63 Moons Share Price Target offers a strategic insight into the company’s future growth potential. For investors looking to explore 63 Moons Technologies Ltd., a detailed understanding of its future growth trajectory is crucial. This article will provide a comprehensive analysis of the 63 Moons Share Price Target from 2025 to 2050, considering its recent financial performance, market standing, and shareholder sentiment.

Company Overview

63 Moons Technologies is a key player in the fintech space, offering a wide range of financial technology services, trading platforms, and exchange-related technology solutions. The company has faced financial challenges in the past, yet it continues to maintain a strong foothold in the fintech sector. The 63 Moons Share Price Target is heavily influenced by its recovery efforts, innovation, and ability to capitalize on market trends.

Financial Overview

Current Share Price

Revenue and Profit Growth

The financial performance of 63 Moons Technologies has shown a fluctuating trend, as seen in the revenue and profit data from 2019 to 2023:

| Year | Revenue (₹ Cr) | Net Profit (₹ Cr) |

|---|---|---|

| 2019 | 464 | -35.45 |

| 2020 | 339 | -46.77 |

| 2021 | 252 | -63.69 |

| 2022 | 230 | -74.38 |

| 2023 | 402 | -21.81 |

Although the company has recorded losses consistently, it has managed to recover significantly in terms of revenue, rising from ₹230 Cr in 2022 to ₹402 Cr in 2023. This improvement in revenue could lead to an eventual reduction in losses, positively influencing the 63 Moons Share Price Target in the coming years.

Fundamental Metrics (As of September 2024)

The key financial metrics for 63 Moons Technologies provide insights into its market position and financial stability:

| Metric | Value |

|---|---|

| Market Cap | ₹1,659 Cr |

| P/E Ratio (TTM) | 9.50 |

| P/B Ratio | 0.50 |

| ROE | 6.65% |

| Debt to Equity | 0.00 |

| EPS (TTM) | ₹37.88 |

| Book Value | ₹726.45 |

| Dividend Yield | 0.56% |

| 52-Week High | ₹690.75 |

| 52-Week Low | ₹239.05 |

| Website | 63 Moons Technologies |

The company’s relatively low price-to-earnings (P/E) ratio of 9.50 and a very strong price-to-book (P/B) ratio of 0.50 suggest the stock is undervalued, which could be appealing to long-term investors. Additionally, with no debt on its books, it has the potential to stabilize and grow its financials, which could positively affect its 63 Moons Share Price Target.

Factors Influencing 63 Moons Share Price Target

Market Position and Strategic Innovation

63 Moons Technologies has been working to innovate and enhance its trading and fintech solutions. Its ability to adapt to the latest market trends and continue expanding its offerings will significantly influence its share price. The company operates in a rapidly evolving fintech sector, and its long-term success hinges on strategic investments in technology and infrastructure.

Financial Stability and Recovery

Despite recording consistent losses, 63 Moons has shown improvement in revenue growth. The lack of debt on its balance sheet and a healthy book value indicate that the company is financially stable. If the company continues on its current trajectory of reducing losses and increasing revenue, this could significantly boost 63 Moons Share Price Target over the next few years.

Expansion Potential

63 Moons’ potential for international expansion in the fintech space could offer significant growth opportunities. Fintech is a rapidly growing industry globally, and 63 Moons, with its expertise in financial technology, can capitalize on these trends. Expansion into new markets will be key to driving its share price upward.

63 Moons Share Price Target 2025

By 2025, the 63 Moons Share Price Target is expected to be between ₹461 and ₹506. This projection assumes that the company will continue its efforts to stabilize its financials, grow its revenue, and reduce losses. If 63 Moons can capitalize on fintech innovations, it could achieve moderate share price growth in the short term.

63 Moons Share Price Target 2030

Looking towards 2030, the 63 Moons Share Price Target is projected to reach between ₹758 and ₹765. The company’s ability to innovate and expand its services in the fintech space will be crucial in achieving this target. As fintech becomes an increasingly vital part of global financial markets, 63 Moons could see steady growth in its share price over the next decade.

