Paradeep Phosphates Share Price Target has been a hot topic for the investors as Paradeep Phosphates is one of India’s leading fertilizer manufacturers, playing a crucial role in supporting agricultural productivity. As a key player in the fertilizer sector, Paradeep Phosphates has garnered investor interest for its future growth potential. This article dives deep into the Paradeep Phosphates Share Price Target for 2025, 2030, 2035, 2040, 2045, and 2050, taking into account the company’s financial performance and industry trends.

Company Overview

Paradeep Phosphates is engaged in manufacturing, distribution, and trading of complex fertilizers, phosphatic fertilizers, and nitrogen-based fertilizers. The company has positioned itself as a leader in supporting India’s agricultural economy. It continues to expand its product portfolio and enhance its distribution network, making it a favored choice for both farmers and investors.

Financial Overview

Current Share Price

Revenue and Profit Growth

Paradeep Phosphates has demonstrated a strong financial performance over the years, as highlighted by its revenue and net profit growth:

| Year | Revenue (₹ Cr) | Net Profit (₹ Cr) |

|---|---|---|

| 2020 | 4,228 | 193 |

| 2021 | 5,184 | 223 |

| 2022 | 7,898 | 398 |

| 2023 | 13,432 | 304 |

| 2024 | 11,644 | 99.91 |

The company witnessed a significant revenue surge in 2023, crossing ₹13,432 Cr. However, its net profit declined to ₹99.91 Cr in 2024, indicating the possibility of increased operational costs or market-related challenges. Nonetheless, Paradeep Phosphates remains a financially sound entity with the potential for recovery and growth.

Fundamental Metrics (As of September 2024)

Below are the key financial metrics of Paradeep Phosphates, providing insights into its current market position:

| Metric | Value |

|---|---|

| Market Cap | ₹7,056 Cr |

| P/E Ratio (TTM) | 31.38 |

| P/B Ratio | 1.98 |

| ROE | 2.80% |

| EPS (TTM) | ₹2.76 |

| Dividend Yield | 0.58% |

| Book Value | ₹43.75 |

| Debt to Equity | 1.13 |

| 52-Week High | ₹98.35 |

| 52-Week Low | ₹58.65 |

| Website | Paradeep Phosphates Ltd |

With a market capitalization of ₹7,056 Cr, Paradeep Phosphates is a well-established player in the fertilizer industry. Its P/E ratio of 31.38 reflects moderate valuation, while the debt-to-equity ratio of 1.13 signals manageable debt levels. The company’s ROE stands at 2.80%, indicating a relatively low return on equity, but this can be improved as operational efficiency increases.

Factors Influencing Paradeep Phosphates Share Price Target

Demand for Fertilizers

As a key manufacturer of phosphatic and nitrogen-based fertilizers, Paradeep Phosphates is well-positioned to benefit from the rising demand for agricultural inputs. India’s growing need for food security and enhanced productivity will drive the long-term growth of the fertilizer industry, thus positively impacting the company’s share price.

Government Policies and Subsidies

Government support for the agricultural sector, including fertilizer subsidies, plays a crucial role in determining Paradeep Phosphates’ financial health. Favorable policies can boost the company’s revenue and profitability, contributing to a positive share price outlook.

Operational Efficiency

Paradeep Phosphates’ ability to manage its production costs and improve operational efficiency will directly impact its profitability and long-term stock performance. Enhanced processes and technology adoption could help the company maintain profitability even in challenging market conditions.

Paradeep Phosphates Share Price Target 2025

By 2025, the Paradeep Phosphates Share Price Target is projected to be in the range of ₹100 to ₹110. The company’s steady revenue growth and its focus on expanding its market share will likely contribute to a moderate increase in its stock price. Government subsidies and demand for fertilizers will continue to support the company’s financial performance.

Paradeep Phosphates Share Price Target 2030

Looking forward to 2030, the Paradeep Phosphates Share Price Target is expected to be between ₹230 and ₹250. As Paradeep Phosphates continues to expand its product portfolio and improve operational efficiency, its share price is likely to benefit from sustained demand in the agriculture sector and potential export opportunities.

Paradeep Phosphates Share Price Target 2035

By 2035, the Paradeep Phosphates Share Price Target is anticipated to be in the range of ₹480 to ₹500. The company’s investments in technology, market expansion, and product diversification will drive long-term growth. Rising demand for sustainable fertilizers and increasing market share in domestic and international markets will further enhance the stock price.

