The Suzlon share price target 2030 is a significant factor for investors looking beyond short-term volatility and focused on India’s long-term renewable energy boom. Suzlon Energy Limited has emerged from a challenging period with a stronger financial sheet, increased profitability, and renewed execution velocity.

This article covers Suzlon’s estimated share price range for 2030, including with growth drivers, risks, and investment appropriateness.

Suzlon Share Price Target 2030

- Target Range: ₹115 – ₹155

- Average Expected Price: ~₹135

The 2030 projection reflects moderate but steady compounding from current levels, assuming continued profitability, controlled debt, and sustained demand for wind energy projects.

Financial Overview

| Metric | Value |

|---|---|

| Market Cap | ₹71,533 Cr (As of Dec 2025) |

| P/E Ratio (TTM) | 22.57 |

| P/B Ratio | 9.13 |

| Industry P/E | 48.13 |

| Debt to Equity Ratio | 0.05 |

| ROE | 40.37% |

| EPS (TTM) | 2.33 |

| Dividend Yield | 0.00% |

| Book Value | 5.76 |

| Face Value | 2 |

| Official Website | Suzlon Energy |

Current Market Position

Why Suzlon Share Price Target 2030 Could Grow

1. Long-Term Renewable Energy Expansion in India

India’s renewable energy program envisions large capacity expansions by 2030. Wind energy remains an important pillar alongside solar and hybrid projects. Suzlon’s existing footprint positions it well to gain from this structural development.

2. Improving Earnings Visibility

Compared to prior years, Suzlon currently has:

- Positive and rising net worth

- Strong EPS improvement

- Lower leverage and improved cash-flow discipline

If earnings growth persists over the decade, value stability improves — enabling a progressive re-rating.

3. Scale Benefits and Service Revenues

By 2030, a larger installed base can generate:

- Recurring operations & maintenance (O&M) income

- Better margin stability

- Higher lifetime value per turbine installed

These factors reduce reliance on only new project wins.

Suzlon – Projected Metrics for 2030

| Metric (2030) | Conservative | Base (Most Likely) | Bull Case |

|---|---|---|---|

| Revenue (₹ Cr) | 16,152 | 19,373 | 25,149 |

| Profit (₹ Cr) | 1,938 | 3,197 | 5,030 |

| Net Worth (₹ Cr) | 8,972 | 12,281 | 15,194 |

| Estimated EPS (₹) | 2.18 | 3.59 | 5.66 |

| Assumed P/E Multiple | 18× | 25× | 35× |

| Indicative Share Price (₹) | ~39 | ~90 | ~198 |

This scenario comparison demonstrates how Suzlon’s 2030 value relies on both profits growth and market re-rating.

While the conservative thesis predicts slower growth and restrained value, the bull case reflects strong execution, margin improvement, and a premium multiple. The base scenario represents a balanced outcome, assuming sustained renewable demand and conservative financial management.

Suzlon Share Price target 2030: Growth Drivers vs Risks

| Key Growth Drivers (2030) | Risks Investors Should Watch (2030) |

|---|---|

| Large-scale renewable capacity additions in India | Policy and auction uncertainty affecting project flow |

| Repowering of older wind turbines | Pricing pressure due to competition from global players |

| Growth in long-term service and maintenance contracts | Execution delays or cost overruns |

| Improved balance sheet enabling selective expansion | Cyclicality in capital expenditure by power producers |

| Potential participation in hybrid and storage-linked projects | Stock price volatility driven by retail participation |

Suzlon’s 2030 projection balances fundamental renewable-energy growth and

operational improvements against policy sensitivity and competitive challenges.

Is Suzlon a Good Investment for 2030?

Suzlon may suit:

- Investors with a long-term view (5+ years)

- Those wanting exposure to the renewable energy subject

- Investors comfortable with modest risk and volatility

It may not suit:

- Conservative investors wanting dependable dividends

- Short-term traders aiming for rapid momentum plays

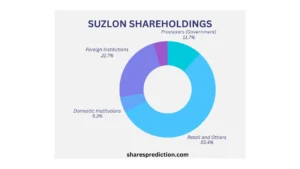

Shareholding pattern

| Investor Type | Shareholding (%) |

|---|---|

| Retail & Others | 55.40% |

| Foreign Institutions | 22.70% |

| Promoters | 11.73% |

| Other Domestic Institutions | 5.25% |

| Mutual Funds | 4.91% |

How this ownership mix can help growth

- Higher Foreign Institutional (FI) share (~22.7%) may provide discipline, longer-term capital, and better governance/oversight. Their presence aids Suzlon share price target 2030 discovery and reduces retail-driven volatility.

- Strong retail interest (~55%) may preserve liquidity and bolster momentum rallies, but also raises short-term volatility. With rising FI ownership, the net impact may be positive.

- Significant but not dominating promoter ownership (~11.7%) encourages operational improvements and strategic collaborations, while low skin might lead to activist or institutional influence.

- Implication for growth: A rising institutional basis (FIs and mutual funds) coupled with strengthening fundamentals will enable Suzlon access bigger project finance, better supplier credit, and smoother secondary-market behavior — all of which support sustainable execution and scaling of Suzlon share price target 2030.

Conclusion

The Suzlon share price target 2030 will primarily rely on how consistently the firm implements its growth strategies over the following years. Suzlon has already achieved tremendous progress by fixing its financial sheet, returning to profitability, and improving its net worth – greatly lessening the concerns that were weighed on the company.

Read the full long-term outlook here: Suzlon share price target 2026 to 2050

FAQs

Q1. What is the Suzlon share price target 2030?

Answer: Typical target scenarios range from ~₹40 (conservative) up to ₹198 (bull) depending on growth, margins and valuation; a balanced/base case suggests ₹80–100 as a reasonable mid-path depending on re-rating.

Q2. What assumptions would justify a ₹135 price for suzlon share price target 2030?

Answer: You need EPS growth to ₹4–5+ by 2030 and a market re-rating to P/E ≈ 30+, or stronger-than-expected revenue/margin expansion.

Q3. Which metric should investors watch most closely for the 2030 thesis?

Answer: Orderbook growth, recurring O&M margins, net worth trends, and EPS trajectory — these signal durable earnings and justify higher valuation multiples.

Q4. How realistic is the suzlon share price target 2030 bull scenario?

Answer: It’s achievable but requires sustained high revenue CAGR (≈18%), margin expansion, dominant market share wins, and a favourable macro/valuation environment — all simultaneous conditions.

Q5. Does the current shareholding support long-term growth?

Answer: Yes — rising institutional ownership helps stability and governance. However, retail dominance still makes the stock susceptible to sentiment swings.

Q6. Will Suzlon pay dividends by 2030?

Answer: If earnings and net worth continue improving, Suzlon may start shareholder returns by 2030, but early years post-turnaround typically favour reinvestment over dividends.

Q7. How sensitive are price outcomes to policy changes?

Answer: Highly sensitive. Auction frameworks, tariffs, and repowering incentives materially affect new project flow and margins.

Q8. Should long-term investors buy Suzlon now for 2030?

Answer: If you’re a long-term investor who believes in India’s renewable push and can tolerate volatility, accumulating on weakness with a staggered approach is reasonable.

Q9. What are the biggest execution risks to the 2030 targets?

Answer: Project delays, supply-chain bottlenecks, margin compression from competition, and any reversal in financing conditions.

Q10. How frequently should investors re-check the thesis?

Answer: Annually — or after any major earnings release, big order win/loss, or significant policy change. Re-evaluate if EPS or net worth deviates >20% from the scenario paths.