63 Moons Share Price Target 2035

By 2035, 63 Moons Share Price Target is anticipated to reach a of ₹912 to ₹1072. The company’s long-term investments in technology and its ability to reduce operational losses will contribute to its growth. As the fintech industry expands, 63 Moons’ offerings will become more valuable, likely driving its share price higher.

63 Moons Share Price Target 2040

In 2040, the 63 Moons Share Price Target is expected to rise to between ₹1,393 and ₹1,456. The company’s continued growth in the fintech space, coupled with potential international expansion and innovative offerings, will likely drive this share price increase.

63 Moons Share Price Target 2045

By 2045, the 63 Moons Share Price Target could be between ₹1,630 and ₹1,780. The company’s strong position in the fintech industry and its consistent efforts to improve financial performance will likely contribute to sustained growth, leading to a strong share price increase over the long term.

63 Moons Share Price Target 2050

Looking towards 2050, the 63 Moons Share Price Target is anticipated to reach ₹1,980 to ₹2,200. The company’s commitment to technological advancements, international growth, and profitability will play a crucial role in determining its share price. As the fintech industry matures, 63 Moons could solidify itself as a major player, offering high returns to long-term investors.

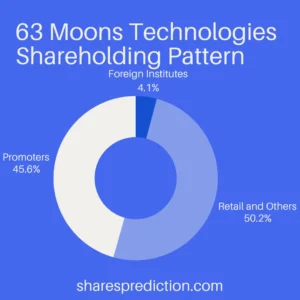

Shareholding Pattern

As of September 2024, the shareholding pattern of 63 Moons Technologies is as follows:

| Category | Percentage (%) |

|---|---|

| Retail and Others | 50.15% |

| Promoters | 45.63% |

| Foreign Institutions | 4.12% |

| Other Domestic Institutions | 0.09% |

The large retail ownership at 50.15% shows strong interest from individual investors, while the significant promoter holding of 45.63% reflects insider confidence in the company’s future. This balanced shareholding structure suggests that the company has wide investor appeal, which positively supports its Share Price Target.

Conclusion

The 63 Moons Share Price Target for 2025, 2030, 2035, 2040, 2045, and 2050 paints an optimistic picture for long-term growth. While the company has faced financial struggles, its recent revenue recovery, strong fundamentals, and strategic positioning in the fintech space indicate potential for future success. Investors who believe in 63 Moons’ ability to stabilize and innovate may find it to be a rewarding long-term investment opportunity.

FAQs About 63 Moons Technologies

Q1. What services does 63 Moons Technologies provide?

63 Moons Technologies offers fintech solutions, including trading platforms, exchanges, and other financial technology-driven services.

Q2. Where is 63 Moons Technologies headquartered?

63 Moons Technologies is headquartered in Mumbai, Maharashtra, India.

Q3. How does 63 Moons maintain its competitive edge?

63 Moons maintains its edge by continuously innovating its trading platforms and leveraging its technology-driven solutions.

Q4. What sectors does 63 Moons serve?

63 Moons primarily serves the financial services sector, focusing on trading platforms and fintech solutions.

Q5. What is the company’s current financial strategy?

63 Moons aims to reduce its losses while increasing revenue through innovation and technology-driven financial solutions.

Q6. Who are the main competitors of 63 Moons?

Key competitors include other fintech platforms, exchanges, and trading service providers like NSE, MCX, and BSE.

Q7. What is 63 Moons’ long-term strategy?

63 Moons is focused on expanding its technological capabilities, reducing operational costs, and targeting international expansion for long-term growth.

Q8. Does 63 Moons have a global presence?

Yes, 63 Moons provides its technology and services to various international markets.

Q9. How does 63 Moons plan to grow its fintech offerings?

63 Moons invests in research and development to continually innovate and expand its offerings in financial technology.

Q10. What are the growth prospects for 63 Moons?

If 63 Moons continues to innovate and recover financially, it has significant long-term growth potential in the fintech sector.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.