Satluj Jal Vidyut Nigam (SJVN) is a significant player in India’s hydroelectric power sector. Investors looking for sustainable growth need to understand the long-term share price projections for SJVN. This blog provides a detailed analysis of SJVN share price target for 2026, 2030, 2035, 2040, 2045, and 2050 based on current market trends, industry dynamics, and expert insights.

Company Background and Current Status

History and Background

Established in 1988, SJVN is a joint venture between the Government of India and the Government of Himachal Pradesh. The company focuses on hydroelectric power projects and has diversified into other renewable energy sources like wind and solar power.

Past 5 Years Growth Analysis

| Fiscal Year | Revenue Growth | Profit Growth | Market Share Growth |

|---|---|---|---|

| 2021 | 3,223 | 1,646 | 12,791 |

| 2022 | 2,635 | 990 | 13,170 |

| 2023 | 3,283 | 1,359 | 13,860 |

| 2024 | 2,877 | 911 | 14,071 |

| 2025 | 3,377 | 818 | 14,189 |

SJVN has demonstrated consistent revenue and market share growth over the last five years. Despite short-term profit fluctuations, the company has steadily expanded its operational footprint, reflecting strong fundamentals and long-term scalability.

Current Operations and Major Projects

SJVN currently operates several large-scale hydroelectric plants, with the Nathpa Jhakri Hydro Power Station being its flagship project. In addition, the company is actively developing solar parks and wind power projects across multiple Indian states and neighboring countries like Nepal and Bhutan, strengthening its renewable energy portfolio.

Financial Performance of SJVN

| Financial Metric | Value |

|---|---|

| Market Cap | ₹31,085 (As of February 2026) |

| P/E Ratio (TTM) | 49.13 |

| Industry P/E | 23.67 |

| Debt to Equity Ratio | 2.03 |

| ROE | 3.82% |

| EPS (TTM) | 1.61 |

| Dividend Yield | 1.85% |

| Book Value | 37.12 |

| Face Value | 10 |

| 52 Week High | ₹107.50 |

| 52 Week Low | ₹68.13 |

| Official Website | SJVN Ltd. |

SJVN trades at a premium valuation compared to the industry average, indicating strong investor expectations for future growth. However, moderate ROE and high debt levels suggest that profitability improvement will be key for sustained share price appreciation.

Current Market Position

The stock has shown resilience and growth, making it a reliable investment in the renewable energy sector.

Industry Overview

Current State of the Energy Sector

The global energy sector is undergoing a massive shift toward clean and renewable sources. Hydropower remains one of the most reliable renewable energy options, offering long-term sustainability and low operational costs.

Emerging Trends and Future Prospects

Technological advancements in energy storage, grid management, and renewable infrastructure are expected to accelerate sector growth. India’s aggressive renewable capacity targets further strengthen long-term demand.

Regulatory Environment

The Indian government aims to achieve 450 GW of renewable energy capacity by 2030, which directly benefits public sector companies like SJVN through policy support, subsidies, and long-term power purchase agreements.

Factors Influencing SJVN’s Share Price

Internal Factors

- Management Strategies: SJVN’s focus on expanding its renewable energy portfolio and improving operational efficiency is key to its growth.

- Financial Health: The company maintains a healthy balance sheet with significant cash reserves and low debt levels.

- Ongoing Projects: Completion of major projects like the Arun-3 Hydropower Project in Nepal will enhance SJVN’s capacity and revenue.

External Factors

- Market Conditions: Global economic trends and energy demand influence SJVN’s market performance.

- Technological Advancements: Innovations in renewable energy technologies can improve efficiency and reduce costs.

- Regulatory Policies: Supportive government policies are essential for SJVN’s growth.

- Competitive Landscape: The presence of other major players in the renewable energy sector impacts SJVN’s market share.

SJVN Share Price Target 2026

Short-term Growth Drivers

-

Timely completion of ongoing hydroelectric and renewable projects

-

Rapid expansion in solar and wind energy capacity across multiple states

-

Continued government incentives and policy support for clean energy

Projections

Based on current market trends and operational developments, analysts estimate that the SJVN share price target for 2026 could range between ₹100 and ₹250. This projection is supported by the company’s strong project pipeline, increasing renewable energy contribution, and a favorable regulatory environment that enhances long-term growth visibility.

conditions.

