Suzlon Energy Ltd., a prominent name in the renewable energy sector, particularly in wind energy, has been a subject of interest for investors and market analysts. With over 25 years in the business and a significant market share in India and operations in over 18 countries, Suzlon’s stock presents a fascinating case for analysis. This blog post delves into the predicted suzlon share price targets from 2026 to 2050, evaluating its strengths, weaknesses, and market position.

Overview

Financial table for Suzlon Energy Limited

| Metric | Value |

|---|---|

| Market Cap | ₹71,533 Cr (As of Dec 2025) |

| P/E Ratio (TTM) | 22.57 |

| P/B Ratio | 9.13 |

| Industry P/E | 48.13 |

| Debt to Equity Ratio | 0.05 |

| ROE | 40.37% |

| EPS (TTM) | 2.33 |

| Dividend Yield | 0.00% |

| Book Value | 5.76 |

| Face Value | 2 |

| Official Website | Suzlon Energy |

Current Market Position

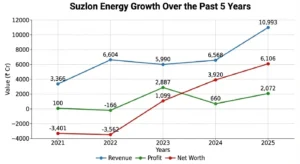

Suzlon Energy Growth Over the Past 5 Years

| Year | Revenue (₹ Cr) | Profit (₹ Cr) | Net Worth (₹ Cr) |

|---|---|---|---|

| 2021 | 3,366 | 100 | -3,401 |

| 2022 | 6,604 | -166 | -3,562 |

| 2023 | 5,990 | 2,887 | 1,099 |

| 2024 | 6,568 | 660 | 3,920 |

| 2025 | 10,993 | 2,072 | 6,106 |

Analysis

-

Revenue momentum: Strong acceleration in 2025 after a consolidation phase in 2023–24.

-

Profit turnaround: Loss in 2022 followed by sharp profitability recovery from 2023 onward.

-

Balance-sheet repair: Net worth flipped from negative to positive in 2023 and strengthened consistently through 2025.

Suzlon Energy’s five-year financial trend highlights a decisive turnaround. Revenue crossed ₹10,000 Cr in 2025, profitability stabilized after earlier losses, and net worth improved sharply — strengthening the long-term investment thesis despite short-term stock volatility.

Suzlon Share Price Target 2026

For 2026, the target fluctuates from ₹80 to ₹85, averaging at ₹82.5. This growth is driven by the increasing demand for renewable energy, favorable government policies, and Suzlon’s commitment to innovation and technology.

Read detailed analysis: Suzlon Share Price Target 2026

Suzlon Share Price Target 2030

Looking further ahead, the 2030 target is set between ₹115 and ₹155, averaging at ₹135. This significant increase is due to the global demand for renewable energy, India’s renewable energy ambitions, and Suzlon’s potential to capitalize on these opportunities.

Read detailed analysis: Suzlon Share Price Target 2030

Suzlon Share Price Target 2035

By 2035, the share price target is expected to range from ₹200 to ₹260, averaging at ₹230. This growth is driven by Suzlon’s strong market position, diverse product offerings, and continuous innovation in the renewable energy sector.

Read detailed analysis: Suzlon Share Price Target 2035

Suzlon Share Price Target 2040

In 2040, the share price target is projected to be between ₹310 and ₹415, averaging at ₹363. This significant increase is due to the continued growth in the renewable energy sector, Suzlon’s strategic partnerships, and its commitment to sustainable energy solutions.

Read detailed analysis: Suzlon Share Price Target 2040

Suzlon Share Price Target 2045

By 2045, the share price target is expected to range from ₹460 to ₹610, averaging at ₹535. This growth is driven by Suzlon’s leadership in the renewable energy sector, its robust financial health, and the increasing global demand for sustainable energy solutions.

Read detailed analysis: Suzlon Share Price Target 2045

Suzlon Share Price Target 2050

In 2050, the share price target is projected to be between ₹600 and ₹780, averaging at ₹690. This significant increase is due to Suzlon’s continued growth, its strong market position, and the increasing global demand for renewable energy.

