Vedanta Limited is a leading global natural resources company with a diversified portfolio spanning zinc, lead, silver, copper, iron ore, aluminium, power, and oil & gas. This article provides detailed Vedanta share price targets for 2026, 2030, 2035, 2040, 2045, and 2050, based on updated fundamentals, recent financial performance, and long-term industry trends.

Company Overview

Vedanta Limited, based in Mumbai, India, operates across many continents with large operations in India and Africa. Since its start in 1976, Vedanta has developed into one of the greatest diversified mining and natural resources corporations in the world. The company continues to focus on operational efficiency, cost optimisation, and sustainable development while strengthening its core businesses.

Current Share Price

Financial Table (As of Jan 2026)

| Metric | Value |

|---|---|

| Market Cap | ₹2,65,842 Cr |

| P/E Ratio (TTM) | 16.86 |

| Industry P/E | 13.25 |

| P/B Ratio | 7.46 |

| Debt to Equity | 2.12 |

| ROE | 29.92% |

| EPS (TTM) | ₹45.45 |

| Dividend Yield | 5.68% |

| Book Value | ₹102.66 |

| Face Value | ₹1 |

| 52-Week High | ₹769.80 |

| 52-Week Low | ₹363.00 |

| Official Website | Vedanta Limited |

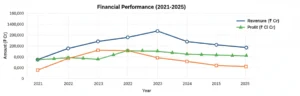

Past 5 Years Growth: Revenue, Profit, and Net Worth

The table below presents a consolidated view of Vedanta Limited’s financial performance over the last five years, highlighting trends in revenue, profitability, and net worth.

| Year | Revenue (₹ Cr) | Profit (₹ Cr) | Net Worth (₹ Cr) |

|---|---|---|---|

| 2021 | 91,442 | 15,033 | 77,416 |

| 2022 | 1,35,332 | 23,709 | 82,704 |

| 2023 | 1,50,159 | 14,506 | 49,427 |

| 2024 | 1,46,277 | 7,539 | 42,069 |

| 2025 | 1,56,643 | 20,535 | 53,753 |

Despite cyclical pressure on profits during 2023–2024, Vedanta demonstrated strong revenue resilience and a sharp profit recovery in 2025, indicating improving operational efficiency and favourable commodity trends. The recovery in net worth further supports balance-sheet stabilisation.

Market and Industry Analysis

The worldwide metals and natural resources sector remains a vital backbone of economic progress. Demand for aluminium, copper, zinc, and energy resources is predicted to expand steadily due to infrastructure expansion, electrification, renewable energy initiatives, and urbanisation.

Vedanta’s broad business eliminates dependent on any particular commodity and enables the company to gain from long-term structural demand. Its strong presence throughout upstream and downstream businesses further boosts margin stability over time.

Factors Influencing Vedanta’s Share Price

Internal Factors

- Financial Strength and Cash Flows:

Vedanta’s ability to generate strong operating cash flows supports dividend payouts and debt servicing. - Management and Strategy:

Experienced leadership and a focus on cost optimisation and asset monetisation improve long-term shareholder value. - Diversification:

Exposure across multiple metals and energy segments lowers business risk compared to single-commodity peers.

External Factors

- Commodity Prices:

Global supply-demand dynamics directly influence earnings. - Regulatory Environment:

Mining regulations, environmental policies, and government approvals impact expansion plans. - Global Economy:

Industrial growth and infrastructure spending drive metal demand.

Vedanta Share Price Target 2026

In the short term, Vedanta’s share price is expected to benefit from ongoing projects and favorable market conditions. Analysts project a steady growth rate driven by increased production capacity and higher commodity prices. The share price target for 2026 is estimated to be in the range of ₹730 – ₹840, reflecting moderate growth and positive investor sentiment.

Vedanta Share Price Target 2030

By 2030, Vedanta aims to strengthen its market position through strategic investments and expansions. The growing demand for metals and minerals, coupled with Vedanta’s diversified portfolio, is expected to drive significant growth. Analysts predict a share price target of ₹1,230 – ₹1,480, considering the company’s robust financial performance and favorable industry outlook.

Vedanta Share Price Target 2035

Looking ahead to 2035, Vedanta’s long-term growth prospects are promising. The company’s continued focus on innovation, sustainability, and technological advancements is expected to enhance operational efficiency and profitability. The share price target for 2035 is projected to be around ₹2,100 – ₹2,650, reflecting Vedanta’s strong market position and growth potential.

