Rattan Power Share Price Targets for 2026, 2030, 2035, 2040, 2045, and 2050 are critical for investors planning for the future. Rattan Power Ltd., a major participant in the energy market, has been strategically expanding into renewable energy. As investors anticipate possible profits, comprehending Rattan Power’s share price goals for 2026, 2030, 2035, 2040, 2045, and 2050 becomes critical. This article examines the elements impacting Rattan Power’s stock performance and forecasts its future growth possibilities.

About Rattan Power Ltd.

Rattan Power Ltd., founded with an aim to make a substantial contribution to the energy industry, focuses on renewable energy. The firm is engaged in a variety of power production projects, including solar, wind, and thermal energy. Rattan Power, headquartered in India, is listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange. Over the last few years, the company has gone through a stressed phase, followed by balance‑sheet repair and a visible turnaround in profitability and net worth. The recent recovery phase has renewed investor interest, especially from retail participants.

Current Share Price

Financial Table (as of Jan 2026)

| Metric | Value |

|---|---|

| Market Capitalization | ₹4,753 Cr |

| P/E Ratio (TTM) | 55.31 |

| Industry P/E | 22.47 |

| P/B Ratio | 1.05 |

| ROE | 1.89% |

| EPS (TTM) | 0.16 |

| Debt to Equity | 0.85 |

| Book Value | ₹8.46 |

| Dividend Yield | 0.00% |

| Official Website | Rattan Power |

Factors Influencing Rattan Power Share Price Target

Market Demand for Renewable Energy

- Government Policies and Incentives: Supportive government policies and incentives for renewable energy adoption drive up demand.

- Environmental Concerns: Increased awareness and measures to minimize carbon emissions are driving demand for sustainable energy solutions.

Technological Advancements

- Innovation in Energy Production: Continuous advancements in renewable energy technologies.

- R&D Investments: Continuous investments in research and development to improve energy and operational efficiency.

Financial Performance.

- Sales and profit growth: A consistent increase in sales and profitability boosts investor confidence.

- Effective cost management strategies boost corporate profitability.

Market Expansion

- Geographic diversification entails expanding into new local and foreign markets.

- Product Line Expansion: Expanding the portfolio of energy goods and services.

Strategic Partnerships and Collaborations

- Industry Alliances: Collaborations with other industry participants to expand market reach and product offers.

- Secure government contracts for large-scale renewable energy projects.

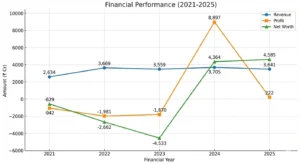

Financial Performance Trend (Yearly)

The table below combines revenue, profit, and net worth trends to give a clear view of Rattan Power’s financial turnaround trajectory.

| Financial Year | Revenue (₹ Cr) | Profit (₹ Cr) | Net Worth (₹ Cr) |

|---|---|---|---|

| 2021 | 2,634 | -942 | -629 |

| 2022 | 3,669 | -1,981 | -2,662 |

| 2023 | 3,559 | -1,870 | -4,533 |

| 2024 | 3,705 | 8,897 | 4,364 |

| 2025 | 3,641 | 222 | 4,585 |

Revenue stability above ₹3,500 Cr combined with a sharp recovery in profit and net worth from FY2024 onward signals a structural turnaround rather than a temporary bounce.

Rattan Power Share Price Analysis

Rattan Power Share Price Target 2026

Rattan Power share price target for 2026 is expected to be between ₹19.5 – ₹21.5. This projection is based on robust market demand, strategic market expansion, and technological advancements. As global focus on renewable energy grows, Rattan Power’s innovations and growth strategy are likely to attract significant investor interest.

Rattan Power Share Price Target 2030

By 2030, Rattan Power share price target is projected to range from ₹45 – ₹55. This growth will be driven by sustained profitability, technological innovations, and global market expansion. Environmental regulations and rising demand for sustainable energy products will further enhance Rattan Power’s market value.

Rattan Power Share Price Target 2035

For 2035, Rattan Power share price target is anticipated to be between ₹85 – ₹100. Strong financial growth, strategic partnerships, and industry leadership will support this increase. Continuous innovation and technology adaptation will ensure competitiveness and long-term value for investors.

Rattan Power Share Price Target 2040

In 2040, Rattan Power share price target is expected to be around ₹150 – ₹175. Ongoing innovation, market expansion, and rising global demand for premium energy products will drive this growth. Rattan Power’s strategic vision and robust financial performance will continue to boost stock value.

Rattan Power Share Price Target 2045

By 2045, Rattan Power share price target is forecasted to be between ₹240 – ₹280. Long-term growth, innovation, and strategic collaborations will drive this increase. The global shift towards sustainable energy will strengthen Rattan Power’s market position and investor confidence.

Rattan Power Share Price Target 2050

Rattan Power share price target for 2050 is projected to be between ₹350 – ₹420. Decades of consistent growth, technological advancements, and market leadership will support this target. Rattan Power’s focus on innovation, sustainability, and market expansion will deliver substantial long-term shareholder value.

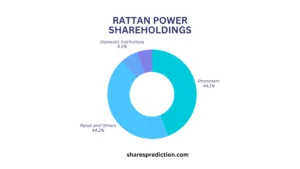

Rattan Power Shareholding Pattern

| Investor Category | Holding (%) |

|---|---|

| Retail & Others | 44.16% |

| Promoters | 44.06% |

| Other Domestic Institutions | 6.48% |

| Foreign Institutions | 5.13% |

| Mutual Funds | 0.17% |

Strong retail participation signals high interest, while low MF holding indicates scope for future institutional entry if performance sustains.

Conclusion

Rattan Power share price targets for 2026, 2030, 2035, 2040, 2045, and 2050 indicate a promising future driven by robust financial growth, continuous innovation, and strategic expansion. As global demand for renewable energy intensifies, Rattan Power’s commitment to sustainability and technological advancements positions it well for long-term success. Investors can expect significant value appreciation, making Rattan Power Ltd. a compelling investment choice in the evolving energy sector.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.