Syncom Formulations Share Price Target offers valuable insights into the company’s growth potential and market performance.Investors looking into Syncom Formulations should consider the potential share price targets for the upcoming decades. This article provides a detailed analysis of the projected share price targets for 2026 through 2050, using the company’s financial metrics and market position.

Company Overview

Syncom Formulations (India) Ltd. is a well-established pharmaceutical company known for its wide range of formulations and healthcare products. The company has made a significant impact in the industry with its quality offerings and a robust market presence. The Syncom Formulations Share Price Target is influenced by the company’s ability to maintain a steady growth trajectory and adapt to market trends.

Financial Overview

Current Share Price

Revenue and Profit Growth

Syncom Formulations has shown consistent growth in both revenue and net profit over the past few years. Below is a detailed overview of the company’s financial performance from 2016 to 2023:

| Year | Revenue (₹ Cr) | Net Profit (₹ Cr) |

|---|---|---|

| 2015 | 175 | 9.76 |

| 2016 | 187 | 10.36 |

| 2017 | 188 | 10.53 |

| 2022 | 232 | 19.79 |

| 2023 | 239 | 20.07 |

| 2024 | 277 | 25.31 |

| 2025 | 482 | 49.43 |

The sharp rise in revenue and net profit in FY25 marks a transformational phase for Syncom Formulations. After moderate growth in previous years, the company reported a significant jump in both topline and bottomline, indicating improved business scalability, better product mix, and stronger market penetration. This financial acceleration in FY25 forms the foundation for positive growth expectations in 2026 and beyond.

Fundamental Metrics (As of January 2026)

The following fundamental metrics reflect the financial health and market position of Syncom Formulations, which are critical for assessing the Syncom Formulations Share Price Target:

| Metric | Value |

|---|---|

| Market Cap | ₹1,274 Cr |

| P/E Ratio (TTM) | 20.22 |

| P/B Ratio | 3.37 |

| ROE | 16.66% |

| Debt to Equity | 0.00 |

| EPS (TTM) | ₹0.67 |

| Book Value | ₹4.03 |

| 52-Week High | ₹23.49 |

| 52-Week Low | ₹11.65 |

| Website | Syncom Formulations India Ltd |

The fundamental indicators as of 2026 highlight Syncom Formulations’ strengthening financial position. A healthy ROE reflects efficient capital utilization, while the absence of long-term debt indicates strong balance sheet stability. The company’s reasonable valuation multiples suggest that growth is being driven by fundamentals rather than speculation, making it structurally attractive for long-term investors.

Factors Influencing Syncom Formulations Share Price Target

Market Position and Product Range

Syncom Formulations has built a strong market position through its diverse product range in the pharmaceutical sector. The company’s focus on quality and innovation has helped it maintain a competitive edge, which positively impacts the Syncom Formulations Share Price Target. As the demand for healthcare products continues to rise, Syncom Formulations is well-positioned to capitalize on these opportunities.

Promoter Confidence

As of January 2026, promoters hold 50.57% of Syncom Formulations’ shares. This significant promoter holding reflects strong confidence in the company’s future prospects. High promoter confidence is often seen as a positive indicator, suggesting that those with the most knowledge about the company’s operations are optimistic about its future, thereby supporting a favorable Syncom Formulations Share Price Target.

Financial Stability and Growth

Syncom Formulations’ financial stability, highlighted by a low debt-to-equity ratio and consistent revenue growth, positions the company well for future share price appreciation. The company’s ability to maintain healthy profit margins while expanding its market share is expected to drive the Syncom Formulations Share Price Target upward over the coming years.

Syncom Formulations Share Price Target 2026

In 2026, Syncom Formulations’ share price trajectory is primarily supported by its strong FY25 financial performance, improving earnings visibility, and expanding pharmaceutical demand. The company’s revenue growth and sharp improvement in net profit have strengthened investor sentiment.

Based on current business fundamentals, operational stability, and industry outlook, the Syncom Formulations Share Price Target for 2026 is estimated in the range of ₹40 to ₹45, assuming continued execution of growth strategies and stable market conditions.

Syncom Formulations Share Price Target 2030

Looking forward to 2030, the Syncom Formulations Share Price Target is projected to reach between ₹65 and ₹70. The company’s sustained focus on product development and expanding its customer base will be critical in achieving this target. As Syncom Formulations continues to grow and adapt to industry trends, its share price is expected to follow a positive trajectory.