Vedanta Share Price Target 2040

By 2040, Vedanta is expected to capitalize on emerging market opportunities and technological advancements. The company’s strategic initiatives, such as digital transformation and sustainable mining practices, will likely drive growth. Analysts project a share price target of ₹3,300 – ₹4,100, considering Vedanta’s strong market position and favorable industry trends.

Vedanta Share Price Target 2045

As Vedanta continues to expand its global footprint and diversify its product portfolio, the company’s long-term growth outlook remains positive. The increasing demand for metals and minerals, driven by technological advancements and industrialization, is expected to boost Vedanta’s revenue and profitability. The share price target for 2045 is estimated to be in the range of ₹4,900 – ₹6,000.

Vedanta Share Price Target 2050

By 2050, Vedanta envisions becoming a global leader in the mining and natural resources sector. The company’s focus on sustainability, innovation, and strategic expansions is likely to drive significant growth. Analysts predict a share price target of ₹6,500 – ₹8,800, considering Vedanta’s strong market position, diversified portfolio, and favorable industry trends.

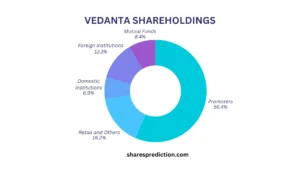

Shareholding Pattern (Latest)

| Investor Type | Shareholding (%) |

|---|---|

| Promoters | 56.38% |

| Retail & Others | 16.17% |

| Foreign Institutions | 12.15% |

| Mutual Funds | 8.43% |

| Other Domestic Institutions | 6.88% |

A strong promoter holding reflects long-term commitment, while steady institutional participation indicates confidence in Vedanta’s fundamentals.

Risks and Challenges

While Vedanta’s growth prospects are promising, the company faces several risks and challenges:

- Commodity Price Volatility: Fluctuations in commodity prices can impact Vedanta’s revenue and profitability.

- Regulatory Risks: Changes in government policies and regulations may affect Vedanta’s operations and growth.

- Environmental and Social Risks: Vedanta’s mining operations have environmental and social impacts that need to be managed effectively.

Conclusion

Vedanta Limited’s share price targets for 2026, 2030, 2035, 2040, 2045, and 2050 reflect the company’s strong growth potential and favorable industry outlook. While there are risks and challenges, Vedanta’s strategic initiatives, diversified portfolio, and focus on sustainability position the company for long-term success. Investors should consider these projections and conduct thorough research before making investment decisions.

FAQs

Who is the Chairman and CEO of Vedanta Limited?

The current Chairman of Vedanta Limited is Anil Agarwal, the founder of the company. The CEO is Sunil Duggal, who oversees the company’s operations and strategic initiatives.

What are the main business segments of Vedanta Limited?

Vedanta Limited operates in several key business segments including zinc, lead, silver, copper, iron ore, aluminum, power, and oil & gas. These diverse operations help the company maintain a robust presence in the natural resources sector.

Where is Vedanta Limited headquartered?

Vedanta Limited is headquartered in Mumbai, India. The company has significant operations in India and Africa and a presence in several other countries.

What are some of Vedanta Limited’s sustainability initiatives?

Vedanta is committed to sustainable development, focusing on minimizing environmental impact and improving community well-being. The company invests in renewable energy projects, water conservation, and afforestation programs, and promotes sustainable mining practices.

How does Vedanta Limited contribute to community development?

Vedanta runs various community development programs focusing on healthcare, education, and livelihood. The company supports local communities through initiatives like mobile health units, mid-day meal programs for school children, and vocational training centers.

What is the history and founding of Vedanta Limited?

Vedanta Limited was founded in 1976 by Anil Agarwal. Initially focused on the aluminum business, the company has since diversified into other minerals and resources, growing into one of the largest natural resources companies globally.

In which countries does Vedanta Limited operate?

Vedanta has operations in India, Zambia, Namibia, South Africa, Liberia, and Ireland, among others. The company is also involved in projects and operations in countries like Australia and the United Arab Emirates.

What are the future growth plans of Vedanta Limited?

Vedanta aims to expand its footprint in the natural resources sector through strategic investments and acquisitions. The company plans to increase its production capacity, invest in new technologies, and explore new mining opportunities globally.

How does Vedanta Limited ensure environmental compliance?

Vedanta adheres to strict environmental regulations and standards across all its operations. The company implements advanced environmental management systems, conducts regular audits, and collaborates with environmental experts to ensure compliance and minimize its ecological footprint.

What are some of the major achievements of Vedanta Limited?

Vedanta has received numerous awards for its contributions to the mining and natural resources sector. The company is recognized for its excellence in corporate governance, sustainability, and community development initiatives. Notable achievements include significant increases in production capacity and successful expansions into new markets.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analyses and insights can help you make informed investment decisions.