Vikas Lifecare Share Price Target has gained the attention of investors looking for growth potential in the plastic sector. Vikas Lifecare is an emerging player in the Indian market, involved in manufacturing polymer and rubber compounds, along with trading various chemicals and other industrial raw materials. As a growing company with a focus on expanding its market share, the Vikas Lifecare Share Price Target for 2026 to 2050 has attracted significant interest. This article provides an analysis of Vikas Lifecare’s financial performance, shareholding pattern, and future price targets.

Company Overview

Vikas Lifecare is a leading manufacturer and distributor of polymer-based compounds and chemicals in India. The company serves a wide range of industries including agriculture, infrastructure, packaging, and automotive. With a vision to expand its product line and increase its market presence, Vikas Lifecare is positioning itself as a key player in India’s rapidly growing economy. The Vikas Lifecare Share Price Target reflects its potential for growth, as it continues to diversify its operations and strengthen its financial position.

Financial Overview

Current Share Price

Revenue and Profit Growth

Vikas Lifecare’s financial performance has been mixed over the years, showing both growth and setbacks. Below is a table summarizing the company’s revenue and net profit figures:

| Year | Revenue (₹ Cr) | Net Profit (₹ Cr) |

|---|---|---|

| 2021 | 76.01 | -3.50 |

| 2022 | 345.00 | 28.95 |

| 2023 | 448.00 | -15.51 |

| 2024 | 472 | 13.45 |

| 2025 | 506 | -10.92 |

From a 2026 outlook, the consistent rise in revenue indicates improving business scale and growing market acceptance. However, recurring profit fluctuations highlight margin pressure and cost sensitivity, which remain key risk factors for investors evaluating the Vikas Lifecare Share Price Target.

Fundamental Metrics (As of February 2026)

Vikas Lifecare’s fundamental metrics offer insight into its financial stability:

| Metric | Value |

|---|---|

| Market Cap | ₹307 Cr |

| P/E Ratio (TTM) | -27.50 |

| P/B Ratio | 0.58 |

| ROE | -2.00% |

| EPS (TTM) | -0.06 |

| Dividend Yield | 0.00% |

| Book Value | ₹2.86 |

| Debt to Equity | 0.14 |

| 52-Week High | ₹3.62 |

| 52-Week Low | ₹1.57 |

| Website | Vikas Lifecare Ltd. |

From a 2026 fundamental perspective, Vikas Lifecare trades below its book value, indicating possible undervaluation. The low debt-to-equity ratio reflects conservative financial leverage, which supports long-term stability. However, negative ROE and EPS suggest that profitability improvement is critical for meaningful re-rating of the stock in future.

Factors Influencing Vikas Lifecare Share Price Target

Expanding Market Presence

Vikas Lifecare has been aggressively expanding its operations, particularly in the polymer and chemical sectors. With increasing demand for materials in sectors like agriculture, infrastructure, and automotive, the company is well-positioned for growth, which could drive share price appreciation in the future.

Volatile Profitability

While the company has shown impressive revenue growth, its profitability has fluctuated. Investors need to consider these variations, which could impact the Vikas Lifecare Share Price Target over the long term.

Financial Stability

Vikas Lifecare’s low debt-to-equity ratio highlights its conservative financial management, which bodes well for its long-term stability. As the company continues to scale its operations, maintaining financial health will be crucial in determining the share price.

Vikas Lifecare Share Price Target 2026

From a 2026 investment perspective, the Vikas Lifecare Share Price Target is projected to be in the range of ₹5 to ₹18. This outlook is supported by improving revenue visibility, business expansion in polymer segments, and gradual stabilization of operating margins.

Vikas Lifecare Share Price Target 2030

Looking ahead to 2030, the Vikas Lifecare Share Price Target could reach ₹29.4 to ₹34.5. As the company further expands its operations and secures larger contracts, both domestically and internationally, the share price could see substantial growth.

Vikas Lifecare Share Price Target 2035

By 2035, the Vikas Lifecare Share Price Target is projected to be between ₹52.7 and ₹58.1. With the potential for continued expansion and a stronger financial position, Vikas Lifecare is expected to become a more established player in its industry, driving its share price higher.

Vikas Lifecare Share Price Target 2040

In 2040, the Vikas Lifecare Share Price Target is forecasted to be around ₹72.4 to ₹75.1. As the company continues to evolve and gain market share, investors can expect steady growth over the long term.

Vikas Lifecare Share Price Target 2045

By 2045, the Vikas Lifecare Share Price Target could reach between ₹95.1 and ₹101.4. As the company diversifies and strengthens its revenue streams, sustained growth in the share price is expected.

Vikas Lifecare Share Price Target 2050

Looking ahead to 2050, the Vikas Lifecare Share Price Target is anticipated to be around ₹120 to ₹135. Long-term investors could benefit from the company’s growth and its focus on expanding its product lines and market reach.

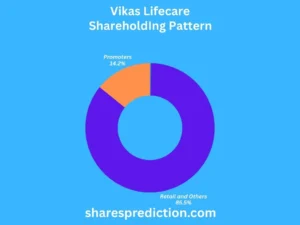

Shareholding Pattern

As of February 2026, the shareholding pattern of Vikas Lifecare is as follows:

| Category | Percentage (%) |

|---|---|

| Retail and Others | 85.52% |

| Promoters | 14.20% |

| Foreign Institutions | 0.28% |

The high retail participation indicates strong interest from individual investors. Promoter holding of over 14% reflects internal confidence in business prospects, while minimal FII holding suggests potential for future institutional inflows if financial performance improves.

Conclusion

The Vikas Lifecare Share Price Target for 2026, 2030, 2035, 2040, 2045, and 2050 showcases the company’s potential for long-term growth. With expanding operations, growing market presence, and solid financial management, Vikas Lifecare is poised to offer steady returns for long-term investors. However, the company’s volatile profitability could be a concern, and investors should monitor its financial performance closely in the coming years.

FAQs About Vikas Lifecare

Q1. What is Vikas Lifecare’s primary business focus?

Vikas Lifecare is involved in manufacturing and trading polymer-based compounds and chemicals.

Q2. How has Vikas Lifecare performed financially?

The company has shown strong revenue growth but volatile profitability over recent years.

Q3. What are the future growth prospects for Vikas Lifecare?

With its expanding market presence and product line, Vikas Lifecare is expected to experience steady growth in the coming years.

Q4. What is Vikas Lifecare’s current market cap?

As of February 2026, the company’s market cap stands at ₹307 Cr.

Q5. What is the shareholding pattern of Vikas Lifecare?

Retail investors hold over 85% of the company’s shares, followed by promoters at 14%.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.