company-Specific Risks

- Debt Management: High debt levels can impact the company’s financial stability.

- Operational Inefficiencies: Inefficiencies in operations can lead to increased costs and reduced profitability.

- Project Delays: Delays in project execution can affect growth projections and financial performance.

Conclusion

From a 2026 perspective, Reliance Power represents a classic turnaround stock. While the company still carries significant financial risk, its improving profitability, strategic restructuring, and alignment with India’s renewable energy goals provide a realistic foundation for long-term growth.

Investors with a high-risk appetite and long-term horizon may find value, but conservative investors should remain cautious.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analyses and insights can help you make informed investment decisions.

FAQs

-

Who is the chairman of Reliance Power?

- The current chairman of Reliance Power is Anil Dhirubhai Ambani, who is also the founder of the Reliance Group.

-

Who is the CEO of Reliance Power?

- As of the latest information available, the CEO of Reliance Power is Mr. K. Raja Gopal.

-

What is the primary business of Reliance Power?

- Reliance Power is primarily engaged in the development, construction, and operation of power projects in domestic and international markets.

-

What are the major power projects undertaken by Reliance Power?

- Some of the major power projects include the Sasan Ultra Mega Power Project, the Rosa Power Plant, and the Butibori Power Project.

-

Where is the headquarters of Reliance Power located?

- The headquarters of Reliance Power is located in Navi Mumbai, Maharashtra, India.

-

When was Reliance Power founded?

- Reliance Power was incorporated on January 17, 1995.

-

What is the mission of Reliance Power?

- Reliance Power aims to provide reliable, clean, and affordable power, contributing to the socio-economic development of the regions it operates in.

-

How does Reliance Power contribute to renewable energy?

- Reliance Power has several renewable energy projects, including solar and wind power plants, as part of its commitment to sustainable energy solutions.

-

What are some CSR initiatives by Reliance Power?

- Reliance Power engages in various corporate social responsibility (CSR) activities, focusing on education, healthcare, and rural development.

-

How can I contact Reliance Power for customer service?

- Customers can contact Reliance Power through their official website or customer service helpline available on the website.

Comments and Discussion

User Engagement

We value your feedback! Leave your comments below and share your thoughts on RVNL’s future.

Community Interaction

Join the discussion and interact with other investors to exchange ideas and insights.