Ujjivan Small Finance Bank Share Price Target has gained the attention of investors looking for growth potential in the financial sector. Ujjivan Small Finance Bank (Ujjivan SFB) has become a significant player in the banking industry thanks to its growing scale, balance sheet, and customer base. Based on financial performance, fundamentals, and long-term compounding potential, this article gives a detailed look at Ujjivan Small Finance Bank’s share price targets from 2026 to 2050.

Company Overview

Ujjivan Small Finance Bank is a Bengaluru-headquartered small finance bank focused on serving underserved and underbanked parts of the population. The bank provides savings and current accounts, term deposits, loans, and microfinance programs primarily to individuals, MSMEs, and rural consumers. The Ujjivan Small Finance Bank Share Price Target is based on its consistent financial performance and its strategic market expansion.

Financial Overview

Current Share Price

Fundamental Metrics (As of September 2024)

The following key fundamental metrics provide insight into the financial health and market position of Ujjivan SFB, which is critical for projecting its share price targets:

| Metric | Value |

|---|---|

| Market Capitalization | ₹12,231 Cr |

| P/E Ratio (TTM) | 24.74 |

| Industry P/E | 14.83 |

| P/B Ratio | 1.96 |

| ROE | 7.93% |

| EPS (TTM) | ₹2.55 |

| Dividend Yield | 0.00% |

| Book Value | ₹32.14 |

| Debt to Equity | NA |

| 52-Week High | ₹68.00 |

| 52-Week Low | ₹30.88 |

| Website | Ujjivan Small Finance Bank |

The valuation reflects growth expectations, while improving net worth and expanding operations support long-term compounding potential.

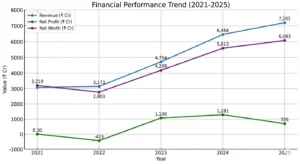

Revenue and Profit Growth

| Year | Revenue (₹ Cr) | Net Profit (₹ Cr) | Net Worth (₹ Cr) |

|---|---|---|---|

| 2021 | 3,108 | 8.30 | 3,219 |

| 2022 | 3,173 | -415 | 2,803 |

| 2023 | 4,754 | 1,100 | 4,209 |

| 2024 | 6,464 | 1,281 | 5,613 |

| 2025 | 7,201 | 726 | 6,083 |

Revenue has more than doubled since FY2021, while consistent net worth growth highlights balance-sheet strengthening despite profit normalization in FY2025.

Factors Influencing Ujjivan Small Finance Bank Share Price Target

Financial Inclusion and Credit Growth

Ujjivan SFB benefits from increased demand for formal loans among micro-entrepreneurs, MSMEs, and rural households.

Balance Sheet Expansion

Consistent growth in net worth improves lending capacity and supports sustainable loan growth over the long term.

Digital Banking Adoption

Technology-led efforts enhance customer experience, improve efficiency, and facilitate scalable expansion.

Ujjivan Small Finance Bank Share Price Target 2026

By 2026, the Ujjivan Small Finance Bank Share Price Target is expected to range between ₹82 and ₹90. This estimate considers the bank’s strong revenue growth and profitability recovery. Continued market expansion, coupled with its focus on product innovation, will likely drive share price growth in the short term.

Ujjivan Small Finance Bank Share Price Target 2030

Looking ahead to 2030, the Ujjivan Small Finance Bank Share Price Target is projected to reach between ₹149 and ₹185. As the bank continues to expand its financial services and increase its customer base, it is well-positioned to capture further market share. If Ujjivan SFB sustains its current momentum, its share price is likely to appreciate significantly over the next decade.

Ujjivan Small Finance Bank Share Price Target 2035

By 2035, Ujjivan Small Finance Bank Share Price Target is anticipated to achieve a price of ₹271 to ₹327. The bank’s commitment to serving underserved markets, alongside its focus on technological advancements, will likely lead to substantial value creation. Long-term investments in infrastructure and digital banking will be key factors in this share price growth.