SJVN Share Price Target 2030

Mid-term Strategic Initiatives

- Scaling renewable energy capacity

- Strategic partnerships

- Focus on sustainability and ESG metrics

Projections

Projections indicate a share price target of ₹320 by 2030, reflecting significant growth in capacity and revenue.

SJVN Share Price Target 2035

Long-term Growth Potential

- Continued expansion in renewable energy

- Diversification into new markets

- Achieving sustainability milestones

Projections

A share price target of ₹450 by 2035 is expected, driven by long-term strategic initiatives and market trends.

SJVN Share Price Target 2040

Evolution of the Energy Sector

- Technological advancements

- Strategic role in India’s energy transition

Projections

A share price target of ₹600 by 2040, considering technological and market advancements.

SJVN Share Price Target 2045

Long-term Sustainability Goals

- Achieving net-zero carbon emissions

- Leading innovations in renewable energy

Projections

A share price target of ₹750 by 2045, driven by long-term sustainability goals and market leadership.

SJVN Share Price Target 2050

Vision for the Future

- SJVN as a global leader in renewable energy

- Transformative projects and innovations

Projections

A share price target of ₹900 by 2050, based on long-term growth and strategic initiatives.

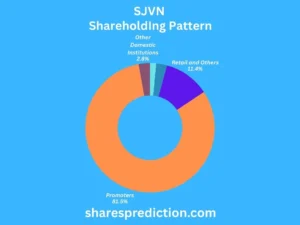

Shareholding Pattern

Investor Types and Ratios

| Investor Type | Shareholding (%) |

|---|---|

| Promoters | 81.85 |

| Foreign Institutions | 2.70 |

| Domestic Institutions | 2.84 |

| Mutual Funds | 1.57 |

| Retail and Others | 11.47 |

High promoter holding reflects strong government backing and long-term strategic stability.

Risk Factors and Challenges

Business Model Risks

- Dependence on regulatory approvals

- Project execution risks

Economic and Market Risks

- Fluctuations in energy prices

- Global economic downturns

Regulatory and Environmental Challenges

- Compliance with environmental regulations

- Managing environmental impacts

Mitigation Strategies

- Diversification of energy portfolio

- Robust risk management practices

Conclusion

The SJVN share price target 2026, 2030, 2035, 2045, 2050 indicates strong long-term growth potential, supported by renewable energy expansion, government policy support, and strategic diversification. While short-term volatility may persist, SJVN remains a fundamentally solid stock for investors seeking exposure to India’s clean energy future.

Additional Resources

Frequently Asked Questions (FAQs) about SJVN

-

Who is the Chairman and Managing Director of SJVN?

- The current Chairman and Managing Director of SJVN is Nand Lal Sharma.

-

What is the primary business of SJVN?

- SJVN is primarily engaged in the generation of electricity through hydroelectric power projects. The company has also diversified into wind and solar power generation.

-

When was SJVN established?

- SJVN was established in 1988 as a joint venture between the Government of India and the Government of Himachal Pradesh.

-

Where is the headquarters of SJVN located?

- The headquarters of SJVN is located in Shimla, Himachal Pradesh, India.

-

What are some major projects undertaken by SJVN?

- Some of the major projects undertaken by SJVN include the Nathpa Jhakri Hydro Power Station and the Arun-3 Hydropower Project in Nepal.

-

What initiatives has SJVN taken towards renewable energy?

- SJVN has diversified into renewable energy sectors such as wind and solar power. The company has set up several wind and solar power projects across India to enhance its renewable energy capacity.

-

What is the vision of SJVN for the future?

- SJVN aims to become a global player in the energy sector by expanding its capacity to 50,000 MW by 2040, with a significant focus on renewable energy sources.

-

How does SJVN contribute to social responsibility?

- SJVN undertakes various Corporate Social Responsibility (CSR) initiatives focused on education, healthcare, infrastructure development, and environmental sustainability in the regions where it operates.

-

What are the recent developments in SJVN’s project portfolio?

- Recent developments include the commissioning of new solar and wind power projects, ongoing construction of the Arun-3 Hydropower Project, and plans for new hydroelectric projects in India and neighboring countries.

-

What awards and recognitions has SJVN received?

- SJVN has received numerous awards for its operational excellence, environmental sustainability initiatives, and corporate governance practices. Notable awards include the CBIP Award for Best Performing Utility in Hydropower and the SCOPE Excellence Award.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analyses and insights can help you make informed investment decisions.