Paytm is a leading digital payment and financial services platform in India. Initially starting as a mobile recharge and bill payment service, it has grown into a comprehensive ecosystem that includes a digital wallet, online payment solutions, e-commerce via Paytm Mall, and banking services through Paytm Payments Bank. This article will explore the Paytm share price target 2026, 2030, 2035, 2040, 2045, and 2050, considering the current market trends, industry dynamics, and the company’s growth strategies.

Paytm Share Price Current Market Performance

Financial Table for Paytm

| Company Name | Paytm |

|---|---|

| Market Cap | ₹ 74,870 Cr (As of January 2026) |

| P/E Ratio | -427.60 |

| Industry P/E | 116.83 |

| Debt to Equity Ratio | 0.01 |

| ROE | 0.74% |

| Dividend Yield | 0.00% |

| 52 Week High | ₹ 1381.80 |

| 52 Week Low | ₹ 651.50 |

| Official Website | Paytm |

The following table presents the latest available financial snapshot of Paytm based on publicly available data as of 2026, helping investors assess the company’s valuation, profitability, and overall financial position.

Paytm Growth over the Past 5 years

| Year | Revenue Growth | Profit Growth | EBITDA Growth |

|---|---|---|---|

| 2021 | 3,186 | -1,701 | 6,516 |

| 2022 | 5,264 | -2,396 | 14,130 |

| 2023 | 8,400 | -1,777 | 12,993 |

| 2024 | 10,525 | -1,422 | 13,298 |

| 2025 | 7,625 | -663 | 14,997 |

Paytm has demonstrated strong revenue and EBITDA growth over the past five years, reflecting rising adoption of digital payments and financial services. Although the company has remained loss-making, the scale of losses has narrowed significantly, indicating improving operational efficiency and better cost control. From a 2026 perspective, Paytm appears to be moving steadily towards profitability, supported by higher merchant monetisation, growth in lending and insurance segments, and a stronger focus on sustainable business models.

Paytm Share Price Target 2026

The Paytm share price target for 2026 is based on expectations of operational stabilization, improving margins, and gradual progress towards profitability. The company’s performance will largely depend on its ability to monetize its large user base, expand merchant-driven reminder, and navigate regulatory requirements effectively.

Growth in digital payments, financial services distribution, and business subscriptions is expected to play a critical role in shaping Paytm’s valuation over the medium term.

Paytm Share Price Target 2030

By 2030, Paytm Share Price is expected to reach ₹1500 and ₹2000. This projection assumes favorable market conditions, continued innovation, and effective competition management. The company envisions expanding its ecosystem of financial services to cover a comprehensive range of offerings, including advanced lending solutions, diverse insurance products, and sophisticated wealth management services, all integrated into a seamless digital platform.

Paytm Share Price Target 2035

For the year 2035, Paytm Share Price is expected to reach ₹2500 to ₹3000. These estimates are speculative and subject to change based on future developments in the fintech industry and broader financial markets. Paytm’s ability to expand its financial services ecosystem, enhance profitability, and maintain a strong market position amidst evolving technological advancements and regulatory landscapes.

Paytm Share Price Target 2040

For the year 2040, Paytm Share Price is expected to reach ₹3000 – ₹5000 . This aim is continuously broadening its suite of financial products and services, including lending, insurance, and wealth management, to offer comprehensive solutions to users and businesses.

Paytm Share Price Target 2045

By 2045, Paytm Share Price is expected to reach ₹5000 to ₹7000. It assuming continued successful execution of its strategic initiatives, market expansion, technological advancements, and favorable regulatory environment.

Paytm Share Price Target 2050

By 2050, Paytm Share Price is expected to reach ₹10,000 to ₹15,000. These estimates hinge on Paytm’s ability to sustain growth, expand its market presence, innovate effectively, and adapt to future market challenges.

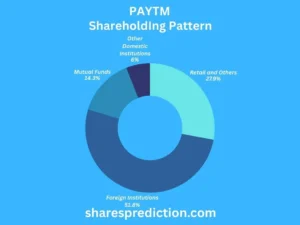

Investor Types and Shareholding Ratios

| Investor Type | Percentage of Shares (%) |

|---|---|

| Foreign Institutions | 51.76% |

| Retail and Others | 27.92% |

| Mutual Funds | 14.34% |

| Other Domestic Institutions | 5.98% |

The shareholding pattern of Paytm reflects strong participation from foreign institutional investors and mutual funds, indicating institutional confidence in the company’s long-term business model. Retail investors also hold a meaningful stake, demonstrating widespread public interest in Paytm as a leading fintech platform in India.

This diversified ownership structure supports liquidity, corporate governance, and long-term capital stability.

Conclusion

As of 2026, Paytm remains a major player in India’s digital payments and fintech ecosystem, supported by a strong brand, extensive merchant network, and widespread consumer adoption. However, the company continues to operate in a highly competitive and regulated environment, where profitability and compliance remain key challenges.

Paytm’s long-term success will depend on its ability to scale high-margin financial services, control operational costs, maintain regulatory alignment, and effectively convert its transaction volumes into sustainable revenue. For investors, Paytm represents a high-potential but high-risk fintech stock with significant upside tied to successful execution of its business strategy.

FAQs

-

Who is the founder of Paytm?

- Vijay Shekhar Sharma founded Paytm in 2010. He is also the CEO of the company.

-

What does Paytm stand for?

- Paytm stands for “Pay Through Mobile.”

-

What are some of the key services offered by Paytm?

- Paytm offers a variety of services including mobile recharges, utility bill payments, travel bookings, online shopping, and financial services such as banking, insurance, and mutual funds.

-

How did Paytm evolve from a recharge platform to a financial services giant?

- Paytm started as a mobile recharge platform and expanded its services to include online bill payments, e-commerce, and financial services. The launch of the Paytm wallet in 2014 marked a significant expansion into digital payments, and subsequent developments like Paytm Payments Bank and Paytm Money further solidified its position in the financial sector.

-

What is Paytm Payments Bank, and how does it differ from traditional banks?

- Paytm Payments Bank is a new model of banking introduced by the Reserve Bank of India. It offers all the banking services except lending and issuing credit cards. It focuses on digital transactions and offers benefits like zero balance accounts and high-interest savings accounts.

-

What role did Paytm play during the demonetization period in India?

- During the 2016 demonetization in India, Paytm saw a significant increase in user adoption as people shifted to digital payments due to the cash shortage. The company’s tagline “Paytm Karo” became synonymous with digital payments during this period.

-

What is Paytm Mall, and how does it function?

- Paytm Mall is Paytm’s e-commerce platform, offering a wide range of products from electronics and fashion to groceries. It combines the convenience of online shopping with the trust of a retail experience, including features like verified sellers and easy returns.

-

What initiatives has Paytm taken for financial inclusion?

- Paytm has launched various initiatives for financial inclusion, such as providing banking services to the unbanked population, offering small loans and micro-insurance, and setting up Paytm Ka ATM outlets to help people access banking services in remote areas.

-

What are Paytm’s international ventures?

- Paytm has expanded its services internationally through its subsidiary One97 Communications. It has invested in startups and collaborated with companies in countries like Canada and Japan to offer similar digital payment and financial services.

-

How does Paytm ensure the security of its users’ data?

- Paytm employs multiple layers of security measures, including encryption, two-factor authentication, and regular security audits, to protect users’ data. They also provide guidelines and support to help users recognize and avoid potential scams.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analyses and insights can help you make informed investment decisions.