Samvardhana Motherson share price target has become a hot topic among investors these days as Samvardhana Motherson is a major player in the global automotive components industry, with a significant presence across various sectors. The company’s financial performance and strategic growth initiatives have attracted the attention of long-term investors. In this article, we will analyze the Samvardhana Motherson share price target for 2026, 2030, 2035, 2040, 2045, and 2050 based on its current financial metrics and market trends.

Company Overview

Samvardhana Motherson primarily focuses on supplying a range of automotive components, including wiring harnesses, mirrors, and polymer components, to global automakers. Over the years, the company has expanded its operations through acquisitions and strategic partnerships, establishing itself as a leading global player.

Financial Overview

Current Share Price

Revenue and Profit Growth

Samvardhana Motherson has demonstrated steady growth in both revenue and profit over recent years. Below is a summary of its financial performance:

| Year | Revenue (₹ Cr) | Net Profit (₹ Cr) |

|---|---|---|

| 2020 | 60,954 | 934 |

| 2021 | 57,599 | 1,243 |

| 2022 | 64,032 | 817 |

| 2023 | 78,958 | 1,670 |

| 2024 | 98,879 | 3,020 |

| 2025 | 1,14,220 | 4,146 |

Samvardhana Motherson has shown a strong financial turnaround over the last few years, with consistent growth in both revenue and profitability.

The company’s revenue increased from ₹60,954 Cr in 2020 to ₹1,14,220 Cr in 2025, reflecting robust business expansion and rising global demand. Net profit also improved significantly from ₹934 Cr in 2020 to ₹4,146 Cr in 2025, indicating better operational efficiency and margin improvement.

Despite a temporary decline in revenue during 2021, the company made a strong recovery from 2022 onwards. The sharp rise in profit in 2024 and 2025 highlights Motherson’s ability to scale operations, control costs, and benefit from higher value-added products in the automotive supply chain.

Fundamental Metrics (As of February 2026)

The following table provides key financial metrics for Samvardhana Motherson, reflecting its strong market position and potential for future growth:

| Metric | Value |

|---|---|

| Market Cap | ₹1,36,627 Cr |

| P/E Ratio (TTM) | 37.52 |

| P/B Ratio | 3.68 |

| ROE | 8.80% |

| EPS (TTM) | ₹3.45 |

| Dividend Yield | 0.44% |

| Book Value | ₹35.18 |

| Debt to Equity | 0.53 |

| 52-Week High | ₹135.83 |

| 52-Week Low | ₹71.50 |

| Website | Samvardhana Motherson |

As of February 2026, Samvardhana Motherson has a market capitalization of ₹1,36,627 Cr, placing it firmly in the large-cap segment. The company is currently trading at a P/E ratio of 37.52, which indicates that investors are pricing in strong future growth prospects.

With a P/B ratio of 3.68 and a book value of ₹35.18, the stock reflects healthy asset backing. The return on equity (ROE) of 8.80% suggests stable capital efficiency, while the debt-to-equity ratio of 0.53 indicates a balanced capital structure with manageable leverage.

An EPS of ₹3.45 and a dividend yield of 0.44% show that the company is generating consistent earnings while also rewarding shareholders, making it attractive for both growth and long-term investors.

Factors Influencing Samvardhana Motherson Share Price Target

Automotive Industry Growth

The global automotive industry continues to grow, driven by increasing demand for electric vehicles (EVs) and autonomous driving technologies. Samvardhana Motherson, with its diverse product offerings, is well-positioned to capitalize on this trend.

Operational Efficiency

The company’s focus on operational efficiency, cost control, and innovation has allowed it to maintain profitability even in challenging market conditions. Its ability to continue delivering strong financial results will play a key role in future share price appreciation.

Global Expansion and Acquisitions

Samvardhana Motherson has pursued an aggressive expansion strategy, making several acquisitions and establishing joint ventures to expand its market presence. This strategy is expected to further enhance its growth prospects and positively impact its share price.

Samvardhana Motherson Share Price Target 2026

By 2026, the Samvardhana Motherson share price target is expected to be in the range of ₹250 to ₹270. This projection is based on the company’s strong revenue growth from ₹60,954 Cr in 2020 to ₹1,14,220 Cr in 2025, along with a significant improvement in net profit.