Syncom Formulations Share Price Target 2035

By 2035, Syncom Formulations is anticipated to reach a Syncom Formulations Share Price Target of ₹90 to ₹95. The company’s ongoing investments in R&D, coupled with its strong market presence, are expected to drive significant value creation for shareholders. This period is likely to see Syncom Formulations further solidify its position in the pharmaceutical sector, boosting its share price.

Syncom Formulations Share Price Target 2040

In 2040, the Syncom Formulations Share Price Target is expected to rise to approximately ₹123 to ₹129. Syncom Formulations’ ability to stay ahead of market trends and maintain financial discipline will be instrumental in reaching this target. The company’s strategic initiatives, including expansion into new product lines and markets, are likely to contribute to substantial share price growth.

Syncom Formulations Share Price Target 2045

By 2045, the Syncom Formulations Share Price Target is forecasted to be between ₹178 and ₹187. This projection is based on Syncom Formulations’ sustained market leadership, global expansion strategies, and consistent financial performance. As the company continues to execute its long-term vision, investors can expect significant returns, making Syncom Formulations a promising long-term investment.

Syncom Formulations Share Price Target 2050

Looking ahead to 2050, the Syncom Formulations Share Price Target is anticipated to be in the range of ₹242 to ₹268. Syncom Formulations’ long-term strategies, including innovation, market expansion, and brand strengthening, are expected to drive significant shareholder value. The company’s commitment to maintaining its market leadership and adapting to global trends will likely make it a standout investment over the next few decades.

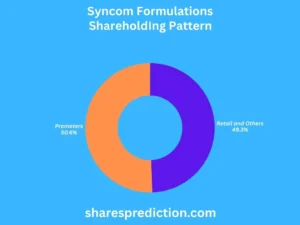

Shareholding Pattern

As of January 2026, Syncom Formulations’ shareholding pattern is as follows:

| Category | Percentage (%) |

|---|---|

| Promoters | 50.57% |

| Retail and Others | 49.34% |

| Foreign Institutions | 0.09% |

As of 2026, Syncom Formulations maintains a balanced shareholding structure, with promoters holding a slight majority stake while nearly half of the equity is owned by retail and institutional investors. This distribution reflects both internal confidence and strong participation from public investors, which improves liquidity and market depth for the stock.

Conclusion

The Syncom Formulations Share Price Target for 2026, 2030, 2035, 2040, 2045, and 2050 suggests a promising future for the company, driven by consistent financial growth and strategic expansion. Investors can expect significant value appreciation over the long term, making Syncom Formulations an attractive investment opportunity in the pharmaceutical sector. The company’s strong fundamentals, coupled with its strategic initiatives, are expected to deliver substantial returns for shareholders, positioning Syncom Formulations as a leading player in the industry.

FAQs About Syncom Formulations

Q1. What products does Syncom Formulations manufacture?

Syncom Formulations produces a wide range of pharmaceutical formulations and healthcare products.

Q2. Where is Syncom Formulations headquartered?

Syncom Formulations is headquartered in Mumbai, Maharashtra, India.

Q3. How does Syncom Formulations maintain product quality?

Syncom Formulations maintains product quality through stringent quality control measures and advanced manufacturing technology.

Q4. What are Syncom Formulations’ sustainability initiatives?

Syncom Formulations focuses on eco-friendly manufacturing practices and sustainability as part of its corporate responsibility.

Q5. How does Syncom Formulations contribute to the community?

Syncom Formulations engages in CSR activities, including healthcare and educational initiatives.

Q6. What is Syncom Formulations’ primary market?

Syncom Formulations primarily serves the Indian pharmaceutical market.

Q7. Who are the main competitors of Syncom Formulations?

Key competitors include Cipla, Sun Pharma, and Dr. Reddy’s Laboratories.

Q8. How does Syncom Formulations innovate its products?

Syncom Formulations invests in R&D to continuously innovate and improve its product offerings.

Q9. What is Syncom Formulations’ approach to customer satisfaction?

Syncom Formulations focuses on delivering high-quality, effective, and affordable healthcare products to ensure customer satisfaction.

Q10. Does Syncom Formulations have an international presence?

Yes, Syncom Formulations exports its products to various countries, expanding its global footprint.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.