Paradeep Phosphates Share Price Target 2040

In 2040, the Paradeep Phosphates Share Price Target could reach between ₹720 and ₹850. The company’s ability to capitalize on industry trends and technological advancements in fertilizer production will likely drive further growth. Increasing focus on organic and sustainable fertilizers may provide additional revenue streams.

Paradeep Phosphates Share Price Target 2045

By 2045, the Paradeep Phosphates Share Price Target is projected to be between ₹980 and ₹1100. As the global population grows and food production becomes increasingly important, the demand for fertilizers is expected to rise. Paradeep Phosphates, being a major player in this industry, is likely to benefit from these long-term trends, driving sustained growth in its share price.

Paradeep Phosphates Share Price Target 2050

Looking towards 2050, the Paradeep Phosphates Share Price Target is forecasted to be in the range of ₹1350 to ₹1400. By this time, the company is expected to have a dominant market position, both in India and internationally. Increased demand for food production, coupled with advancements in fertilizer technology, will ensure sustained growth for Paradeep Phosphates, making it a sound long-term investment.

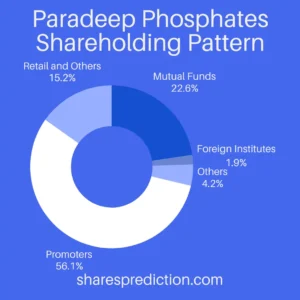

Shareholding Pattern

As of September 2024, the shareholding pattern of Paradeep Phosphates is as follows:

| Category | Percentage (%) |

|---|---|

| Promoters | 56.08% |

| Mutual Funds | 22.62% |

| Retail And Others | 15.18% |

| Other Domestic Institutions | 4.21% |

| Foreign Institutions | 1.90% |

With 56.08% of shares held by promoters, Paradeep Phosphates enjoys strong support from its key stakeholders. Institutional investors, including mutual funds and foreign institutions, also show confidence in the company’s future prospects, further solidifying its growth potential.

Conclusion

The Paradeep Phosphates Share Price Target for 2025, 2030, 2035, 2040, 2045, and 2050 reflects a promising growth trajectory. As one of the leading fertilizer manufacturers in India, the company is well-positioned to benefit from the increasing demand for agricultural inputs. With sound financial performance and a strategic focus on expansion, Paradeep Phosphates is expected to offer substantial returns to long-term investors.

FAQs About Paradeep Phosphates

Q1. What does Paradeep Phosphates specialize in?

Paradeep Phosphates specializes in the production and distribution of complex fertilizers, phosphatic fertilizers, and nitrogen-based fertilizers.

Q2. Is Paradeep Phosphates a good long-term investment?

Yes, Paradeep Phosphates is considered a strong long-term investment due to its established market presence, steady revenue growth, and the increasing demand for fertilizers in India.

Q3. What are the company’s key challenges?

The company faces challenges such as fluctuating raw material costs, government regulations, and market competition in the fertilizer sector.

Q4. Does Paradeep Phosphates offer dividends?

Yes, Paradeep Phosphates offers a modest dividend yield of 0.58% as of 2024.

Q5. How does the company’s debt position affect its growth?

With a debt-to-equity ratio of 1.13, the company maintains a manageable debt level that allows for future expansion without significant financial strain.

Q6. What is the promoter holding in Paradeep Phosphates?

As of September 2024, the promoters hold 56.08% of the company’s shares, indicating strong commitment and confidence in its long-term prospects.

Q7. How has the company’s revenue grown over the years?

The company has seen significant revenue growth, from ₹4,228 Cr in 2020 to ₹13,432 Cr in 2023, although there was a slight decline to ₹11,644 Cr in 2024.

Q8. What is the market outlook for the fertilizer industry?

The fertilizer industry is expected to grow steadily due to the increasing need for agricultural productivity and food security, which will benefit companies like Paradeep Phosphates.

Q9. What is the company’s market capitalization?

As of 2024, Paradeep Phosphates has a market capitalization of ₹7,056 Cr.

Q10. What are the factors driving the share price of Paradeep Phosphates?

Key factors include market demand for fertilizers, government subsidies, operational efficiency, and technological advancements in fertilizer production.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.