The growing demand for automotive components, especially in electric vehicles, coupled with Motherson’s expanding global footprint and improving operational margins, is likely to support steady share price appreciation in 2026. The company’s focus on strategic acquisitions and product diversification further strengthens its medium-term growth outlook.

Samvardhana Motherson Share Price Target 2030

Looking ahead to 2030, the Samvardhana Motherson share price target is expected to reach between ₹520 and ₹550. As the company strengthens its global presence and continues to expand its product offerings, it is likely to see steady appreciation in its share price over the next decade.

Samvardhana Motherson Share Price Target 2035

By 2035, the Samvardhana Motherson share price target is anticipated to be in the range of ₹900 to ₹1050. The company’s continued growth in revenue and profitability, along with its strategic focus on the automotive and EV markets, will drive long-term share price growth.

Samvardhana Motherson Share Price Target 2040

In 2040, the Samvardhana Motherson share price target could rise to between ₹1500 and ₹1550. The company’s ability to maintain its leadership in the global automotive components industry will be key to achieving this growth.

Samvardhana Motherson Share Price Target 2045

By 2045, the Samvardhana Motherson share price target is expected to be in the range of ₹2200 to ₹2650. The company’s strong financial performance, driven by its global expansion and operational excellence, will continue to fuel share price appreciation.

Samvardhana Motherson Share Price Target 2050

Looking towards 2050, the Samvardhana Motherson share price target is projected to reach ₹3700 to ₹3750. With its dominant market position and ability to adapt to changing industry trends, the company’s long-term growth prospects remain strong.

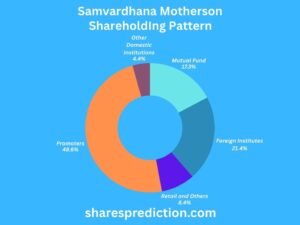

Shareholding Pattern

As of February 2026, the shareholding pattern of Samvardhana Motherson is as follows:

| Category | Percentage (%) |

|---|---|

| Promoters | 48.60% |

| Mutual Funds | 17.25% |

| Foreign Institutions | 21.35% |

| Retail and Others | 8.44% |

| Other Domestic Institutions | 4.36% |

As of February 2026, the shareholding pattern of Samvardhana Motherson shows strong promoter and institutional participation.

Promoters hold 48.60%, reflecting strong promoter confidence and long-term commitment to the business. Foreign Institutional Investors (FIIs) hold 21.35%, while Mutual Funds hold 17.25%, indicating high institutional trust in the company’s growth potential.

Retail investors and others hold 8.44%, and Other Domestic Institutions account for 4.36%. The healthy mix of promoter and institutional ownership provides stability and signals strong market confidence.

Conclusion

The Samvardhana Motherson share price target for 2026, 2030, 2035, 2040, 2045, and 2050 suggests moderate to strong growth over the coming decades. With its leadership in the global automotive components industry, solid financial performance, and strategic expansion initiatives, Samvardhana Motherson presents a compelling investment opportunity for long-term investors.

FAQs About Samvardhana Motherson

Q1. What does Samvardhana Motherson specialize in?

Samvardhana Motherson specializes in manufacturing and supplying automotive components, including wiring harnesses, mirrors, and polymer parts.

Q2. Is Samvardhana Motherson a good long-term investment?

Yes, Samvardhana Motherson can be considered a strong long-term investment, given its consistent growth in revenue, global expansion strategy, and leadership in the automotive industry.

Q3. What are the company’s key challenges?

Key challenges for Samvardhana Motherson include rising competition in the automotive sector, supply chain disruptions, and adapting to evolving automotive technologies such as electric and autonomous vehicles.

Q4. Does Samvardhana Motherson offer dividends?

Yes, Samvardhana Motherson offers a dividend yield of 0.42% as of 2024.

Q5. What is the company’s market capitalization?

As of 2024, the market capitalization of Samvardhana Motherson stands at ₹1,27,871 Cr.

Q6. How has the company’s revenue grown in recent years?

The company’s revenue grew from ₹60,954 Cr in 2020 to ₹98,879 Cr in 2024, showcasing a strong growth trajectory.

Q7. What is the role of promoters in the company?

The promoters hold 60.36% of the company’s shares, indicating their significant influence and long-term commitment to the company’s growth.

Q8. What are the key factors influencing the company’s share price target?

Key factors include global automotive industry growth, the company’s operational efficiency, and its strategic expansion through acquisitions.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.