Wipro Share Price Target for 2026, 2030, 2035, 2040, 2045, and 2050 are critical because the company is one of the leaders in the IT industry. This article investigates the elements impacting Wipro’s stock valuation, and updates long-term targets based on the most recent fundamentals, trends in financial performance, and a realistic yet hopeful compounding strategy.

Company Overview

Wipro Limited is a global leader in information technology (IT), consulting, and business process services. The company was established in 1945. The company was initially in the vegetable oil business, but in the 1980s, under Azim Premji’s leadership, it shifted its focus to information technology services. Taking into consideration the present market trends, the dynamics of the industry, and the growth strategies of the company, this article will investigate the share price objective for Wipro in the years 2026, 2030, 2035, 2040, 2045, and 2050 on the stock market.

Today, Wipro Limited is a global leader in IT services, consulting, and business process services, with operations in more than 50 countries. Wipro was founded in 1945 and became an IT major under Azim Premji’s leadership. Today, the company focuses on digital transformation, cloud computing, engineering research and development, cybersecurity, and AI-led services. It has a robust balance sheet, a lot of shares held by promoters, and it makes money consistently, which makes it a key long-term IT sector investment.

Wipro Share Price Current Market Performance

Financial table for Wipro

| Metric | Value |

|---|---|

| Market Capitalization | ₹2,80,270 Cr (As of Jan 2026) |

| P/E Ratio (TTM) | 20.68 |

| Industry P/E | 25.74 |

| P/B Ratio | 3.27 |

| ROE | 15.77% |

| EPS (TTM) | 12.92 |

| Debt to Equity | 0.19 |

| Book Value | ₹81.61 |

| Dividend Yield | 2.24% |

| 52 Week High | ₹579.90 |

| 52 Week Low | ₹375.05 |

| Official Website | Wipro |

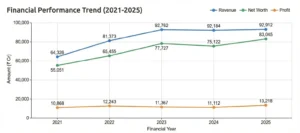

Wipro Growth over the Past 5 Years

| Financial Year | Revenue (₹ Cr) | Profit (₹ Cr) | Net Worth (₹ Cr) |

|---|---|---|---|

| 2021 | 64,326 | 10,868 | 55,051 |

| 2022 | 81,373 | 12,243 | 65,455 |

| 2023 | 92,762 | 11,367 | 77,727 |

| 2024 | 92,184 | 11,112 | 75,122 |

| 2025 | 92,912 | 13,218 | 83,045 |

Revenue stability near ₹90,000+ Cr combined with rising net worth and profit recovery in FY2025 supports long-term compounding.

Wipro Share Price Target 2026

It is anticipated that the Wipro share price target for 2026 will fall within the range of ₹320 – ₹341.5. The company’s stock has been exhibiting a consistent upward trend, which is attributed to its robust financial performance and strategic initiatives in engineering R&D, cloud services, and digital transformation.

Wipro Share Price Target 2030

Wipro share price target by 2030 is anticipated to fall within the range of ₹520 – ₹600. Analysts suggest that the company’s sustained leadership in digital transformation, cloud, engineering R&D, and next-generation technologies such as quantum computing and 6G will drive this growth.

Wipro Share Price Target 2035

Wipro share price target for 2035 is expected to range between ₹900 – ₹1,050. This forecast is based on current market trends, past performance, and the company’s growth potential. Analysts believe that Wipro’s diverse revenue base and strategic initiatives in areas such as AI and digital transformation could contribute to this significant growth over the coming decade.

Wipro Share Price Target 2040

Wipro share price target for 2040 is expected to range between ₹1,500 – ₹1,700. This range represents the company’s anticipated growth, which will be driven by advancements in digital services, cloud computing, and engineering solutions. Analysts believe that Wipro’s ongoing focus on innovation and strategic acquisitions will greatly contribute to its long-term growth, putting it well within the competitive IT market.

Wipro Share Price Target 2045

Stock market analysts predict that Wipro share price will be between ₹2,400 – ₹2,700 by 2045. These forecasts are based on the company’s past performance, growth potential, and market trends in the IT industry. The stock’s future price will be heavily influenced by technological breakthroughs, global economic conditions, and Wipro’s financial success.

Wipro Share Price Target 2050

By 2050, Wipro share price is expected to range between ₹3,600 – ₹4,200. This projection takes into account Wipro’s ongoing expansion in the IT sector, strategic ambitions in emerging technologies such as AI and cloud computing, as well as its historical financial success. Analysts anticipate that steady development and successful implementation of its long-term goals will propel the company’s market value dramatically higher by 2050.

Investor Types and Shareholding Ratios

| Investor Category | Holding (%) |

|---|---|

| Promoters | 72.63% |

| Foreign Institutions | 10.49% |

| Retail & Others | 8.50% |

| Mutual Funds | 4.86% |

| Other Domestic Institutions | 3.52% |

Very high promoter holding signals stability, while gradual MF and FII participation supports long-term confidence.

Conclusion

Wipro is still a fundamentally strong, large-cap IT stock that is good for long-term investors who want stable compounding gains instead of speculative ones. Wipro is in a good position to keep giving shareholders value until 2050 because it has steady sales, healthy dividends, rising profits, and a leading position in digital services.

FAQs

- What was Wipro’s original business before IT?

- Wipro originally started as a vegetable oil manufacturer in 1945.

- Who is the founder of Wipro?

- Wipro was founded by Mohamed Premji.

- When did Wipro transition into IT services?

- Wipro transitioned into IT services in the 1980s under the leadership of Azim Premji.

- What are some key industries Wipro serves?

- Wipro provides services to industries such as healthcare, finance, retail, and manufacturing.

- How many countries does Wipro operate in?

- Wipro has operations in over 50 countries worldwide.

- What is Wipro’s commitment to sustainability?

- Wipro is known for its strong sustainability efforts, including initiatives to reduce carbon footprints and promote renewable energy.

- What innovative technologies is Wipro focusing on?

- Wipro is focused on technologies like digital transformation, cloud computing, quantum computing, and 6G.

- What are Wipro’s major strategic initiatives?

- Wipro’s major strategic initiatives include digital transformation, cloud services, and engineering R&D.

- What is Wipro’s approach to corporate social responsibility (CSR)?

- Wipro’s CSR initiatives focus on education, healthcare, and environmental sustainability, among other areas.

- What notable awards or recognitions has Wipro received?

- Wipro has received various awards for innovation, sustainability, and corporate governance, including recognition in the Dow Jones Sustainability Index.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.