Read detailed analysis: Suzlon Share Price Target 2050

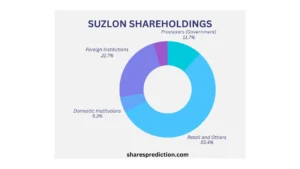

Investor Types and Shareholding Ratios

Here is the latest shareholding pattern for Suzlon Energy as of October 2025:

| Investor Type | Shareholding (%) |

|---|---|

| Retail & Others | 55.40% |

| Foreign Institutions | 22.70% |

| Promoters | 11.73% |

| Other Domestic Institutions | 5.25% |

| Mutual Funds | 4.91% |

This breakdown shows the significant portion held by retail investors and foreign institutions, with a notable share held by promoters.

Strengths, Weaknesses, and Market Position

Suzlon operates in a competitive landscape with key players like Vestas Wind Systems, Inox Wind, ReGen Powertech, and ENERCON. The company’s market position, diverse product offerings, and commitment to innovation and technology are its strengths. However, it faces challenges like high stock volatility, lack of dividend payments, and operational risks.

Financial Health and Growth Opportunities

Suzlon’s journey from 2012 to 2025 shows significant fluctuations in sales, operating profit, and net profit. The company has managed to reduce its debt significantly and improve profitability, indicating effective management strategies. The global demand for renewable energy and India’s renewable energy ambitions present lucrative growth opportunities for Suzlon.

Investment Considerations

Investors should be aware of the risks associated with intense competition, policy and regulatory uncertainties, and environmental and social issues. Keeping an eye on Suzlon’s financial performance, market dynamics, government policies, and technological advancements is crucial.

Conclusion

Suzlon’s stock is suitable for investors with a long-term perspective, comfortable with high-risk investments, and adept at navigating complex market dynamics. The company’s position in the renewable energy sector, combined with its potential for growth and inherent challenges, makes it an intriguing option for bold and visionary investors.

FAQs

-

Who is the Chairman of Suzlon Energy?

- Answer: Tulsi Tanti was the founder and chairman of Suzlon Energy. He played a crucial role in establishing Suzlon as a leading renewable energy company.

-

Who is the CEO of Suzlon Energy?

- Answer: As of the latest update, Ashwani Kumar is the CEO of Suzlon Energy. He brings extensive experience in the renewable energy sector to the company.

-

What does Suzlon Energy specialize in?

- Answer: Suzlon Energy specializes in the manufacturing and installation of wind turbines. They provide end-to-end solutions for wind power projects including design, engineering, procurement, construction, and maintenance.

-

When was Suzlon Energy founded?

- Answer: Suzlon Energy was founded in 1995 by Tulsi Tanti. The company started with a focus on providing sustainable energy solutions through wind power.

-

Where is the headquarters of Suzlon Energy located?

- Answer: The headquarters of Suzlon Energy is located in Pune, Maharashtra, India.

-

What are some major projects undertaken by Suzlon Energy?

- Answer: Suzlon Energy has undertaken several major wind power projects globally, including installations in the United States, Germany, China, and India. Some notable projects include the Dhule Wind Power Project in Maharashtra and the Jaisalmer Wind Park in Rajasthan.

-

What is Suzlon Energy’s contribution to renewable energy?

- Answer: Suzlon Energy has significantly contributed to the growth of wind energy in India and globally. They have installed over 18,800 MW of wind energy capacity across 18 countries, making them one of the largest wind turbine manufacturers in the world.

-

Does Suzlon Energy engage in any sustainability initiatives?

- Answer: Yes, Suzlon Energy is actively involved in sustainability initiatives. They focus on reducing carbon footprints, promoting clean energy, and implementing eco-friendly practices in their operations. They also engage in various community development programs.

-

How does Suzlon Energy ensure the reliability of its wind turbines?

- Answer: Suzlon Energy ensures the reliability of its wind turbines through rigorous quality control measures, continuous research and development, and by employing advanced technologies in their manufacturing processes. They also offer comprehensive maintenance services to ensure optimal performance of their wind installations.

-

What is the vision and mission of Suzlon Energy?

- Answer: Suzlon Energy’s vision is to be the most admired and responsible renewable energy company with a global footprint. Their mission is to provide sustainable, innovative, and reliable wind energy solutions to meet the growing energy needs of the world.

This analysis provides a comprehensive view of Suzlon Energy’s potential in the coming years, balancing its opportunities with the challenges it faces in the dynamic renewable energy market.

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analyses and insights can help you make informed investment decisions.