Ujjivan Small Finance Bank Share Price Target 2040

In 2040, the Ujjivan Small Finance Bank Share Price Target is expected to rise to approximately ₹520 to ₹660. The continued development of financial services catering to microfinance, small businesses, and rural areas will help Ujjivan SFB maintain its competitive edge. If the bank continues to innovate, its share price is expected to follow an upward trajectory.

Ujjivan Small Finance Bank Share Price Target 2045

By 2045, the Ujjivan Small Finance Bank Share Price Target is forecasted to be between ₹880 and ₹1010. The bank’s ability to adapt to evolving customer needs and its expansion into new financial services sectors will likely drive this growth. Investors can expect a steady rise in share price if the bank remains committed to its long-term strategies.

Ujjivan Small Finance Bank Share Price Target 2050

Looking towards 2050, the Ujjivan Small Finance Bank Share Price Target is anticipated to reach ₹1420 to ₹1525. As the banking sector continues to evolve, Ujjivan SFB’s strategic positioning and market reach will play a crucial role in driving its share price higher. The bank’s long-term success will depend on its ability to adapt to industry trends and continue its market expansion.

Shareholding Pattern

| Category | Holding (%) |

|---|---|

| Retail & Others | 55.87% |

| Mutual Funds | 23.82% |

| Foreign Institutions | 15.45% |

| Other Domestic Institutions | 4.85% |

Strong retail participation along with rising mutual fund and foreign institutional ownership reflects growing confidence in the bank’s long-term prospects.

Conclusion

The Ujjivan Small Finance Bank Share Price Target for 2026, 2030, 2035, 2040, 2045, and 2050 presents a positive outlook for long-term investors. The bank’s focus on financial inclusion, expanding its customer base, and improving its financial performance have positioned it for significant growth. Investors looking for opportunities in the financial sector may find Ujjivan SFB a promising investment with strong growth potential in the coming decades.

FAQs About Ujjivan Small Finance Bank

Q1. What services does Ujjivan Small Finance Bank provide?

Ujjivan Small Finance Bank offers a range of financial services, including savings accounts, loans, and microfinance solutions targeted at underserved markets.

Q2. Where is Ujjivan Small Finance Bank headquartered?

Ujjivan Small Finance Bank is headquartered in Bengaluru, Karnataka, India.

Q3. How does Ujjivan SFB support financial inclusion?

Ujjivan SFB focuses on providing banking services to underserved segments, particularly in rural and semi-urban areas, ensuring financial access for all.

Q4. What sectors does Ujjivan SFB cater to?

Ujjivan SFB caters to microfinance, small businesses, and individual consumers, especially in low-income and rural regions.

Q5. How does Ujjivan SFB innovate its banking services?

Ujjivan SFB leverages technology to offer digital banking services, enhancing customer experience and expanding its market reach.

Q6. Who are the main competitors of Ujjivan Small Finance Bank?

Key competitors include Equitas Small Finance Bank, AU Small Finance Bank, and other microfinance-focused institutions.

Q7. What is Ujjivan SFB’s strategy for growth?

Ujjivan SFB focuses on expanding its customer base, enhancing digital banking services, and increasing its presence in rural markets.

Q8. How does Ujjivan SFB ensure customer satisfaction?

The bank prioritizes customer-centric banking solutions, offering easy access to financial products and improving service delivery through digital platforms.

Q9. What is Ujjivan SFB’s approach to sustainability?

Ujjivan SFB emphasizes sustainable growth by providing inclusive financial services that support economic development in underserved regions.

Q10. Does Ujjivan Small Finance Bank have plans for international expansion?

Currently, Ujjivan SFB is focused on domestic growth, with no immediate plans for international expansion.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Investors should research and consult with a financial advisor before making investment decisions.

Call to Action

Stay updated with the latest trends and forecasts by visiting sharesprediction regularly. Our comprehensive analysis and insights can help you make informed investment decisions.